kakutax– Author –

kakutax

kakutax -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

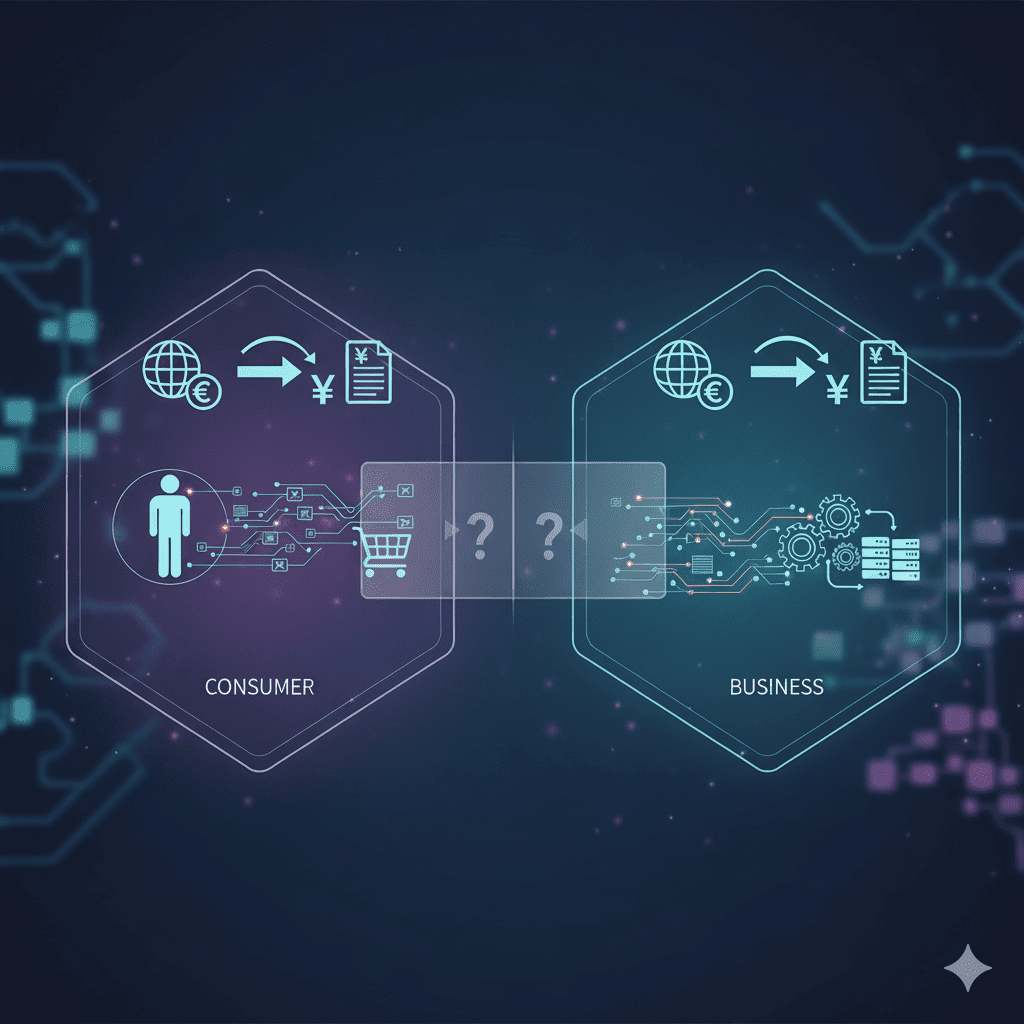

Japan Consumption Tax Guide for Foreign Digital Services & E-books

When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption ... -

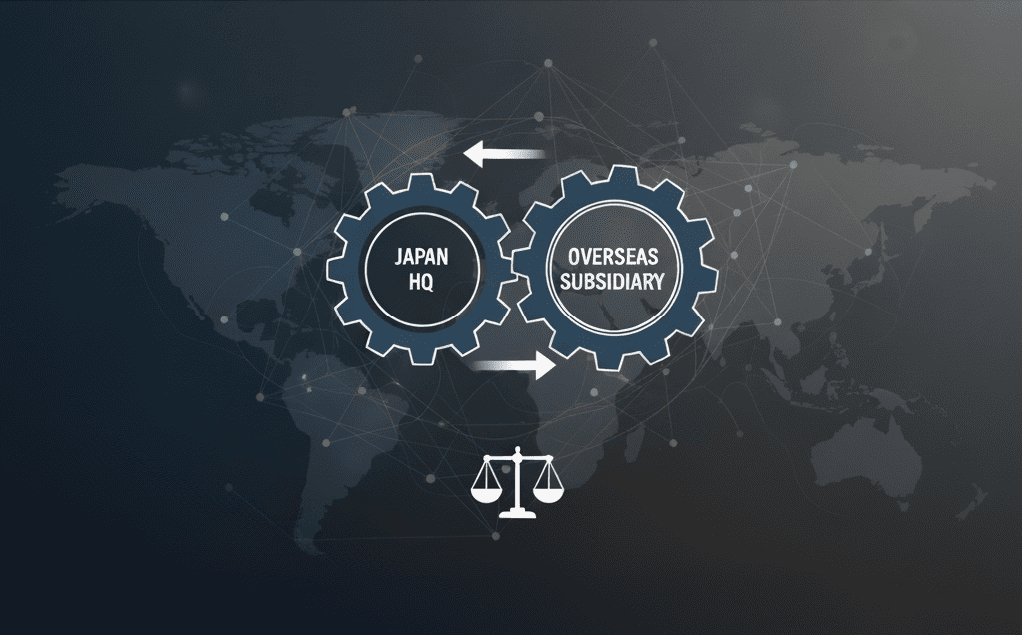

Transfer Pricing Compliance Guide for SMEs: Tax Risk Management

Transfer Pricing Compliance Guide for Small and Medium Enterprises: Essential Implementation Strategies For