Why is domestic and foreign judgment important regarding Japan’s consumption tax?

When considering the taxation relationship for Japanese consumption tax, we consider the taxation relationship in stages. First, we need to consider whether it is subject to Japanese consumption tax based on the domestic/overseas determination. Domestic/overseas refers to whether it is within Japan or outside of Japan, and if it is determined to be a domestic transaction, it is subject to consumption tax as a transaction within Japan (domestic transaction). If it is an overseas transaction, there is no need to consider Japanese consumption tax (import transactions are a different matter).

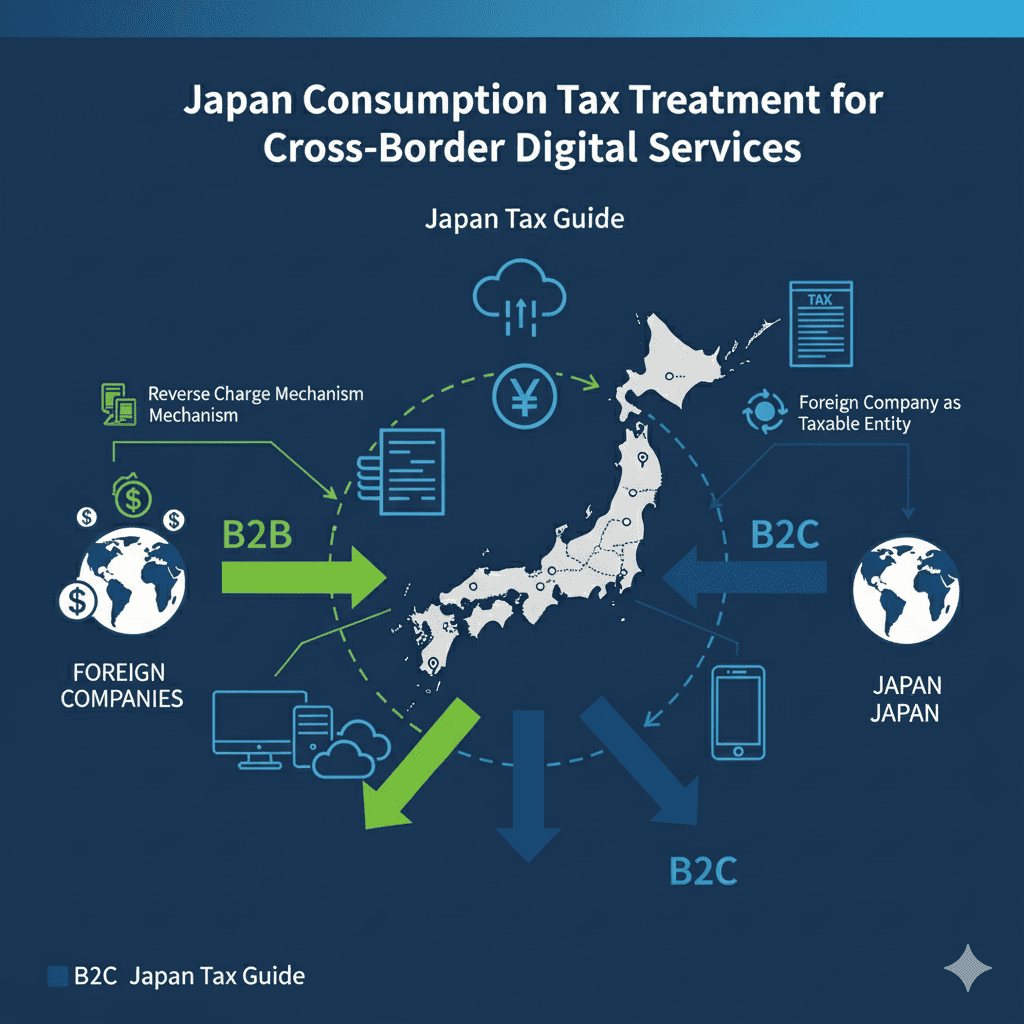

For telecommunications services provided via the internet, such as e-books, music distribution, and cloud services, correctly determining whether the service is subject to consumption tax (determining whether it is domestic or foreign) is an important issue for businesses. In particular, for cross-border transactions, whether or not tax is levied depends on the location of the service recipient, so an appropriate determination of whether the service is domestic or foreign is necessary.

