What is consumption tax export duty free?

This time, I would like to think about the effects of consumption tax export exemption, which is a frequently asked question. We would like to separately post examples of business applications. Regarding consumption tax, it is assumed that the principle method is selected.

This consumption tax calculation method has been simplified for easier understanding. Please understand that the calculation method is different from the actual calculation method.

tax accountant

tax accountantDo you know about consumption tax export duty free?

Does this mean that there is no consumption tax when exporting?

It is not exactly correct to say that it does not take. Originally, this means that it will be exempted.

Is it exempted?

Consumption tax means consumption by consumers within Japan. Assets and services exported overseas are not consumed within Japan, so they are exempted (that is, they are not subject to consumption tax).

Does it mean anything to be exempted?

How to understand the meaning requires an understanding of the basic mechanism of consumption tax.

Basic mechanism for calculating consumption tax

Let’s explain the basic mechanism for calculating consumption tax. In this case, you need to think not from the perspective of a consumer who buys things at a store, but from the perspective of a business owner who purchases and sells products.

It means thinking from the shop’s perspective.

Consumption tax is calculated by subtracting the consumption tax you paid to other businesses from the consumption tax deposited by the customer, and then paying the difference to the tax office as consumption tax.

Suppose a store purchases product A, which costs 90 yen, for 99 yen, including consumption tax of 9 yen. Suppose you sell product A to a consumer for 110 yen (of which 10 yen is consumption tax). In this case, considering only the consumption tax, when purchasing product A, you pay 9 yen in consumption tax, and when you sell product A to a consumer, you receive 10 yen in consumption tax. In this case, the store keeps 10 yen of consumption tax and pays 9 yen of consumption tax. 10 yen – 9 yen = 1 yen consumption tax will be deposited, and the difference of 1 yen will be paid to the tax office as consumption tax.

This means that you pay the difference between the consumption tax deposited and the consumption tax paid.

Consumption tax export duty free

Let’s start by explaining about export duty free.

Export tax duty free means no consumption tax, right?

As I said at the beginning, it does not mean that there is no tax, but that there is a 0% tax charge, also known as 0% tax.

Is it 0% tax? Does that mean it costs 0%?

