Background of the change

With the expansion of cross-border e-commerce, imports of mail-order cargo, etc. increased, and cargo using FS (Fulfillment Service) increased. As a result of this increase, cases of tax evasion occurred in which imports were declared at unreasonably low prices to avoid paying customs duties, etc., and the system was reviewed. Due to a system review, when a foreign corporation that does not have an office in Japan (does not have a PE) imports products into Japan and sells them in Japan under the name of the foreign corporation, the foreign corporation has been clarified as the import declarant.

What is FS (Fulfillment Service) cargo?

This is cargo imported into Japan by overseas sellers, etc. for the purpose of selling to buyers in Japan through an EC site (Internet mail order site), and is subject to warehousing, delivery, etc. provided by the EC platform operator, etc. after importing into Japan. This refers to cargo that is imported with the intention of selling it within Japan using a service that acts on behalf of the customer (Fulfillment Service: FS).

Clarification of the meaning of import declarer (person who intends to import goods)

For goods imported through import transactions, the same applies to the “person who imports goods” stipulated in Basic Circular 6-1(1) of the Customs Law.

6-1 (1) “Person who imports goods” means, in principle, the consignee listed on the purchase invoice (or bill of lading, etc. if there is no purchase invoice) for goods imported through import transactions. say.

Source: Customs Law Basic Notice (partial changes, excerpts)

For goods imported through import transactions (sales contracts), the consignee is, in principle, the consignee listed on the purchase invoice (if there is no purchase invoice, the bill of lading, etc.).

However, rather than making a judgment based only on what is written on the purchase invoice, if a person who is not involved in the import transaction is listed as the consignee, that person will not be the “person who imports the cargo.”

In cases other than the above, it refers to the person who, at the time of import declaration, has the authority to dispose of the imported goods after domestic collection, and if there is a person other than that person who performs the act that is the purpose of import shall be included.

[Examples of persons who perform acts that are the purpose of import]

- Goods imported based on a lease contract shall be imported by the person who leases and uses the goods.

- Goods imported for sale on consignment shall be sold by a person who is entrusted with the sale of the goods and sells them in his/her own (consignee’s) name.

- Goods imported for processing or repair shall be imported by the person processing or repairing the goods.

- Goods imported for destruction shall be handled by the person who destroys the goods.