This article provides a detailed explanation of the domestic/foreign tax determination for the provision of telecommunications services, from specific taxation patterns to practical points to note. We provide an easy-to-understand explanation so you can clearly understand the cases in which consumption tax is levied in transactions with domestic and foreign businesses and consumers.

Definition of Telecommunication Services

Telecommunication services refer to various digital services provided through telecommunication networks (internet, etc.). This specifically includes the distribution of e-books, music, and software, online advertising delivery, cloud service provision, and consulting services conducted via telephone or email.

However, services that mediate communication between third parties using communication equipment (telephone, fax, internet connection services) are excluded from this definition. Additionally, when transaction result notifications are transmitted via telecommunication networks as ancillary services to other asset transfers, these notifications are also excluded from the scope.

Domestic vs. Foreign Transaction Classification Standards

The determination of whether telecommunication services constitute domestic transactions subject to consumption tax (domestic/foreign classification) is based on the “domicile of the service recipient.” This represents a significant change from the previous standard based on the “location of the service provider.”

The specific definition of domicile includes an individual’s residence or dwelling place, and for corporations, the location of their head office or principal place of business. This determination must be made based on objective and reasonable criteria.

Determining whether an address, etc. is in Japan must be based on objective and reasonable criteria. For example, in the case of a service that allows users to download e-books or music over the Internet, confirmation must be made in a reasonable manner according to the nature of each transaction, such as by checking the address provided by the customer against the issuing country information of the credit card used for payment.

Taxation by provider and recipient

The taxation relationship for the provision of telecommunications services is determined by the location of the service provider and the service recipient. The main patterns are explained below.

| Service Provider | Service Recipient | Tax Treatment |

|---|---|---|

| Domestic Business | Foreign Business | Foreign Transaction: Non-taxable |

| Foreign Business | Domestic Business | Domestic Transaction: Taxable |

| Domestic Business | Foreign Business | Foreign Transaction: Non-taxable |

| Foreign Business | Domestic Consumer | Domestic Transaction: Taxable |

| Domestic Business | Domestic Consumer | Domestic Transaction: Taxable |

This is particularly important when a foreign business provides services to domestic businesses or consumers. These transactions are subject to tax as domestic transactions and require appropriate consumption tax treatment. On the other hand, when a domestic business provides services to foreign businesses or consumers, they are considered foreign transactions and are not subject to tax.

This taxation system was established to maintain international tax fairness in line with the global spread of digital services. By placing emphasis on taxation in the place where the service is consumed, it aims to ensure appropriate tax revenue and a fair competitive environment.

Special provisions for permanent establishments and overseas offices

Special treatment applies when a permanent establishment in Japan or an overseas office of a Japanese business is involved. These special provisions are intended to provide a more detailed tax assessment for the provision of telecommunications services to businesses.

When a foreign business receives telecommunications services for businesses at a permanent establishment in Japan, the services are taxed as a domestic transaction if they are necessary for the transfer of assets, etc., conducted in Japan. In this case, the reverse charge method applies, and the business receiving the services is obligated to declare and pay consumption tax.

Conversely, if a domestic business receives telecommunications services for businesses at an overseas business establishment, etc., and the services are only necessary for the transfer of assets, etc., outside of Japan, it will be treated as an overseas transaction and will not be subject to the reverse charge method.

These special provisions are based on the concepts of permanent establishments and overseas business establishments under the Income Tax Act or the Corporation Tax Act, and are an important mechanism for ensuring appropriate taxation of consumption tax in international business activities.

Practical points to note and judgment method

When foreign businesses provide telecommunication services to consumers in Japan, these transactions become subject to Japanese consumption tax, creating appropriate tax procedures and payment obligations that must be understood.

It is necessary to verify the address, etc. of the person receiving the service in an objective and reasonable manner.

In addition, the applicable systems may differ between services for businesses and services for consumers. For services for businesses in particular, it is necessary to consider the applicability of the reverse charge system, and coordination with the other business is also important.

summary

Determining whether consumption tax is imposed on the provision of telecommunications services is an important tax issue in the digital economy. By determining whether consumption tax is imposed on the provision of telecommunications services based on the address of the service recipient, etc., it is possible to establish appropriate taxation relationships for cross-border digital services.