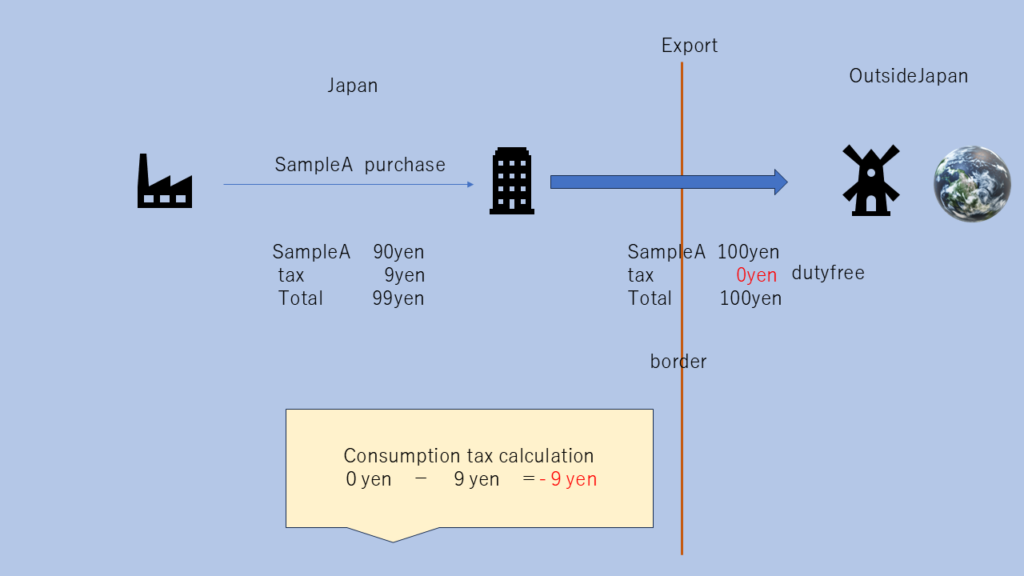

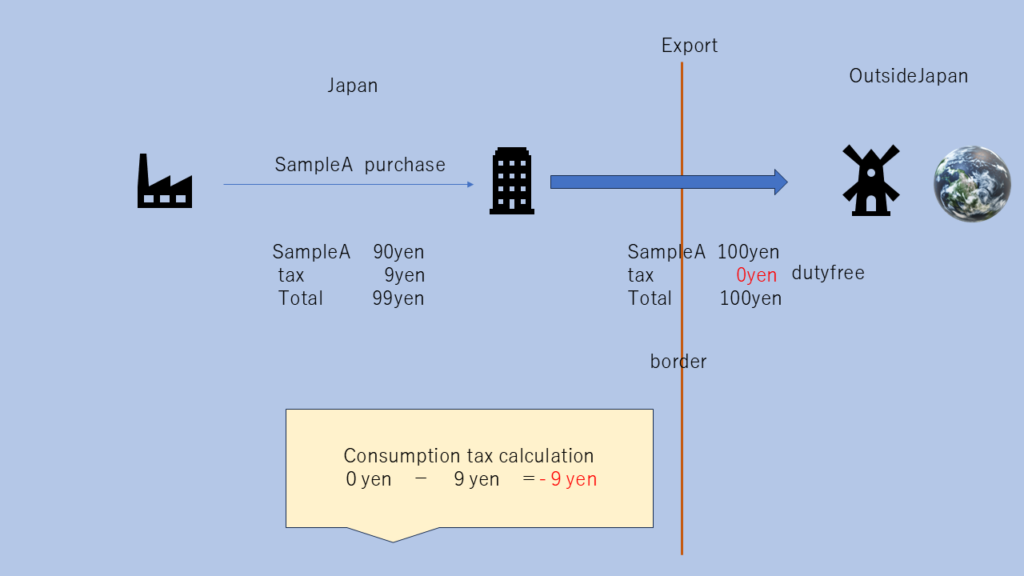

For example, in the example above, if the person to whom you sell the 100 yen product is a company located overseas, let’s say you are exporting the 100 yen product. In this case, the conclusion is that it is possible to export 100 yen and the consumption tax is 0 yen (0%).

In this case, how much consumption tax will I have to pay?

You will purchase a 90 yen product domestically for 99 yen and export (sell) it to a company overseas for 100 yen. The profit on sale will be 1 yen, the difference between 100 yen and 99 yen, if tax-included accounting is used. What do you think will happen to consumption tax?

Consumption tax is the difference between the consumption tax deposited and the consumption tax paid. In this case, since the product is purchased domestically for 99 yen, you pay 9 yen in consumption tax.

In this case, what about consumption tax on sales?

They sell it to overseas companies for 100 yen. The consumption tax is exempted and is 0 yen.

This product is purchased in Japan for 99 yen, so you pay 9 yen in consumption tax in Japan.

What will happen to the consumption tax then?

The difference between the consumption tax of 0 yen deposited and the consumption tax of 9 yen paid will be minus 9 yen. What does minus mean?

If the amount is positive, it will be paid, and if it is negative, it will be refunded. In this case, you will receive a refund of 9 yen.

Will the consumption tax be returned?

Effects of export duty free on businesses

The effect of export tax duty free is that when exporting domestically purchased products overseas, the amount equivalent to the consumption tax paid domestically on the purchased products will be refunded (requirements and limits apply).

Therefore, a business can be established in which foreigners living in Japan export Japanese products from Japan to their home countries.

The system is such that the higher the consumption tax rate, the higher the refund amount. However, the prices of goods seem to be in equilibrium, and even if the tax rate increases, it does not necessarily mean that profits will increase.

Thank you very much for today.

Summary

- Consumption tax export exemption means that if you export a product outside of Japan, the consumption tax is 0% and it is exempt from tax.

- If you purchase a product in Japan and export it outside Japan, you can apply for a refund of the consumption tax on the product purchase in Japan if you meet the requirements.