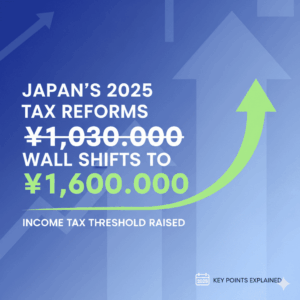

Background of the Correction

Due to the revision of the Customs Act, the requirement for consumption tax declaration arose from the need to clarify the tax burden when importing and selling goods in Japan, and to ensure the proper collection of consumption tax. This revision aims to establish a tax system that allows foreign corporations and businesses without a base in Japan to compete fairly in the domestic market.

Previously, there were cases where foreign corporations selling goods in Japan did not declare as importers, leading to tax omissions. To prevent this, the Customs Act was revised, making it mandatory for importers to declare and pay consumption tax at the time goods are brought into the country.

Before the revision, there were ambiguous cases regarding consumption tax declaration when foreign corporations sold goods domestically immediately after import. However, the revision clearly imposes the obligation of consumption tax declaration on importers.

Contents of the Consumption Tax Act and the Customs Act

Under the Customs Act and the Consumption Tax Act, when importing goods into Japan, the importer is obligated to pay consumption tax. The following provisions of the Consumption Tax Act are relevant.

Article 4 of the Consumption Tax Act (Taxable Objects) imposes consumption tax on the transfer of assets conducted as a business within the country and on specific purchases.

Article 6 of the Consumption Tax Act (Scope of Taxation) imposes consumption tax on domestic transactions conducted by businesses. This includes import transactions.

Article 7 of the Customs Act: A person who intends to import goods subject to the declaration-based taxation method must make a declaration to the customs director regarding the payment of customs duties on the said goods.

Regarding customs duties and consumption tax on imported goods, the person intending to import the goods is liable for the tax payment. However, if the importer does not have an address or business office in Japan, they must appoint a customs manager, who will handle the declaration and tax payment on their behalf.

The amendment to the Customs Act explicitly states that when an importer brings goods into Japan and sells them domestically, the importer is obligated to declare and pay consumption tax. This amendment has further clarified the obligation to declare consumption tax.

Impact of the Customs Act Amendment (Clarification of Importers)

staff

staffI heard that the customs law has been revised. What does it entail?

Yes, the 2023 amendment to the Customs Act particularly affects foreign corporations when importing goods into Japan. Specifically, when a foreign corporation imports and sells goods in Japan, it must declare and pay consumption tax at the time of import.

I see. Why do foreign corporations need to file a consumption tax return due to that amendment?

Simply put, when a foreign corporation import goods into Japan and sells them there, the importer itself becomes liable for consumption tax. Previously, the obligation for corporations without a base in Japan to file consumption tax was not always clear, but this obligation has been clarified with the recent amendment.

Even if a foreign corporation does not have a base in Japan, they must pay consumption tax at the time of import. But what happens if the importer and the seller are different entities in Japan?

That’s a good question. One of the key points of this amendment is the definition of an importer. When a foreign corporation is the importer and sells the imported goods in Japan, that corporation is considered the “importer,” which results in the obligation to file a consumption tax. In other words, the importer becomes the taxpayer.

So, will foreign corporations bear the consumption tax on products sold within Japan?

When goods are consumed within Japan, a consumption tax is levied on that consumption activity. When a foreign corporation imports goods into Japan for sale, it collects the consumption tax from consumers at the time of sale. This means that the foreign corporation pays the consumption tax at the time of import and collects the consumption tax from consumers at the time of domestic sale. Essentially, the difference is what is paid in taxes.

In that case, tax management becomes complicated for foreign corporations, doesn’t it? How should such procedures be carried out?

That’s correct. In particular, foreign corporations without a base in Japan need to appoint an agent called an Attorney for Customs Procedures(ACP) to handle consumption tax filing and payment in Japan on their behalf. This Attorney for Customs Procedures(ACP) will carry out customs procedures and consumption tax filing on behalf of the foreign corporation, so it is important to appoint them properly.

I see. An Attorney for Customs Procedures(ACP) carries out procedures on behalf of a foreign corporation. This means that a foreign corporation must carefully choose an Attorney for Customs Procedures(ACP) in order to sell products in Japan.

That’s right. By choosing the appropriate Attorney for Customs Procedures(ACP), the procedures for consumption tax filing and import-related taxes can proceed smoothly. For foreign corporations, changes in the tax system may seem complex, but with proper preparation, they can be handled without any issues.

Understood! This revision of the customs law is a very important point for foreign corporations doing business in Japan. Thank you for the clear explanation today.

If you have any questions about the declaration or taxation of consumption tax on imports, please feel free to consult with us at any time.

Handling of Purchase Consumption Tax Credit

An import permit is required as a condition for the input consumption tax deduction. Therefore, in order to reclaim the import consumption tax, it is considered necessary for foreign sellers to file a notification of an Attorney for Customs Procedures(ACP) and choose to become a taxable business for consumption tax (or become a qualified invoice issuing business), thereby becoming liable for consumption tax.