How inheritance tax can be deferred if it cannot be paid in cash

If inheritance tax must be paid, it may not be possible to pay the inheritance tax in full by the due date because real estate accounts for a large portion of the inherited property.

In this case, there is a system for deferring the payment of inheritance tax in installments.

This time, I would like to explain the general structure of deferral payments using specific calculation examples. Calculations are explained using interest rates and laws as of January 1, 2023.

What is deferred payment?

The deadline for filing inheritance tax is within 10 months from the date of death (technically speaking, the date of knowledge), but that is also the deadline for paying inheritance tax.

If the inherited property is only cash or deposits, inheritance tax can be paid from the inherited property.

However, if you own a lot of real estate, such as an apartment, you may run into situations where you don’t have enough cash.

In this case, it is possible to pay inheritance tax by selling the real estate and converting it into cash, paying in kind (paying with the real estate itself), or using a bank loan.

Another option is to defer inheritance tax by paying it in installments.

If you are unable to pay the inheritance tax in full at once, there is a system called deferred payment.

When can I use deferred payment system? Also, for what period can the payment be postponed?

1.The inheritance tax amount exceeds 100,000 yen.

2.There are reasons that make it difficult to pay in cash, and the amount is within the range that makes payment difficult.

3.You need to provide collateral equivalent to the deferred tax amount and interest tax amount.

4.You need to submit the application form for deferment to the tax office director by the deadline for inheritance tax payment or the date on which it should be paid (deferral application deadline), with documents related to the provision of collateral attached.

These are the basic requirements.

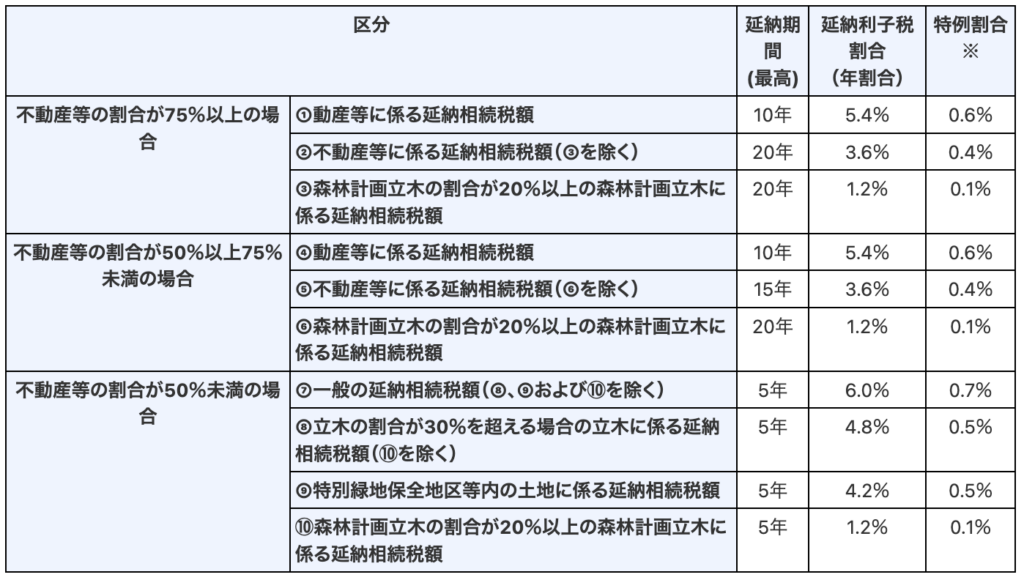

Regarding the deferral period, it is important to note that the period that can be extended and the interest tax (interest) differ depending on the proportion of the inherited property that is real estate, etc.

The period during which tax payments can be deferred and the amount of interest tax will be determined depending on the proportion of inherited property that is real estate, etc.

The “special ratio” in this table is calculated using the “deferral payment special standard ratio” of 0.9% as of January 1, 2023. Therefore, please note that if there is a change in the “Special standard ratio for late payment,” the “Special ratio” in the table below will also change.

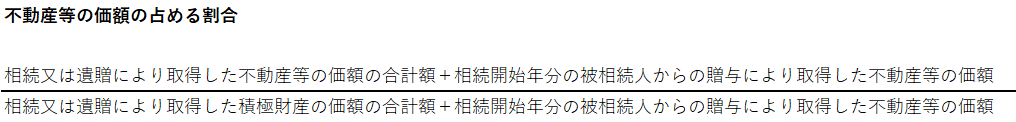

What is the proportion of the value of real estate, etc.?

The formula is very long and difficult to understand, but to summarize it simply, the denominator is the total value of property acquired through inheritance, etc., excluding debts such as loans.

The numerator is the total amount of real estate acquired through inheritance, etc.

In a nutshell, it is the percentage of the inherited property that is owned by real estate, etc.

Regarding the period during which payment can be deferred, the proportion of this real estate etc. will differ depending on the three cases as shown in the following diagram.

Please see here for information on how the deferred payment period and interest tax change depending on the proportion of real estate, etc.

If the proportion of real estate, etc. is 75% or more

If the proportion of real estate, etc. is 50% or more but less than 75%

If the proportion of real estate, etc. is less than 50%

The deferment period and interest tax vary depending on the three ranges.

taxman

taxmanRegarding the deferral of inheritance tax, I think the key point is that the deferral period and interest tax vary depending on the proportion of the value of the real estate, etc.

It seems that the longer the proportion of real estate etc. is, the longer the payment period will be.

I think it’s hard to understand, so I’d like to think about it using a concrete example.

Specific example of deferment

Total assets: 200 million yen (breakdown: 170 million yen in real estate, 30 million yen in cash)

1 heir

Inheritance tax: 48.6 million yen

Tax amount to be paid in arrears: 20 million yen

[Calculation of delayed payment]

First, calculate the percentage of the value of real estate, etc.