small and medium enterprises (SMEs) expanding overseas, compliance with transfer pricing regulations has become an unavoidable an... -

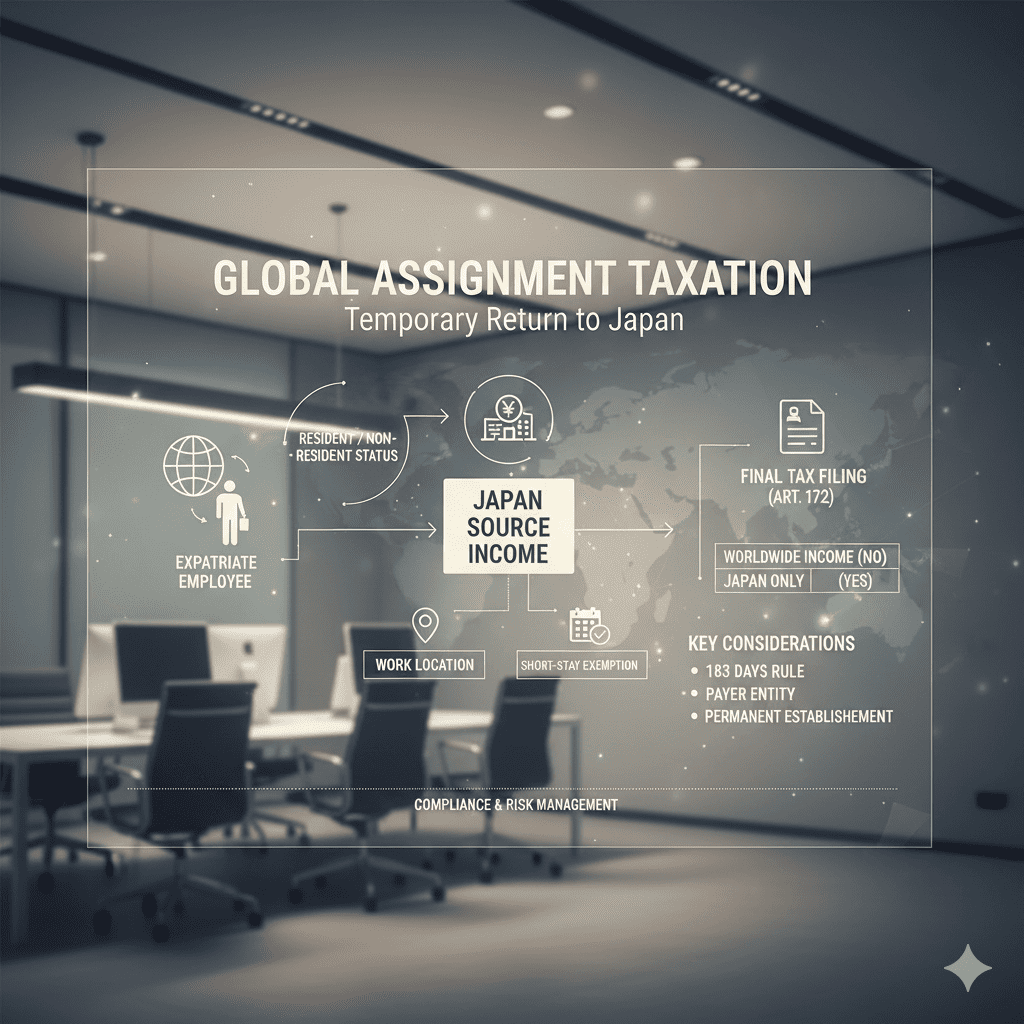

Tax Guide for Japanese Overseas Employees: Temporary Return Rules

Tax Treatment Considerations for Employees Temporarily Returning from Foreign Company Assignments In today's business environment where overseas assignments to foreign subsidiaries are increasing, the tax treatment of assigned employees ... -

