corporate tax– category –

-

Transfer Pricing Compliance Guide for SMEs: Tax Risk Management

Transfer Pricing Compliance Guide for Small and Medium Enterprises: Essential Implementation Strategies For small and medium enterprises (SMEs) expanding overseas, compliance with transfer pricing regulations has become an unavoidable an... -

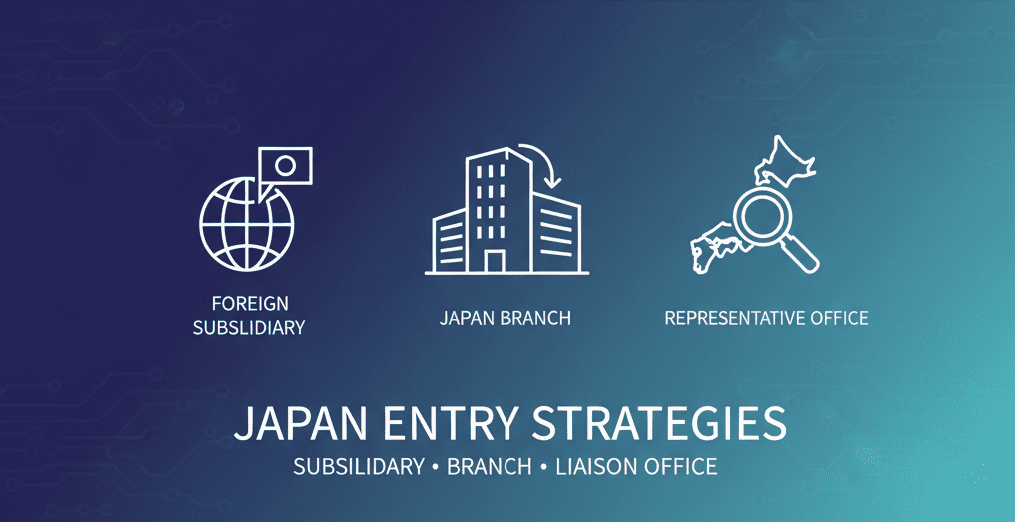

Foreign Company Entry Forms in Japan: Complete Guide

foreign company entry forms in Japan When foreign companies or foreign nationals plan to enter the Japanese market, the first critical decision they face is "which entry form to choose." There are three main options: establishing a Japan... -

