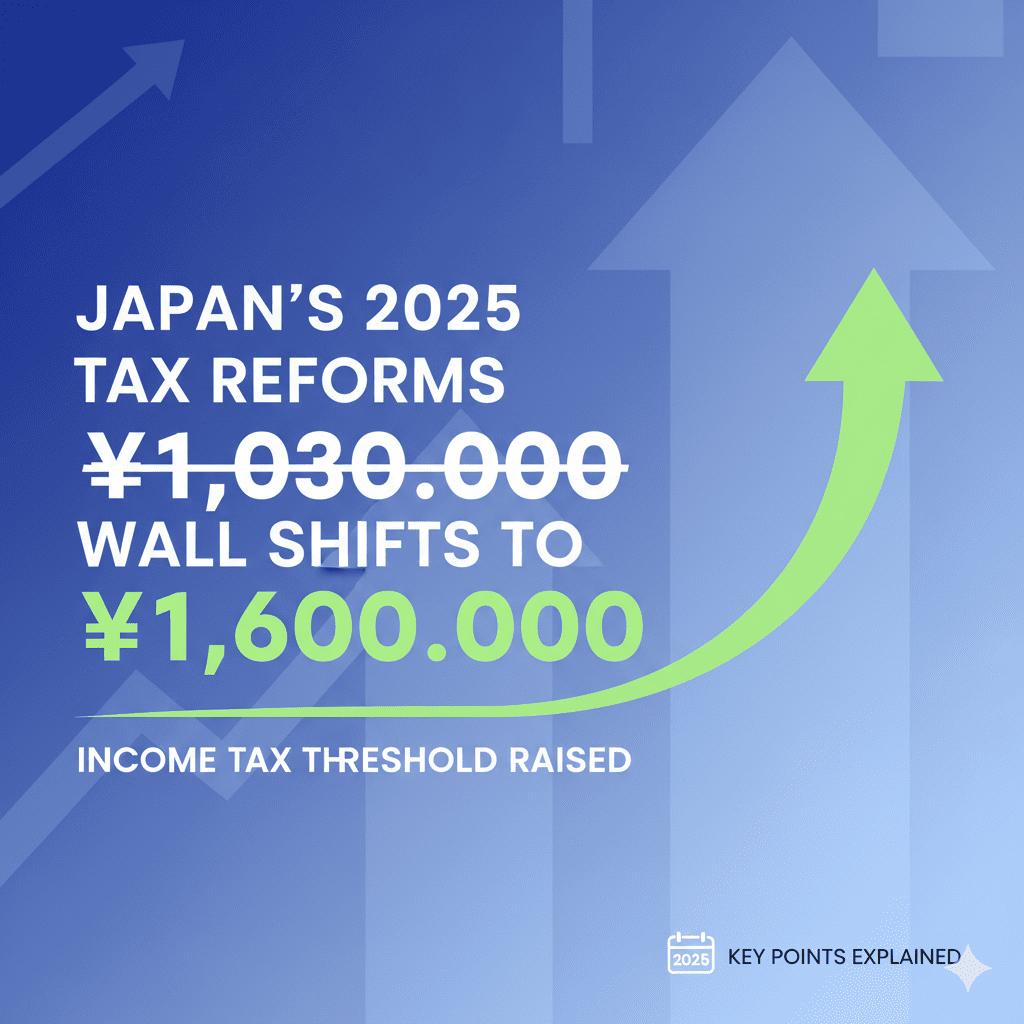

2025 Tax Reform: The 1.03 Million Yen Wall Raised to 1.6 Million Yen! Key Points of Income Tax Reform Explained

The 2025 (Reiwa 7) tax reform has significantly revised Japan’s income tax system, affecting many working individuals. The tax-free threshold, previously known as the “1.03 million yen wall,” has been raised to 1.6 million yen, with reforms to the basic deduction and various other deduction systems.

This reform will reduce the tax burden for a wide range of people, including part-time workers, families with university students, and households with dependent spouses. This article provides a detailed explanation of the key points of the 2025 tax reform and clarifies how these changes will impact your household finances.

Basic Deduction Reform – The 1.03 Million Yen Wall Significantly Raised to 1.6 Million Yen

The most notable aspect of this tax reform is the substantial increase in the basic deduction amount. The basic deduction is now set according to total income, benefiting many taxpayers.

Particularly for the 2025 and 2026 tax years, transitional measures have been implemented with additional amounts added to the previous 580,000 yen basic deduction, substantially increasing the effective deduction amount. For those with total income of 1.32 million yen or less, the basic deduction becomes 950,000 yen, and for salary-only income, the maximum deduction can be received up to 2,003,999 yen.

| Total Income Amount | Salary Income Only (Annual Income) | Basic Deduction (2025-2026) | Basic Deduction (2027 onwards) |

|---|---|---|---|

| 1.32 million yen or less | 2,003,999 yen or less | 950,000 yen | 950,000 yen |

| 1.32 – 3.36 million yen | 2,003,999 – 4,751,999 yen | 880,000 yen | 580,000 yen |

| 3.36 – 4.89 million yen | 4,751,999 – 6,655,556 yen | 680,000 yen | 580,000 yen |

| 4.89 – 6.55 million yen | 6,655,556 – 8.5 million yen | 630,000 yen | 580,000 yen |

| 6.55 – 23.5 million yen | 8.5 – 25.45 million yen | 580,000 yen | 580,000 yen |

Tax Reduction Effect: This reform is expected to provide annual tax reductions of 20,000 to 40,000 yen per household type, benefiting over 80% of taxpayers. This reform can be seen as one that reduces the tax burden on low- and middle-income earners while ensuring it doesn’t favor high-income earners.