Service Export Tax Exemption Guide: Complete International Tax Processing for Japanese Companies

Service Export Tax Exemption: Complete Guide to International Service Transactions and Tax Processing In today's era of expanding international business, Japanese companies increasingly have opportunities to provide services overseas. Su... -

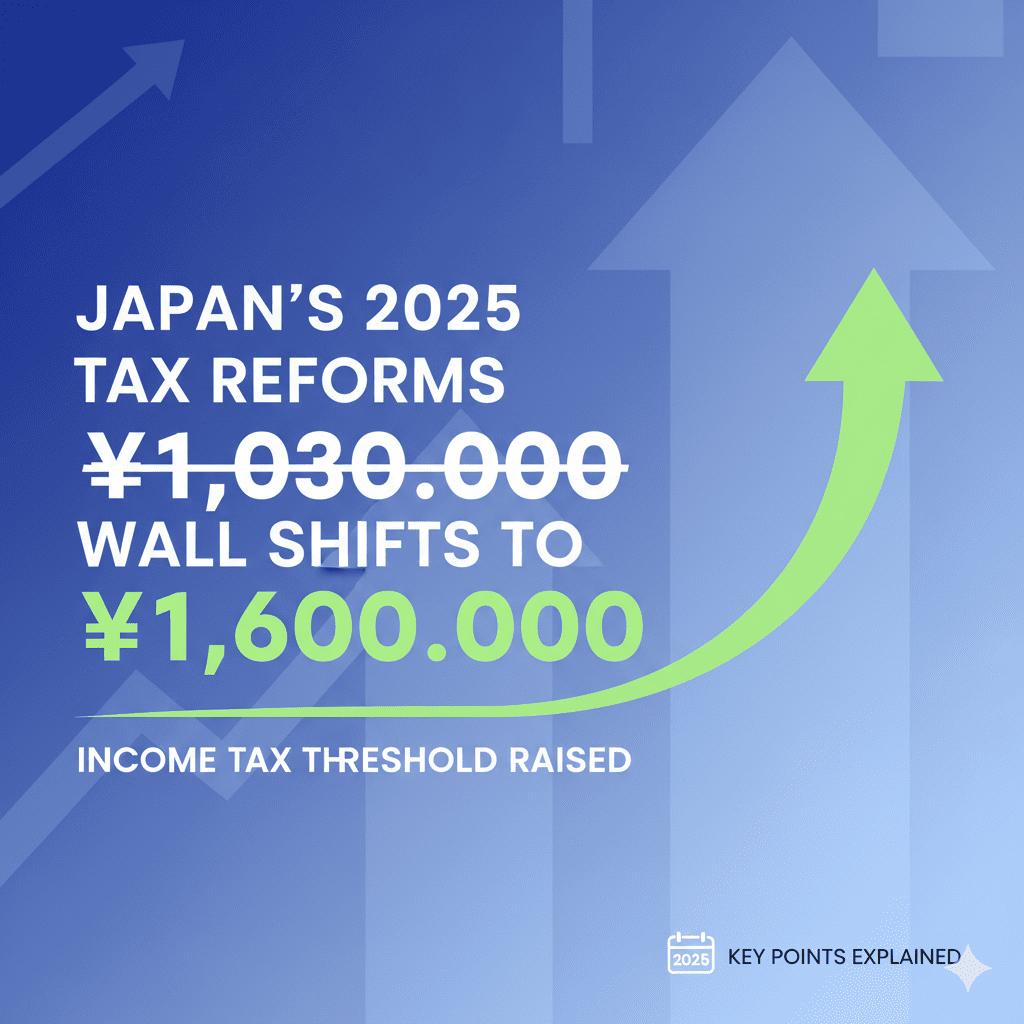

2025 Japan Tax Reform: 1.03M Yen Wall Raised to 1.6M – Complete Guide

2025 Tax Reform: The 1.03 Million Yen Wall Raised to 1.6 Million Yen! Key Points of Income Tax Reform Explained The 2025 (Reiwa 7) tax reform has significantly revised Japan's income tax system, affecting many working individuals. The ta... -

