🎯 Japan Consumption Tax Filing Services for Foreign Companies(Digital Service Providers)

Powerful support for your business expansion in the Japanese market from a tax compliance perspective.

We comprehensively handle the complex Japanese consumption tax filing and payment procedures on your behalf as international tax experts.

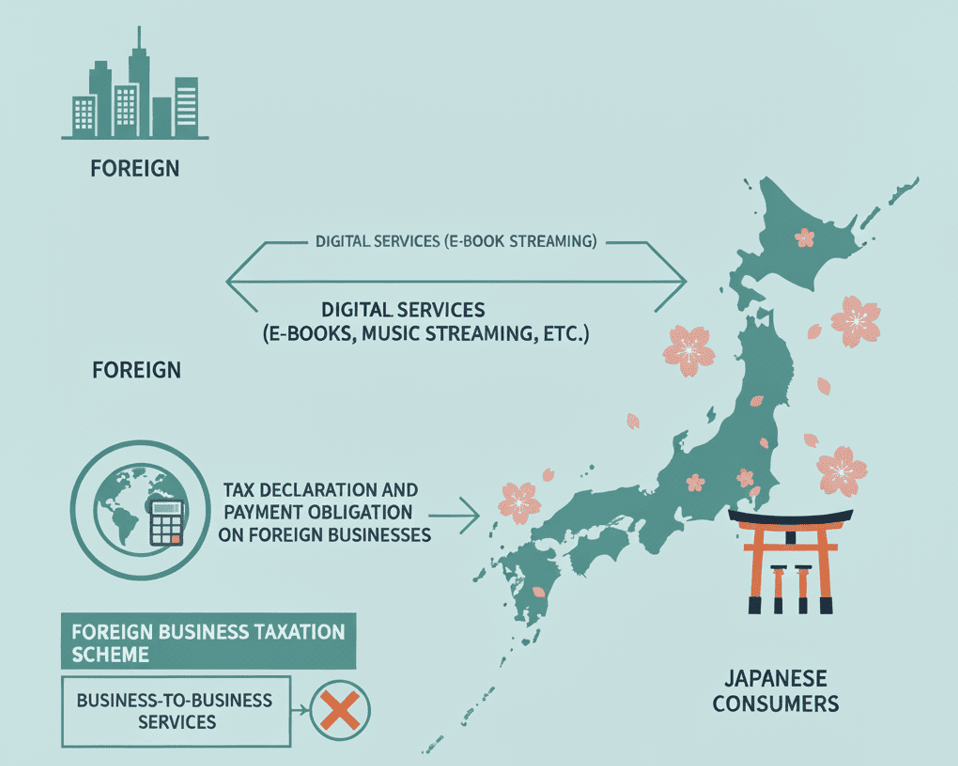

This is a system that directly imposes tax obligations on foreign service providers, such as e-book vendors, because Japanese consumers cannot perform reverse charging (transfer of tax liability).

💻 Tax Administrator Services: Your Japan Compliance Partner

Japan Consumption Tax | Is Your Business Required to File Japan Consumption Tax?

If you provide e-books, videos, apps, online services, etc. to Japanese consumers (individuals and non-business entities) via the internet, the “Foreign Service Provider Taxation System” applies, and your company will have consumption tax filing obligations in Japan. This excludes cases subject to platform taxation through sales via Amazon, Apple Store, etc.

| Typical Applicable Transactions | Tax Obligor |

| Video streaming services from overseas to Japan, app stores, e-book sales, online English conversation, etc. (for Japanese individuals) | Foreign service provider (your company as the service provider) |

💡 Important Note

Even if your website terms of service state “for business use,” if Japanese consumers can freely use the service, it is classified as a “consumer-oriented service” and subject to this system.

👤 Specific Roles and Necessity of Tax Administrator Services

Foreign companies without addresses or offices (permanent establishments: PE) in Japan are required under the Consumption Tax Act to appoint a person in Japan as a “tax administrator” and file notification with the tax office (Consumption Tax Act Article 9).

As international tax specialists, we fully fulfill this obligation.

📊What Does a Tax Administrator Do?

| Service Content | Details | Legal Basis |

| Tax Administrator Appointment Notification | Preparation and submission of appointment notification (and change notification) to tax office | Consumption Tax Act Article 9 |

| Consumption Tax Filing | Preparation and submission of annual consumption tax return (standard or simplified taxation) | Consumption Tax Act Article 45 |

| Payment Procedures | Payment procedure support for finalized consumption tax amount (transfer procedures, payment slip preparation) | Consumption Tax Act Article 50 |

| Invoice Registration Support | Preparation and submission support for “Qualified Invoice Issuer” registration application (optional) | Consumption Tax Act Article 30 |

| Tax Office Correspondence | Receipt, review, and response to notifications and inquiry documents from tax office | Smooth tax administration |

| Data Exchange and Management | Receipt, management, and aggregation of sales and purchase data required for filing | Bookkeeping retention obligations |

📈 Service Fee Guide (Annual Contract)

We offer a clear fee structure based on your company’s sales scale and transaction complexity in the Japanese market.

