taxreturn– category –

-

Foreign Currency Exchange Rate Treatment: Japanese Corporate Tax Law Guide 2025

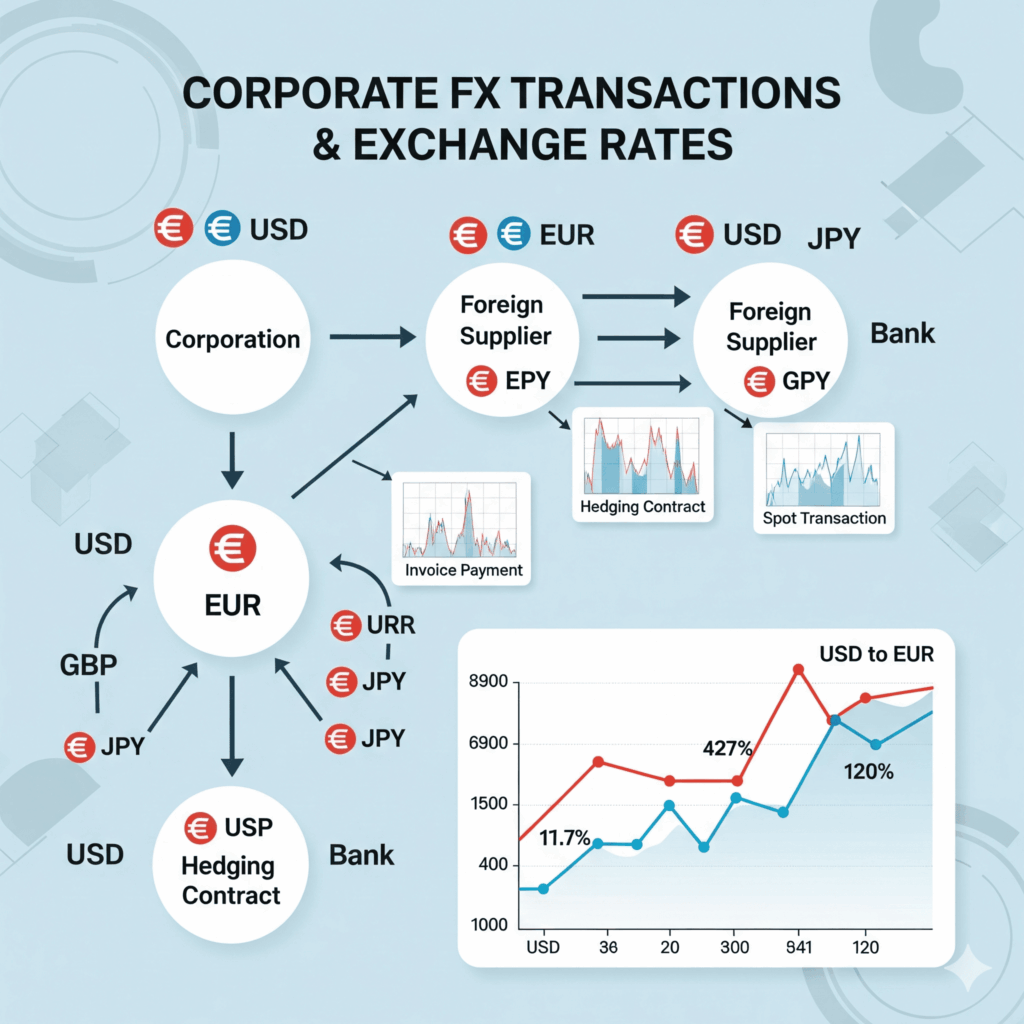

Foreign Currency Exchange Rate Treatment for Corporate Transactions In today's globalized world, many companies engage in foreign currency transactions. However, there are complex rules regarding yen conversion methods for tax purposes, ... -

Japan Export Tax Exemption Guide: Consumption Tax Rules 2025

Japan Export Tax Exemption for Consumption Tax The export tax exemption system is based on the fundamental principle that consumption tax, being a domestic consumption tax, should not be imposed on goods and services consumed abroad. Con... -

Comprehensive Guide to Japan’s Consumption Tax: Eligibility, Calculation, and Simplified Taxation Methods

Subject to consumption tax Consumption tax is only applicable to the following three transactions: Transfer and lending of assets and provision of services carried out by business operators in Japan for compensation as part of their busi...

1