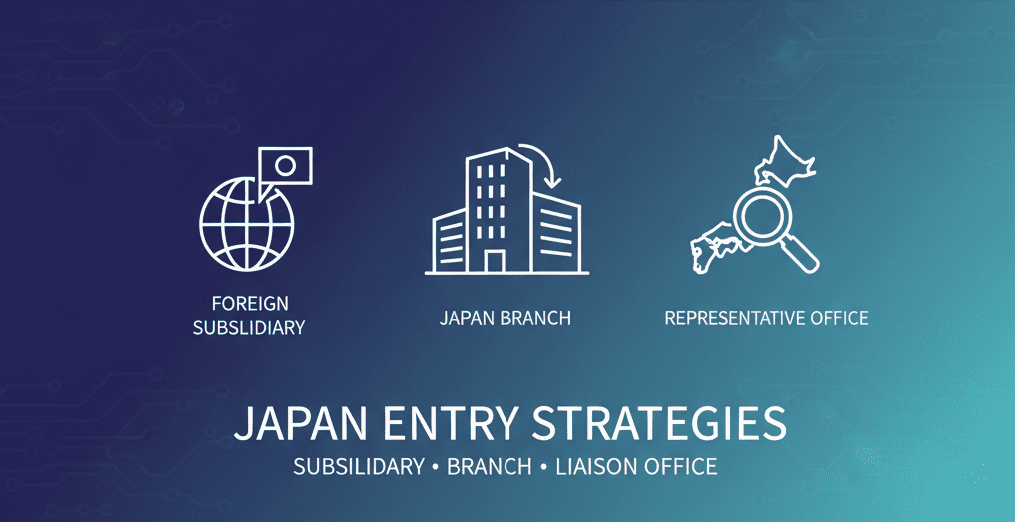

Foreign Company Entry Forms in Japan: Complete Guide

foreign company entry forms in Japan When foreign companies or foreign nationals plan to enter the Japanese market, the first critical decision they face is "which entry form to choose." There are three main options: establishing a Japan... -

Consumption Tax for Non-Residents with Japanese Branches: Guide 2025

Consumption Tax Implications for Services Provided to Non-Residents with Japanese Branches One key transaction type in international consumption tax handling is the "provision of services to non-residents with Japanese branches" and its ... -

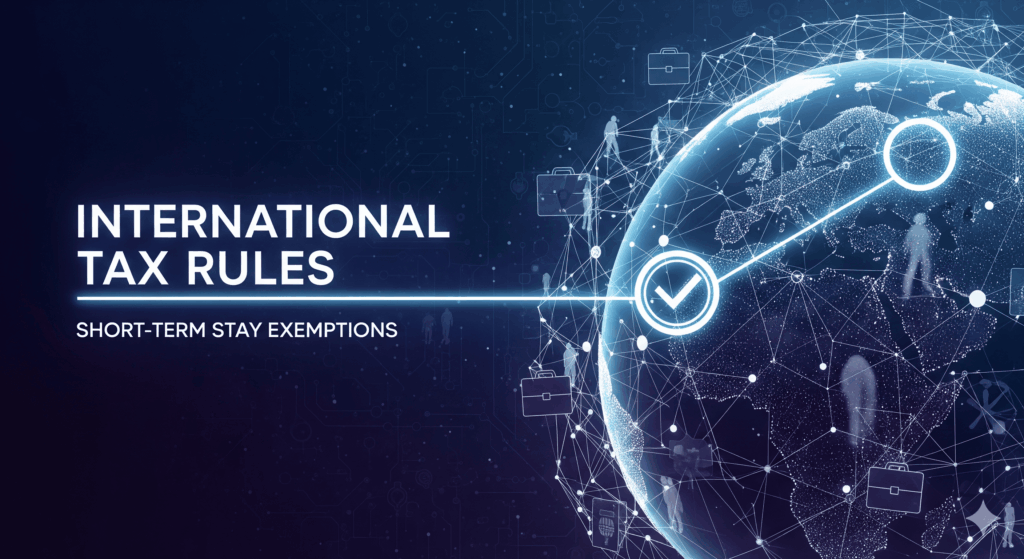

183-Day Rule Guide: Avoid Double Taxation with Short-Term Resident Exemption

Essential International Tax Knowledge In today's globalized world, many companies regularly conduct overseas business trips and short-term assignments. A crucial concept that must be understood in such situations is the "short-term resid... -

