consumption tax– category –

consumption tax of Japan

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

Japan Consumption Tax Guide for Foreign Digital Services & E-books

When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption ... -

Service Export Tax Exemption Guide: Complete International Tax Processing for Japanese Companies

Service Export Tax Exemption: Complete Guide to International Service Transactions and Tax Processing In today's era of expanding international business, Japanese companies increasingly have opportunities to provide services overseas. Su... -

Consumption Tax for Non-Residents with Japanese Branches: Guide 2025

Consumption Tax Implications for Services Provided to Non-Residents with Japanese Branches One key transaction type in international consumption tax handling is the "provision of services to non-residents with Japanese branches" and its ... -

Japan Tax-Exempt Refund System 2026: Complete Guide for Stores

Tax-Exempt Store Refund System Transition in Japan Starting November 1, 2026, Japan's tax-exempt store system will undergo fundamental changes. The complete transition from the traditional "immediate tax-exempt price sales at the point o... -

DDP Import Issues in Japan: Tax Credit Problems & ACP Solutions 2025

Issues with DDP Transactions with Japanese businesses DDP (Delivered Duty Paid) is a commonly used trading condition in international trade. This is a convenient contract where "the seller bears all costs including customs duties an... -

Japan Export Tax Exemption Guide: Consumption Tax Rules 2025

Japan Export Tax Exemption for Consumption Tax The export tax exemption system is based on the fundamental principle that consumption tax, being a domestic consumption tax, should not be imposed on goods and services consumed abroad. Con... -

Cross-Border E-Commerce Japan: Complete Guide for Foreign Companies

Cross-Border E-Commerce for Foreign Companies Without Japanese Operations Cross-border e-commerce business, where foreign companies sell products and services directly to Japanese consumers through their own websites without establishing... -