A. Basic Tax Administrator Package

| Annual Domestic Sales (excl. tax) | Annual Advisory Fee (Tax Administrator Compensation) | Main Services Included |

| Under 50 million yen | Annual: 500,000 yen (Consumption tax filing: 360,000 yen, Tax administrator: 120,000 yen,Interim tax return:20,000yen) | Tax administrator appointment notification, consumption tax return preparation and filing (once annually), tax office correspondence (minor inquiries), payment procedure support |

| 50 million to 100 million yen | Annual: 680,000 yen (Consumption tax filing: 480,000 yen, Tax administrator: 180,000 yen, Interim tax return:20,000yen) | Tax administrator appointment notification, consumption tax return preparation and filing (once annually), tax office correspondence (minor inquiries), payment procedure support |

| Over 100 million yen | Custom Quote | We provide optimal quotes based on transaction volume and complexity. |

※ Above amounts exclude tax.

B. Optional Services (Initial or Spot Fees)

| Service Content | Fee (excl. tax) | Notes |

| Invoice Registration Application Support | 100,000 yen | We handle new registration applications for qualified invoice issuers. |

| Notification Submission Support (Initial Setup) | 50,000 yen | We handle submission of various consumption tax-related notifications other than tax administrator notifications. |

| Retroactive Filing for Past Years | Custom Quote | Costs for retroactive filing support when filing has been neglected since tax obligation arose. |

| English Report Preparation | 50,000 yen per report | Fee for English-language reporting of filing results and tax authority correspondence status. |

💡 Important

We will collect half of the above fees upon contract signing or service commencement. Payment is accepted in Japanese yen. The remaining balance will be invoiced upon completion of tax return filing.

Other Services We Provide

🔍 Consulting

- Pre-assessment of consumption tax liability risks

- Transaction structure optimization advice

- Tax reform information provision

- Tax audit attendance and response support

- Consultation on other Japanese taxes (corporate tax, withholding tax, etc.)

How to Contact [Kaku Japan Tax Service] – Simple 5-Step Process

Please fill out the inquiry form below, enter what you are inquiring about, and request a quote.

We will confirm the details of your inquiry.

We will provide you with a written quotation.

Both will affix their seals.

Both will affix their seals.

Submit Your Inquiry – Fast Response Guaranteed

✅ Why Choose Us: International Tax Experts

1. Advanced Compliance Maintenance

We accurately handle exemption determinations unique to the “Foreign Service Provider Taxation System” (when taxable sales in the base period are 10 million yen or less) and precise processing of input tax credits. We ensure strict legal compliance and minimize future tax audit risks.

2. Strategic Response to Invoice System

To enable input tax credits for Japanese business clients, it is important for foreign companies to establish an invoice (qualified invoice) issuance system. We provide advice on aligning your systems with Japanese invoice requirements.

3. Support System for Foreign Companies

We accommodate English communication (primarily via email) and provide clear explanations of Japan’s tax system to overseas personnel.

📅 Standard Filing Cycle (for December fiscal year-end)

Consumption tax filing for foreign service providers is basically an annual final return. We proceed with procedures in collaboration with your company according to the following schedule.

| Period | Client Actions | Our Support | Deadline |

| 📍 January – December (Taxable Period) | ・Record sales to Japan ・Organize transaction data | ・On-demand tax consultation ・Updates on regulatory changes ・Advice on record-keeping methods | Promptly after each month-end |

| 🔔 Interim Filing Period (Based on prior year tax amount) | 【Once per year】 ・Pay 1/2 of prior year’s tax 【3 times per year】 ・Pay 1/4 of prior year’s tax each time 【11 times per year】 ・Pay 1/12 of prior year’s tax each time | ・Determine interim filing requirement ・Prepare interim tax returns ・Calculate and notify payment amounts ・File returns and process payments ・Schedule management | 【Once per year】August 31 【3 times per year】 May 31, August 31, November 30 【11 times per year】 End of following month ※Required if prior year tax exceeds ¥480,000 |

| 📍 December 31 | ・End of taxable period ・Finalize annual sales | ・Filing preparation | Taxable period end date |

| 📍 January 1-15 | ・Final submission of sales data ・Organize invoices and receipts ・Prepare purchase-related documents | ・Send required document checklist ・Specify data format ・Confirm receipt and review contents | Recommended deadline: January 15 |

| 📍 January 16-31 | ・Provide additional documents (if needed) ・Review filing contents | ・Prepare consumption tax return ・Calculate and verify tax amount ・Present draft return ・Obtain client approval | Target completion: End of January |

| 📍 February 1-15 | ・Prepare tax payment funds ・Approve final return ・Remit payment funds | ・Submit return to tax office ・Process tax payment ・Send filing completion report ・Store copy documents | Legal deadline: February 28 |

| 📍 March onwards | ・Store filing documents ・Begin next period preparation | ・Handle tax office correspondence ・Support next period sales management ・Conduct annual review ・Determine next period interim filing requirement | Document retention: 7 years |

💡 Key Point

The filing deadline is generally within 2 months from the day after the tax period ends. For December fiscal year-end, the deadline is February 28 of the following year.