In this case, 170 million yen ÷ 200 million yen = 85%.

The ratio of the value of real estate, etc. will be 85%≧75%.

Inheritance tax amount: 48.6 million yen x 85% = 41.31 million yen > Tax amount to be paid in arrears: 20 million yen.

According to the National Tax Agency’s table, as of January 1, 2023, in this case, the deferred payment for real estate, etc. will be 20 years and the interest tax will be 0.4%.

In other words, 20 million yen was borrowed from the government for 20 years at an interest rate of 0.4% (it fluctuates depending on changes in the interest rate level. This means that you are borrowing at a variable interest rate). It will be.

Let’s consider cash flow assuming that the interest tax rate continues at 0.4%.

The principal is to be paid in installments over 20 years. In other words, basically 1 million yen each year.

1st year Principal: 1 million yen, interest tax: 20 million yen x 0.4% = 80,000 yen, total tax of 1,080,000 yen

2nd year Principal: 1 million yen, interest tax: 19 million yen X 0.4% = 76,000 yen total tax of 1,076,000 yen

3rd year Principal: 1 million yen, interest tax: 18 million yen x 0.4% = 72,000 yen, total tax of 1,072,000 yen

4th year Principal: 1 million yen, Interest tax: 17 million yen X 0.4% = 68,000 yen total tax of 1,068,000 yen

:

:

20th year Principal: 1 million yen, interest tax: 1 million yen x 0.4% = 4,000 yen, total tax of 1,004,000 yen

In this example, the principal portion of the deferred inheritance tax of 20 million yen will be paid in the amount of 1 million yen each year for 20 years.

Interest tax is currently paid at a rate of 0.4% per year, and in the first year, it is 0.4% of 20 million yen, with an additional 80,000 yen.

From the second year onward, the principal portion decreases by 1 million yen, so the interest tax paid also decreases.

However, since interest tax is calculated according to market interest rates, the interest tax portion may change depending on market interest rate fluctuations.

Advantages and disadvantages of deferral

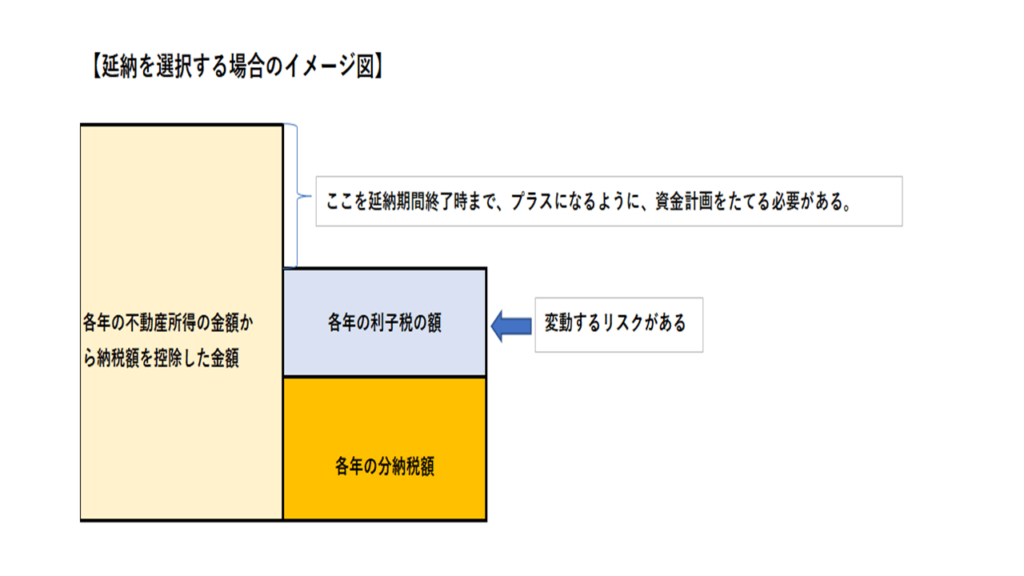

While deferred payment has the advantage of allowing you to postpone payment, it also has the disadvantage of having to pay interest. Let’s consider the advantages and disadvantages here.

The advantage of deferring payment is that you can inherit inherited real estate without selling it, and you can continue to operate the inherited real estate.

In this case, if it is not possible to generate income from the relevant real estate that exceeds the inheritance tax and interest tax paid in installments, it will be necessary to take measures such as reducing the heir’s assets and paying interest tax.

The disadvantage of deferring payment is that the interest tax rate is affected by market interest rate fluctuations, so depending on interest rate fluctuations, the interest tax you pay may become excessive.

The advantage of deferring payment is that you can continue to operate the inherited real estate without having to sell it.

The disadvantage of deferring tax payments is that in addition to the tax amount, you have to pay interest tax, and the interest tax is affected by market interest rate fluctuations, so it is difficult to steadily pay taxes according to the repayment plan. I think you will be asked for it.

Notes on interest tax

As mentioned in the section on the disadvantages of deferral, it is important to note that interest taxes are subject to the risk of interest rate fluctuations.

It is also important to note that interest taxes are not a business expense.

Points to note when choosing whether to defer payment or sell

The biggest risk of receiving a deferment is that the principal and interest must be paid, and the interest is exposed to market interest rate risk.

It is important to note that if interest rates rise in the future, the interest tax you will pay will also increase.

It is also important to understand that interest taxes related to delayed payments are not considered business expenses, so they are not considered expenses when calculating real estate income.

This will have to be paid out of your after-tax earnings each year and out of your own personal assets.

Real estate income must also take into account capital outflows such as large-scale repairs.