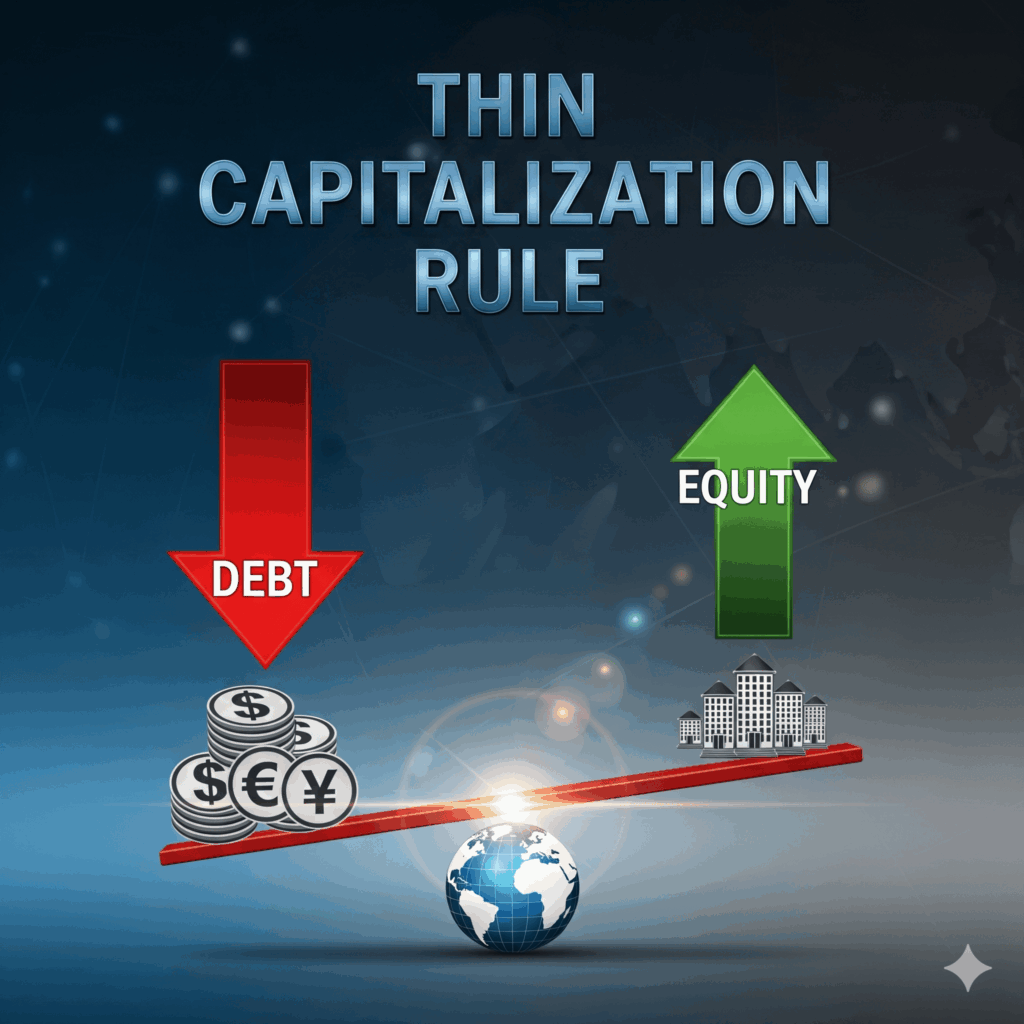

Japan Thin Capitalization Rules Guide: Anti-Tax Avoidance for Overseas Related Companies

Anti-Tax Avoidance System for Transactions with Overseas Related Companies For companies with overseas related companies, the choice of financing methods becomes a crucial tax consideration. The decision between equity investment or borr... -