📄 Documents Required for Filing (Items Clients Generally Need to Prepare)

| Document Type | Content | Submission Format | Submission Deadline |

| ✅ Sales Detail Data | ・Annual sales to Japanese customers ・Transaction dates, amounts, customer information ・Service content details | Excel, CSV, PDF | By January 15 |

| ✅ Invoices/Receipts | ・Copies of issued invoices ・Payment confirmation documents | PDF or scanned | By January 15 |

| ✅ Purchase/Expense Materials (if applicable) | ・Purchases or expenses in Japan ・Invoices (qualified invoices) ・Proof of taxable purchase payments | PDF or scanned | By January 31 |

| ✅ Exchange Rate Information | ・For foreign currency transactions ・Conversion rates used | Excel, memo | With data submission |

| ✅ Previous Return Copy (from 2nd year) | ・Previous year’s final return ・Payment slip copy | Initial submission |

Related Articles

📋 Comprehensive Checklist (Summary)

| Checklist Item | Confirmation Details | Responsible Party |

|---|---|---|

| □ Foreign service provider confirmation | Whether contract party has head office outside Japan | Common |

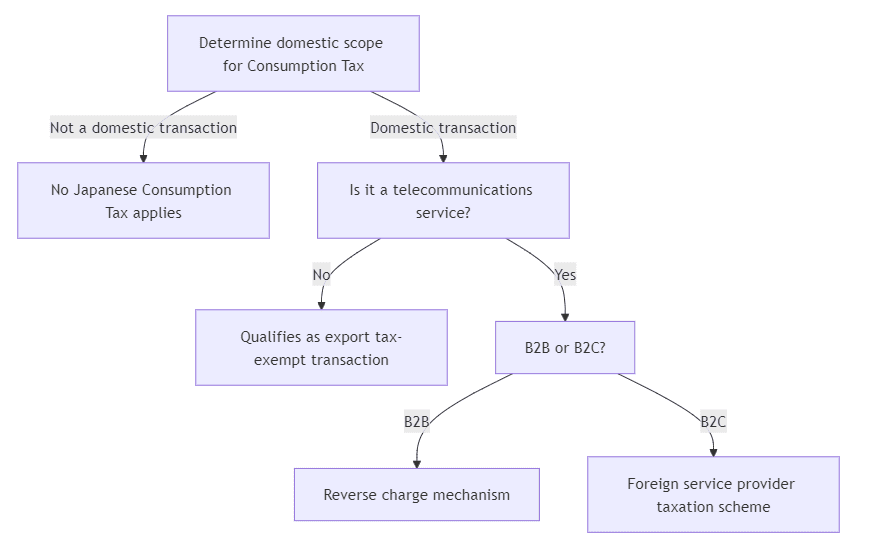

| □ Telecommunications service applicability | Whether service provided via internet | Common |

| □ Domestic transaction determination | Whether service recipient is in Japan | Common |

| □ Business/Consumer classification | Service nature, contract terms, actual usage restrictions | Common |

| □ Taxation method confirmation | Standard, simplified, or 20% special taxation | Domestic businesses |

| □ Taxable sales ratio confirmation | 95% or above vs. below 95% | Domestic businesses |

| □ Reverse charge filing necessity | Filing required only for standard taxation and below 95% | Domestic businesses |

| □ Tax administrator appointment | Whether representative appointed in Japan | Foreign businesses |

| □ Invoice registration | Whether registered as qualified invoice issuer | Foreign businesses |

| □ Consumption tax collection/payment | Whether collecting 10% surcharge and filing | Foreign businesses |

🎯 Practical Points

Consumption tax liability determination is complex, but by mastering these three points: ①accurately understanding transaction realities, ②understanding your company’s taxation method, ③confirming transitional measure requirements, you can prevent mistakes. When in doubt, we recommend consulting with a tax accountant or tax office.

Frequently Asked Questions

Do foreign corporations without bases in Japan need to file consumption tax?

Yes, when foreign corporations provide telecommunications services to Japanese consumers, consumption tax filing obligations arise except in cases eligible for tax exemption. Special attention is required when selling to customers in Japan.What is a tax administrator?

A tax administrator is a representative in Japan who handles tax filing and payment procedures on behalf of foreign corporations without bases in Japan. When consumption tax filing and payment are required, appointing a tax administrator is mandatory.At what level of taxable sales does filing become necessary?

Generally, when taxable sales in the base period (usually 2 periods prior) exceed 10 million yen, consumption tax payment obligations arise. This standard applies to foreign corporations as well. Also, upon becoming a qualified invoice issuer, you become a consumption tax payer from that point. Please contact us for details.Can tax filing be done without being in Japan?

Yes, by appointing a tax administrator, foreign corporations without bases in Japan can file taxes. The tax administrator handles all necessary procedures, so you can rest assured.

Office information

| office name | Kaku Tax Accountant Office |

|---|---|

| representative | Koji Kaku (Certified tax accountant, gyouseishoshi) |

| address | Albergo Ochanomizu421 2-1-19 Kanda Surugadai Chiyoda-ku Tokyo Japan |

| phone | +81-3-5577-3874 |

| mobile | +81-90-4389-6703 |

| info@kakutax.com |