Source Customs data Import declaration items/Customs administration

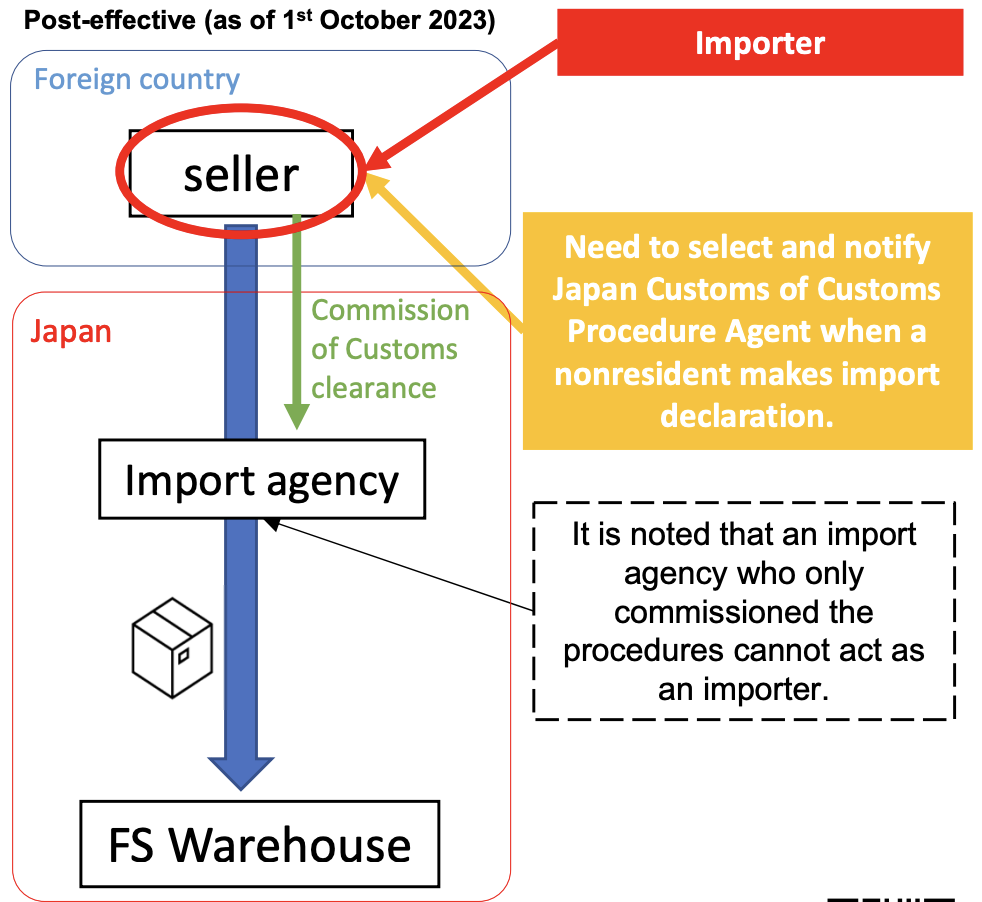

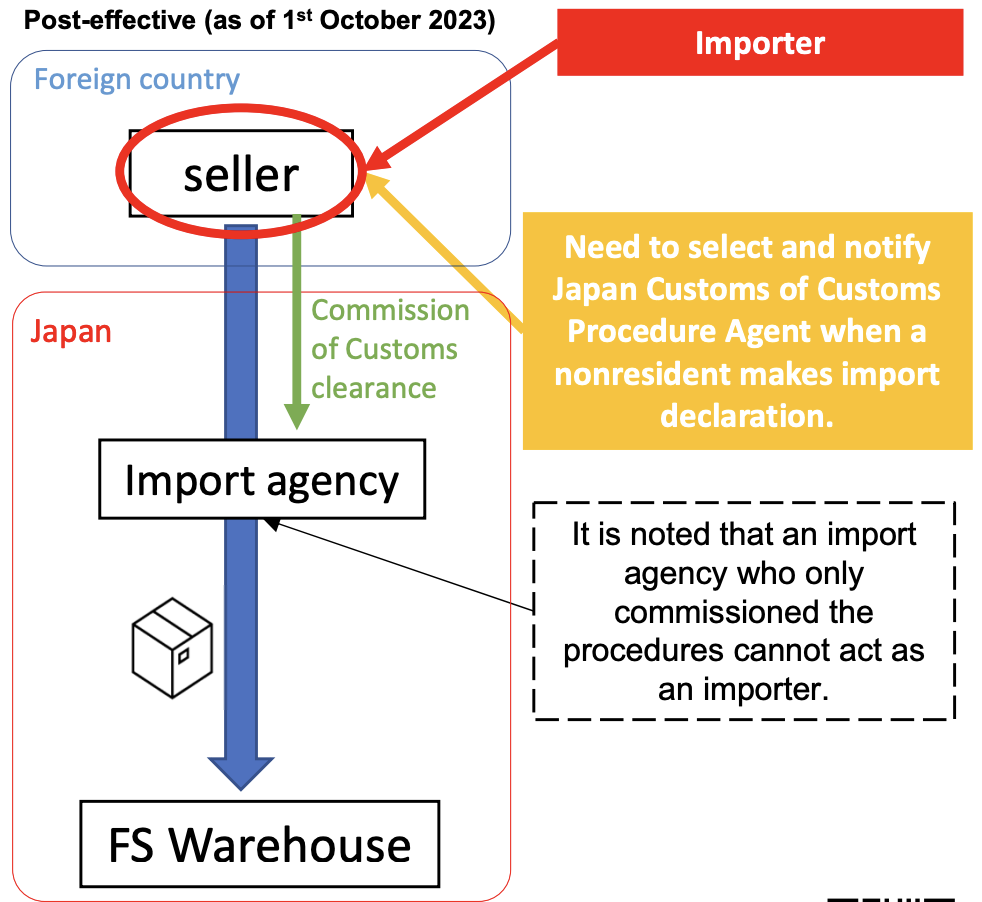

An import agent who is simply entrusted with procedures cannot be an import declarant. When a foreign corporation that does not have an office in Japan imports goods into Japan, the Japanese company that is the buyer in the sales transaction becomes the importer, or appoints a customs administrator and establishes an office in Japan. It is necessary for foreign corporations that do not have the same to become the importer themselves.

System reform by clarifying the meaning of import declaration person

It is no longer possible to designate the import agent (import declaration holder) as the import declaration holder, as was previously the case. This is because the import agent does not know the actual status of the transaction, so the customs cannot fully confirm the details of the declaration.

Since the seller, a foreign corporation that does not have an office in Japan, will be the “import declarant,” it will need to select a “Customs Procedure Agent” and submit the notification to the Japan Customs.

tax accountant

tax accountantIf a foreign corporation A that does not have a base in Japan sells directly to Japanese consumers through Amazon in Japan under its own name, the foreign corporation A must import the goods and do import declaration. In that case, you will also need to appoint a Customs Procedure Agent and notify the Japan Customs.

(Source) Customs: Regarding the review of import declaration items and customs administration system

Treatment under consumption tax law

Consumption tax is levied on imported goods when the goods are removed from the bonded area.

The person responsible for paying consumption tax on imported goods is the person who picks up the goods from the bonded area. The person who picks up the cargo from the bonded area is the import declarant.

Therefore, if the customs clearance service is outsourced to a customs broker and the import cargo is received, the person responsible for paying the tax is the person who entrusted the customs clearance service, not the customs broker.

The business that should receive a purchase tax credit for the amount of consumption tax levied or to be levied on the taxable cargo taken from this bonded area is the person who took the taxable cargo, that is, the person who filed the import declaration.