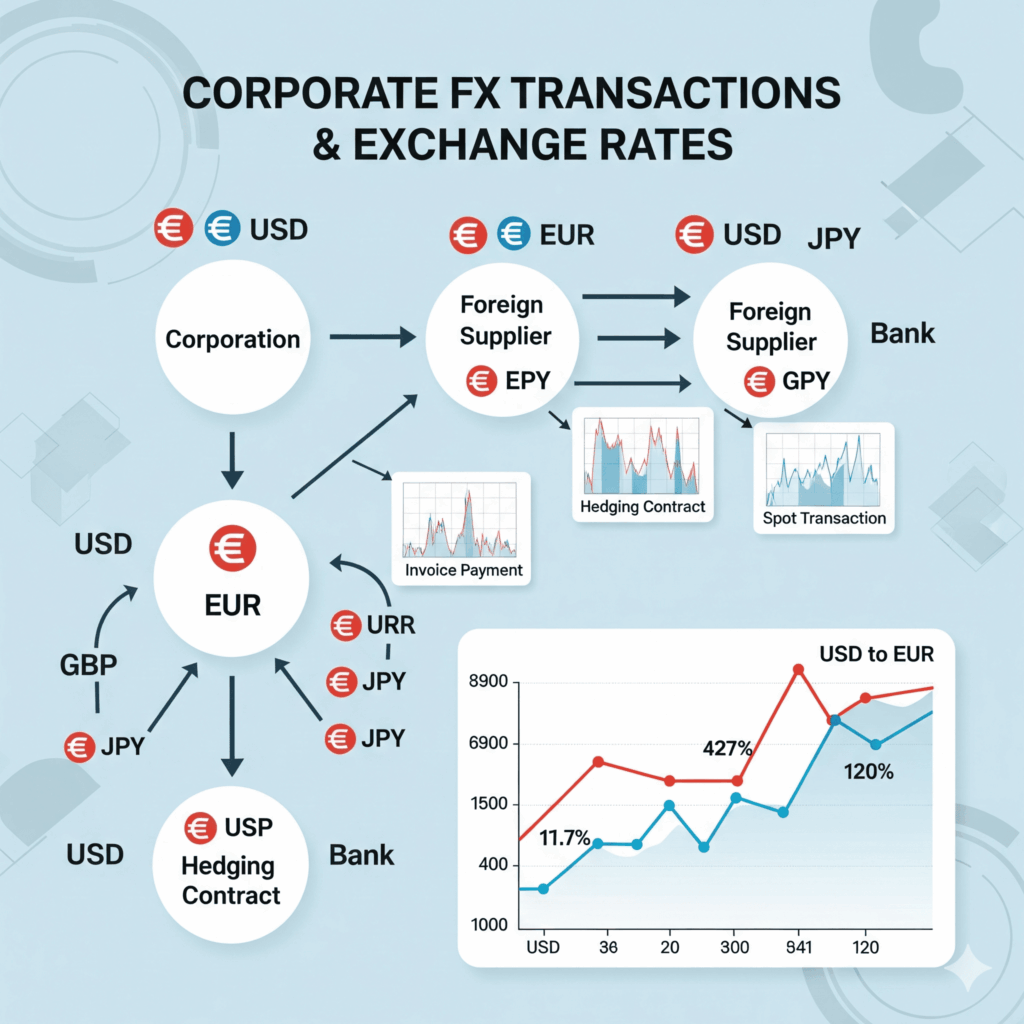

Foreign Currency Exchange Rate Treatment: Japanese Corporate Tax Law Guide 2025

Foreign Currency Exchange Rate Treatment for Corporate Transactions In today's globalized world, many companies engage in foreign currency transactions. However, there are complex rules regarding yen conversion methods for tax purposes, ... -

Tax Treaty Applications for Foreign Corporations in Japan: Guide

Tax Treaty Applications for Payments to Foreign Corporations When making payments of dividends, interest, or royalties to foreign corporations, failure to follow proper procedures can result in a high withholding tax rate of 20.42%. By c... -

Japan Domestic Source Income of Foreign Corporations and the Tax Base for Corporate Tax

Four Categories of Taxpayers and Their Taxation Scope Japan's tax system divides taxpayers into four categories, each with different taxation scopes. Residents are individuals who have an address in Japan or have continuously mainta... -

Japan Tax-Exempt Refund System 2026: Complete Guide for Stores

Tax-Exempt Store Refund System Transition in Japan Starting November 1, 2026, Japan's tax-exempt store system will undergo fundamental changes. The complete transition from the traditional "immediate tax-exempt price sales at the point o... -

