transfer pricing– category –

-

Transfer Pricing Compliance Guide for SMEs: Tax Risk Management

Transfer Pricing Compliance Guide for Small and Medium Enterprises: Essential Implementation Strategies For small and medium enterprises (SMEs) expanding overseas, compliance with transfer pricing regulations has become an unavoidable an... -

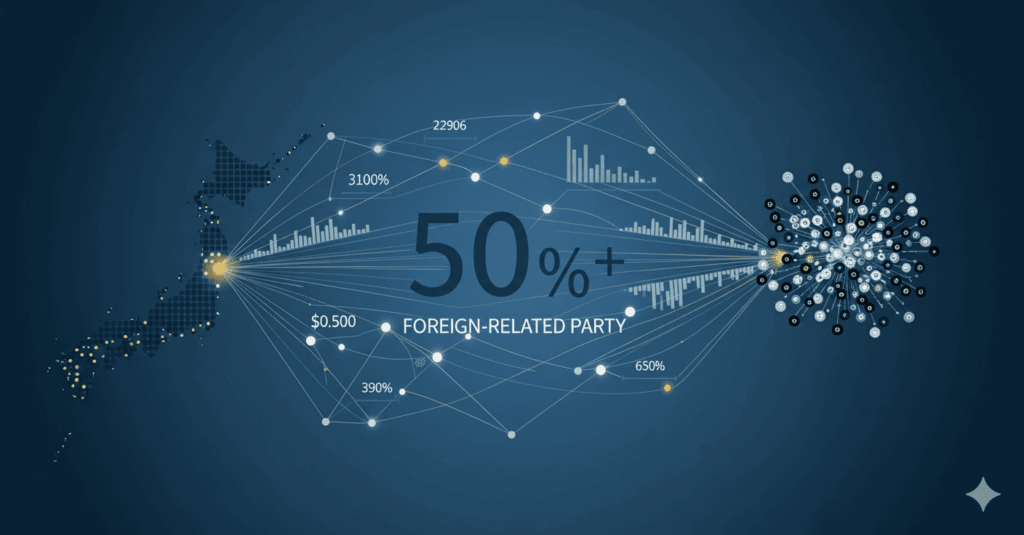

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing Regulations One of the most crucial concepts in transfer pricing regulations is the determination of "foreign related parties." This determination is a vital e... -

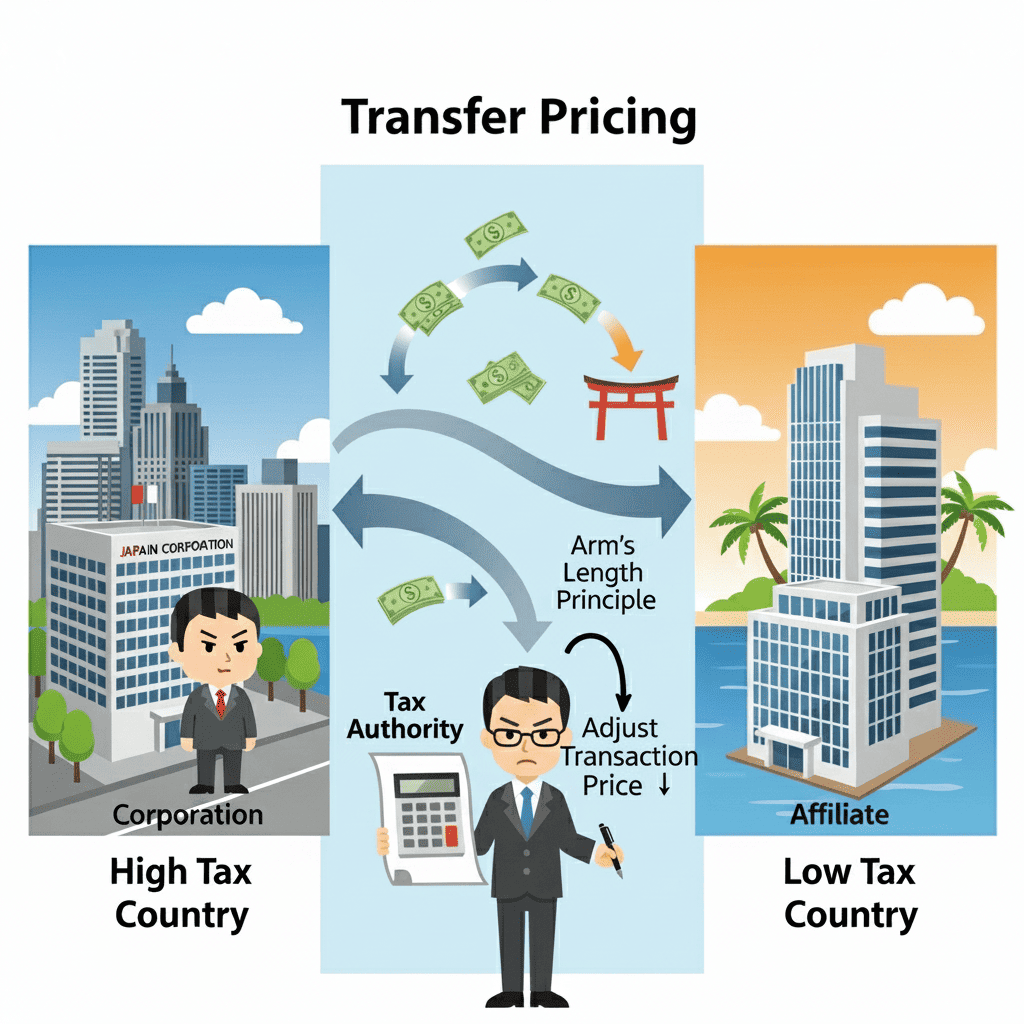

Basics of Japan’s Transfer Pricing System (1)

Basic Mechanism and Purpose of Transfer Pricing Taxation System Transfer pricing taxation system is a system that recalculates taxable income based on appropriate prices when income is transferred overseas due to transaction prices ...

1