In addition, in order to receive the purchase tax credit, it is necessary to retain the “Import Permit Notification“.

Due to a review of the system, the significance of import declaration has been clarified, and if a foreign corporation that does not have a PE in Japan becomes the de facto importer/import declaration holder, it will be necessary to purchase the amount equivalent to the import consumption tax. Tax deductions (refunds may be available) are available.

If Company A, a foreign corporation that does not have a PE in Japan, imports products into Japan and sells them to consumers in Japan on Amazon, the import consumption tax can be deducted from the purchase tax amount. In that case, you will need to appoint a consumption tax agent in Japan, obtain a consumption tax invoice number (becoming a consumption tax payer), and file a consumption tax return.

How can I receive a purchase tax credit for consumption tax on imported goods?

When a foreign corporation (hereinafter referred to as a “foreign corporation”) that does not have a PE in Japan imports products into Japan and sells them to Japanese consumers under its own name, the foreign corporation becomes the import declarer and the person responsible for paying the import consumption tax.

In that case, if the foreign corporation wishes to take a purchase tax credit in calculating the consumption tax for the consumption tax paid on importing the product into Japan, it must first contact the consumption tax payer. It is necessary to become. In that case, it is necessary to appoint a consumption tax agent in Japan. Then, obtain a number (invoice number) that proves that you are a consumption tax payer (more precisely, apply for registration as a qualified invoice issuing business).

This makes it possible to file a consumption tax declaration and deduct import consumption tax on the consumption tax declaration. (If the consumption tax paid in Japan, including import consumption tax, is greater than the consumption tax deposited, a refund may be filed.)

If Company A, a foreign corporation that does not have a PE in Japan, wishes to deduct consumption tax on products imported into Japan, it is necessary to appoint a tax agent in Japan, obtain an invoice number, and file a consumption tax return.