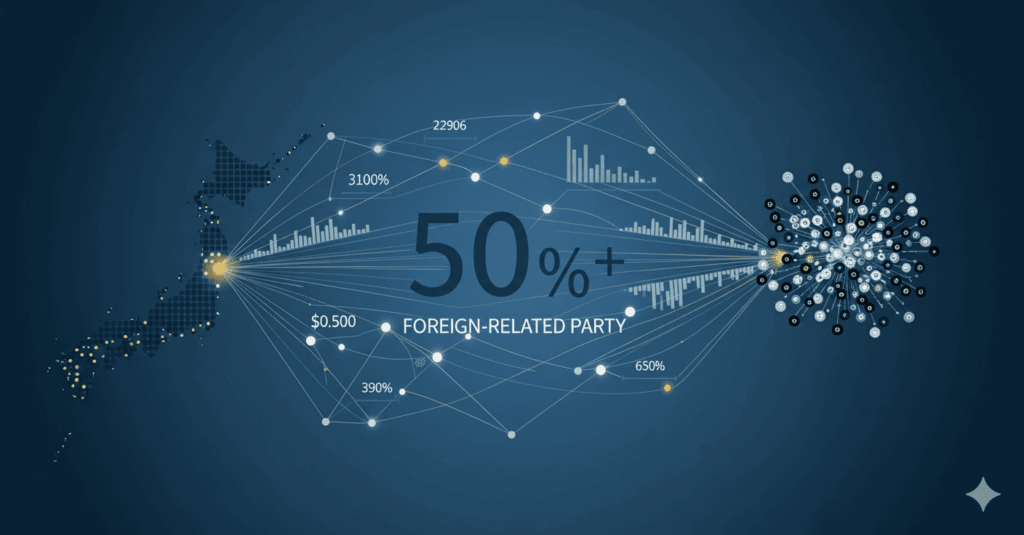

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing Regulations One of the most crucial concepts in transfer pricing regulations is the determination of "foreign related parties." This determination is a vital e... -

DDP Import Issues in Japan: Tax Credit Problems & ACP Solutions 2025

Issues with DDP Transactions with Japanese businesses DDP (Delivered Duty Paid) is a commonly used trading condition in international trade. This is a convenient contract where "the seller bears all costs including customs duties an... -

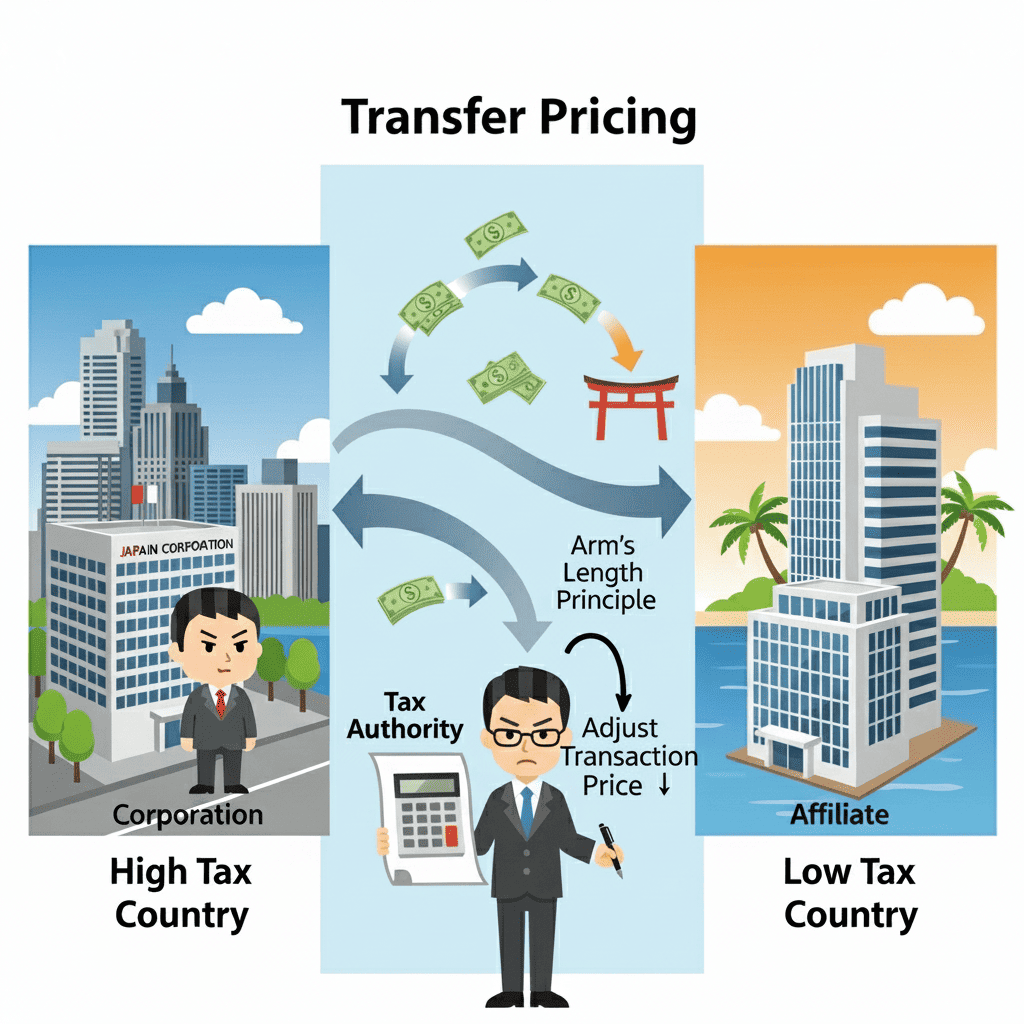

Basics of Japan’s Transfer Pricing System (1)