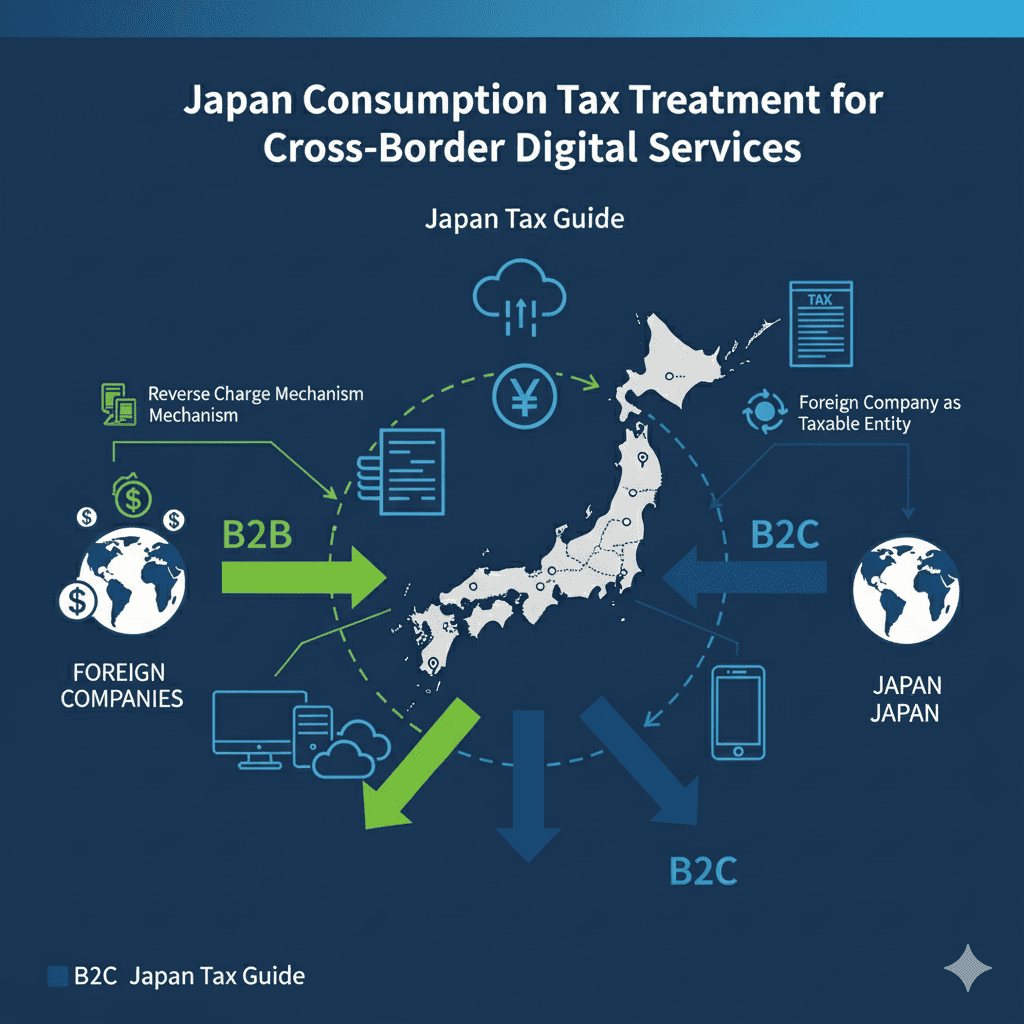

Japan Consumption Tax Treatment for Cross-Border Digital Services | Japan Tax Guide

Why is domestic and foreign judgment important regarding Japan's consumption tax? When considering the taxation relationship for Japanese consumption tax, we consider the taxation relationship in stages. First, we need to consider whethe... -

Amazon Japan Sales Tax for Foreign Companies (Import & Domestic)

What is fulfillment service? "Fulfillment service" is a service that performs a series of operations on behalf of e-commerce site operations, such as storage and management of products, order processing, packaging, shipping, and return h... -

Japan’s Customs Law Changes: New Import Consumption Tax Impact on Export Businesses

Background of the Correction Due to the revision of the Customs Act, the requirement for consumption tax declaration arose from the need to clarify the tax burden when importing and selling goods in Japan, and to ensure the proper collec... -

Comprehensive Guide to Japan’s Consumption Tax: Eligibility, Calculation, and Simplified Taxation Methods

Subject to consumption tax Consumption tax is only applicable to the following three transactions: Transfer and lending of assets and provision of services carried out by business operators in Japan for compensation as part of their busi... -

Comprehensive Guide to Japanese Corporate Tax Procedures: Filing, Deadlines, and Compliance

The general tax-related procedures that Japanese corporations must complete within a year are wide-ranging, including corporate tax, consumption tax, local tax, and withholding tax. We will explain these procedures in chronological order... -

Complete Guide to Japan’s Consumption Tax Invoice System: Requirements, Impacts, and Compliance

Background of the introduction of the consumption tax invoice system Japan's invoice system is a consumption tax-related system that requires businesses to issue and save qualified invoices. This system will be introduced on October 1, 2... -

Japanese Consumption Tax Rules for Foreign Corporations Starting Business: 2024 Revisions

Revision of Japanese consumption tax liability when a foreign corporation starts business in Japan In the case of a foreign corporation, even if there is a base period (in principle, the previous two business years in the case of a corpo... -

Japan’s New Import Tax Rules: Impact on Foreign Corporations Without PE and Fulfillment Services

Background of the change With the expansion of cross-border e-commerce, imports of mail-order cargo, etc. increased, and cargo using FS (Fulfillment Service) increased. As a result of this increase, cases of tax evasion occurred in which... -

Understanding Service Exports and Consumption Tax Exemptions in Japan

Among consumption tax export exemptions, regarding service exports Regarding consumption tax, there is a system called export tax exemption, but here I would like to consider the special field of exporting services. Please note that this... -

Export Duty-Free Explained: Understanding Japan’s Consumption Tax Exemptions for Exports

What is export duty free? Do you know that there is a consumption tax exemption system for exports? Consumption tax is basically levied on items consumed within the country. Domestic means within Japan. Often referred to as tax exemption... -

Understanding Consumption Tax Export Duty Free: Benefits and Business Applications

What is consumption tax export duty free? This time, I would like to think about the effects of consumption tax export exemption, which is a frequently asked question. We would like to separately post examples of business applications. R...

1