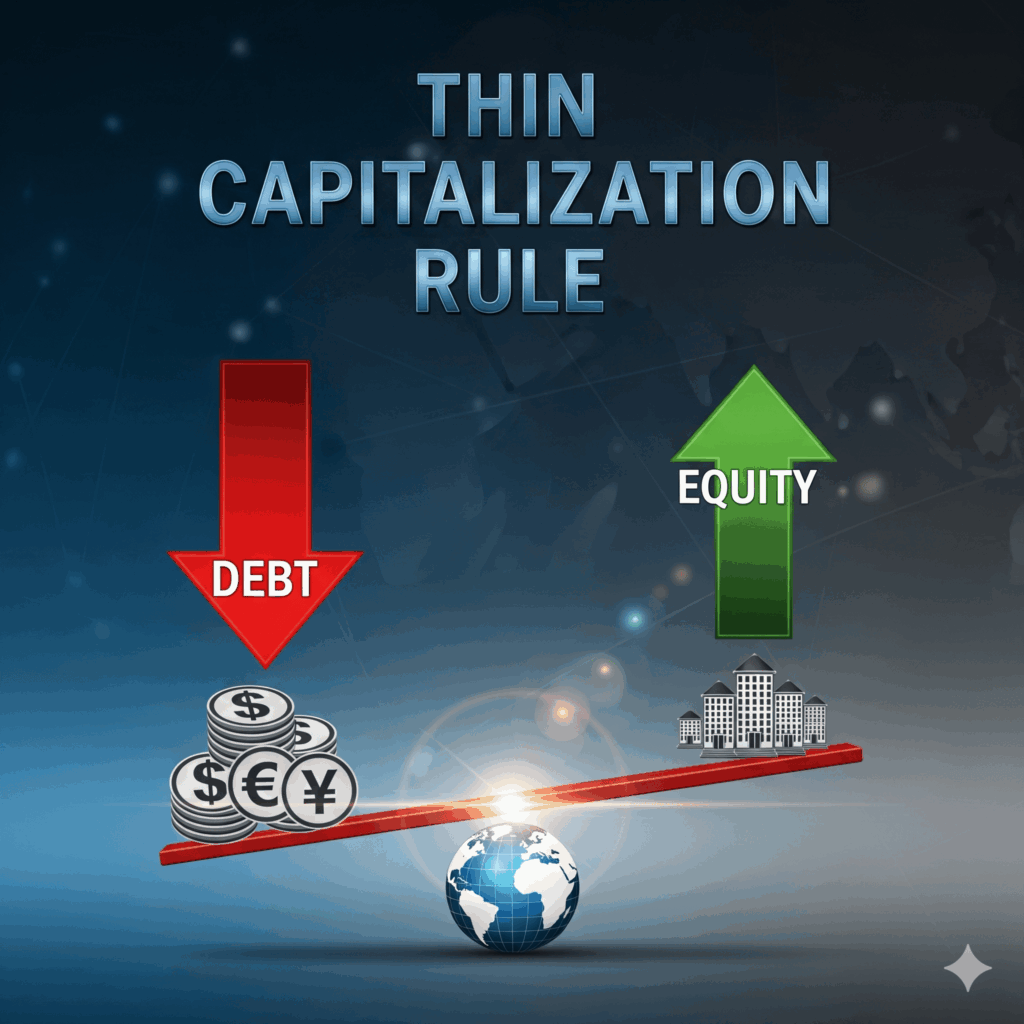

Japan Thin Capitalization Rules Guide: Anti-Tax Avoidance for Overseas Related Companies

Anti-Tax Avoidance System for Transactions with Overseas Related Companies For companies with overseas related companies, the choice of financing methods becomes a crucial tax consideration. The decision between equity investment or borr... -

