Japanese income tax– category –

-

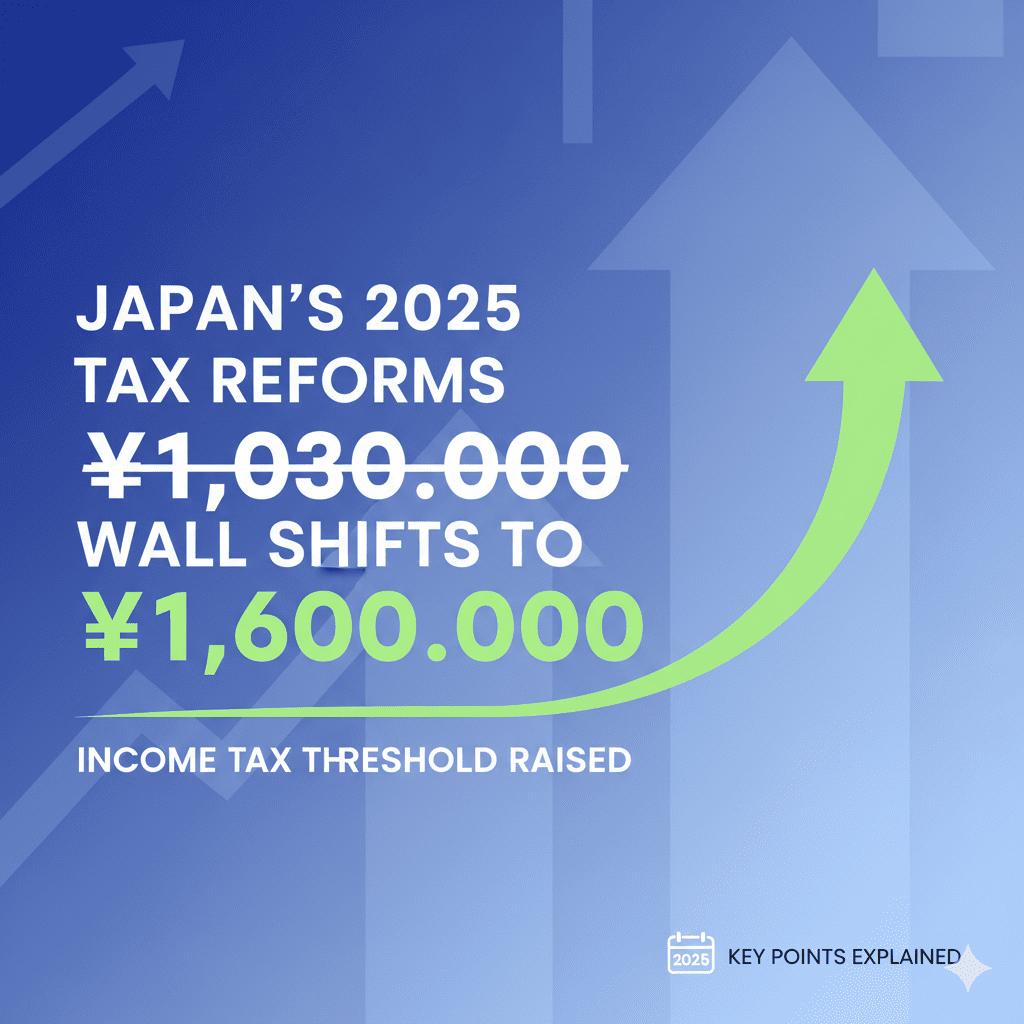

2025 Japan Tax Reform: 1.03M Yen Wall Raised to 1.6M – Complete Guide

2025 Tax Reform: The 1.03 Million Yen Wall Raised to 1.6 Million Yen! Key Points of Income Tax Reform Explained The 2025 (Reiwa 7) tax reform has significantly revised Japan's income tax system, affecting many working individuals. The ta... -

183-Day Rule Guide: Avoid Double Taxation with Short-Term Resident Exemption

Essential International Tax Knowledge In today's globalized world, many companies regularly conduct overseas business trips and short-term assignments. A crucial concept that must be understood in such situations is the "short-term resid... -

Tax Treaty Applications for Foreign Corporations in Japan: Guide

Tax Treaty Applications for Payments to Foreign Corporations When making payments of dividends, interest, or royalties to foreign corporations, failure to follow proper procedures can result in a high withholding tax rate of 20.42%. By c... -

Japan Domestic Source Income of Foreign Corporations and the Tax Base for Corporate Tax

Four Categories of Taxpayers and Their Taxation Scope Japan's tax system divides taxpayers into four categories, each with different taxation scopes. Residents are individuals who have an address in Japan or have continuously mainta... -

Income Tax in Japan: Classification of Residents, Non-Permanent Residents, and Non-Residents

What is a resident? According to the Income Tax Act, a "resident" is defined as an individual who has an address in Japan or an individual who has continued to reside in Japan for one year or more. Residents are liable for Japanese incom... -

Overseas Dependent Deduction: Eligibility, Documents, and Tax Law Updates

Introduction Dependency deduction for dependent relatives residing overseas Dependency deduction, spousal deduction, special spousal deduction, or disability deduction are applicable if certain conditions are met under Japanese tax law. ... -

Comprehensive Guide to Japanese Corporate Tax Procedures: Filing, Deadlines, and Compliance

The general tax-related procedures that Japanese corporations must complete within a year are wide-ranging, including corporate tax, consumption tax, local tax, and withholding tax. We will explain these procedures in chronological order...

1