Employment Income Deduction Reform – Minimum Guarantee Raised to 650,000 Yen

Important reforms have also been made to the employment income deduction, with the minimum guarantee amount raised from the previous 550,000 yen to 650,000 yen. This means that for salary income of 1.9 million yen or less, a uniform employment income deduction of 650,000 yen (previously 550,000 yen) can be received. There are no changes to employment income deduction amounts for salary income exceeding 1.9 million yen.

This reform provides significant benefits particularly for low-income salary earners. For salary income of 1.625 million yen or less, an additional 100,000 yen deduction can be received compared to before, further reducing the effective tax burden.

Important Note for Practice: For 2025 withholding tax procedures, processing will continue as usual until November, with settlements based on new deduction amounts conducted during year-end adjustment in December. Corporate HR personnel should confirm year-end adjustment procedures in advance.

Creation of Special Deduction for Specific Relatives – Supporting Families with University-Age Children

The 2025 tax reform has newly created a “Special Deduction for Specific Relatives.” This system is designed to reduce the tax burden on families supporting relatives aged 19 to 23 (mainly university students).

Specific relatives refer to relatives aged 19 to 23 who live with the taxpayer and have total income between 580,000 and 1.23 million yen. For salary income only, this corresponds to annual income between 1.23 and 1.88 million yen.

| Specific Relative’s Total Income | Salary Income Only (Annual Income) | Special Deduction for Specific Relatives |

|---|---|---|

| 580,000 – 850,000 yen | 1.23 – 1.5 million yen | 630,000 yen |

| 850,000 – 900,000 yen | 1.5 – 1.55 million yen | 610,000 yen |

| 900,000 – 950,000 yen | 1.55 – 1.6 million yen | 510,000 yen |

| 950,000 – 1,000,000 yen | 1.6 – 1.65 million yen | 410,000 yen |

| 1,000,000 – 1,050,000 yen | 1.65 – 1.7 million yen | 310,000 yen |

| 1,050,000 – 1,100,000 yen | 1.7 – 1.75 million yen | 210,000 yen |

| 1,100,000 – 1,150,000 yen | 1.75 – 1.8 million yen | 110,000 yen |

| 1,150,000 – 1,200,000 yen | 1.8 – 1.85 million yen | 60,000 yen |

| 1,200,000 – 1,230,000 yen | 1.85 – 1.88 million yen | 30,000 yen |

This system allows parents to receive the same 630,000 yen deduction as the previous special dependent deduction even if their university student child earns up to 1.5 million yen annually through part-time work. Even when income exceeds 1.5 million yen, the deduction amount decreases gradually, avoiding sudden increases in tax burden.

Reform of Income Requirements for Dependents and Others – Spouse Deduction Also Expanded to 1.23 Million Yen

Along with the basic deduction reform, income requirements for dependent deductions and spouse deductions have also been revised. The income ceiling for various deductions, previously known as “another 1.03 million yen wall,” has been raised, creating a more work-friendly environment for working spouses and dependents.

For spouse deductions, the requirement was previously total income of 480,000 yen or less (salary income of 1.03 million yen or less), but has been raised to 580,000 yen or less (salary income of 1.23 million yen or less) after the reform. The special spouse deduction has also been raised, with the upper limit now at 580,000 to 1.33 million yen (salary income of 1.23 million to 2,015,999 yen).

| Category of Dependents/Others | Revised Income Requirements | Salary Income Only (Annual Income) |

|---|---|---|

| Dependents/Spouse Living Together | 580,000 yen or less | 1.23 million yen or less |

| Spouse for Special Spouse Deduction | 580,000 – 1.33 million yen | 1.23 million – 2,015,999 yen |

| Working Student | 850,000 yen or less | 1.5 million yen or less |

Additionally, the income requirement for the working student deduction has been raised to 850,000 yen or less (1.5 million yen or less for salary income only), making the system more favorable for students balancing studies and work. These reforms will significantly expand work choices for entire families.

Expansion of Special Provisions for Home Workers and Others

Along with the employment income deduction reform, the special provisions for calculating business income for home workers and others have also been revised. The minimum guarantee amount for necessary expenses has been raised from the previous 550,000 yen to 650,000 yen, providing benefits for those engaged in remote work or individual businesses.

This special provision applies to home workers, door-to-door salespeople, collectors, electricity meter readers, and others. Even when actual necessary expenses are less than 650,000 yen, 650,000 yen can be calculated as necessary expenses.

Summary

The 2025 tax reform raises the “1.03 million yen wall” to the “1.6 million yen wall.” Key changes include expansion of the basic deduction, increases in employment income deduction, creation of the special deduction for specific relatives, and relaxation of requirements for various dependent deductions.