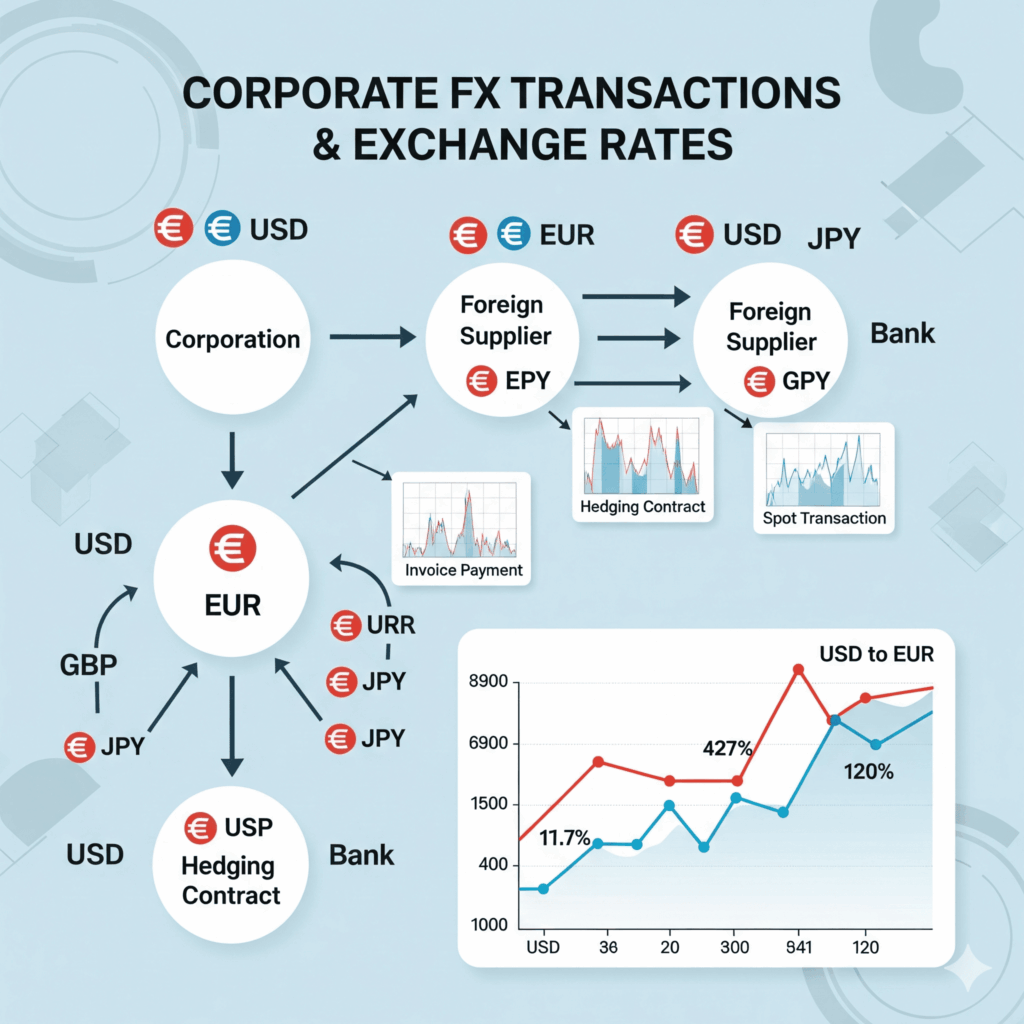

Foreign Currency Exchange Rate Treatment: Japanese Corporate Tax Law Guide 2025

Foreign Currency Exchange Rate Treatment for Corporate Transactions In today's globalized world, many companies engage in foreign currency transactions. However, there are complex rules regarding yen conversion methods for tax purposes, ... -

Japan Domestic Source Income of Foreign Corporations and the Tax Base for Corporate Tax

Four Categories of Taxpayers and Their Taxation Scope Japan's tax system divides taxpayers into four categories, each with different taxation scopes. Residents are individuals who have an address in Japan or have continuously mainta... -

Japan Tax-Exempt Refund System 2026: Complete Guide for Stores

Tax-Exempt Store Refund System Transition in Japan Starting November 1, 2026, Japan's tax-exempt store system will undergo fundamental changes. The complete transition from the traditional "immediate tax-exempt price sales at the point o... -

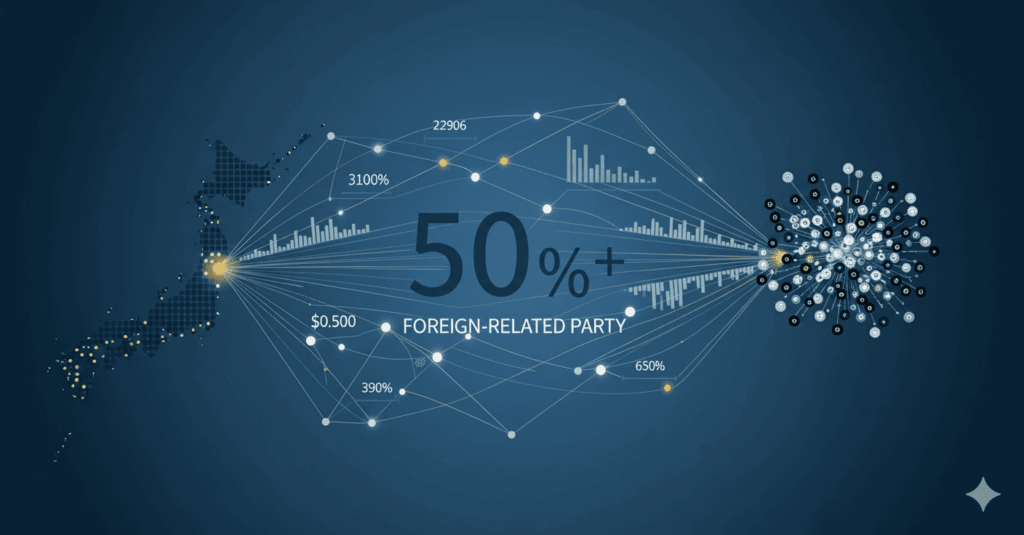

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing Regulations One of the most crucial concepts in transfer pricing regulations is the determination of "foreign related parties." This determination is a vital e...

1