Basic Mechanism and Purpose of Transfer Pricing Taxation System Transfer pricing taxation system is a system that recalculates taxable income based on appropriate prices when income is transferred overseas due to transaction prices ... -

Japan Export Tax Exemption Guide: Consumption Tax Rules 2025

Japan Export Tax Exemption for Consumption Tax The export tax exemption system is based on the fundamental principle that consumption tax, being a domestic consumption tax, should not be imposed on goods and services consumed abroad. Con... -

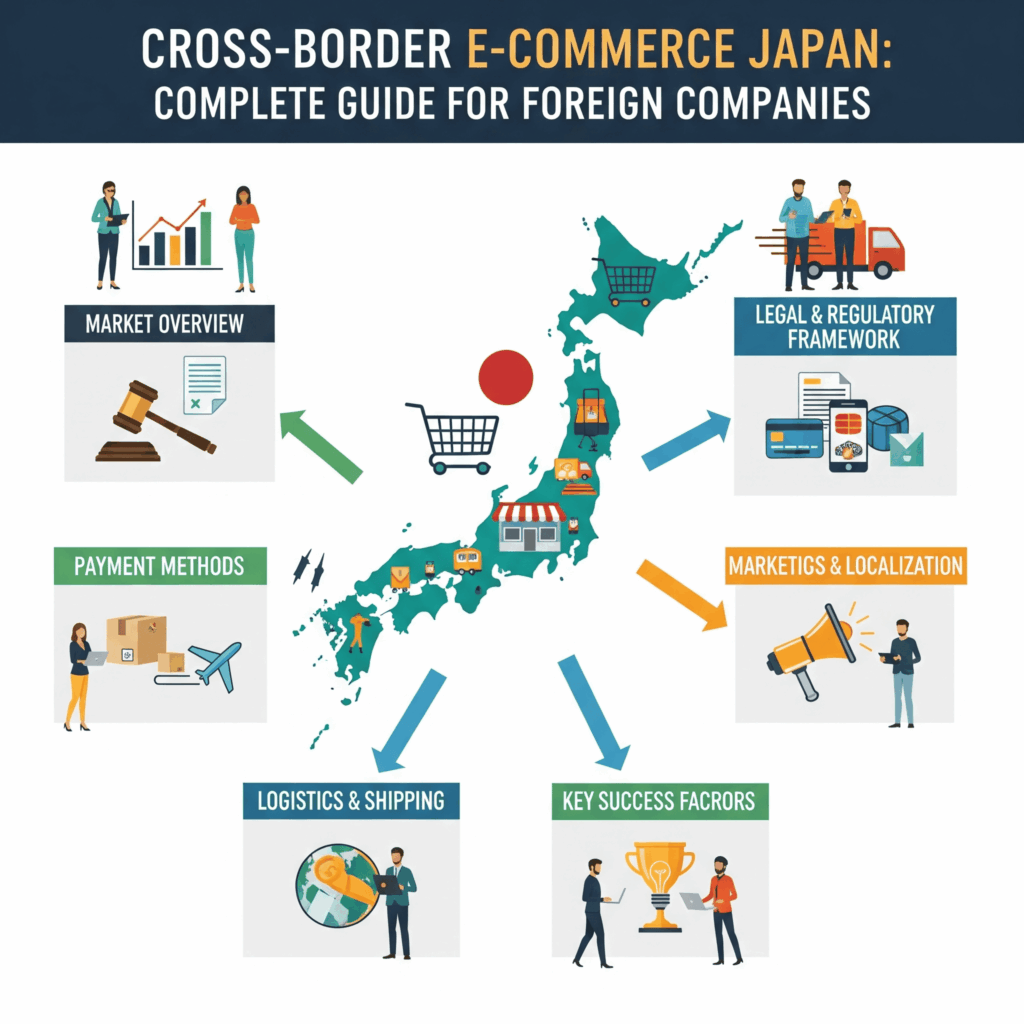

Cross-Border E-Commerce Japan: Complete Guide for Foreign Companies

Cross-Border E-Commerce for Foreign Companies Without Japanese Operations Cross-border e-commerce business, where foreign companies sell products and services directly to Japanese consumers through their own websites without establishing...

12