What is Telecommunication Services Provision Under Consumption Tax Law

“Telecommunication services provision” refers to services provided through communication networks such as the internet. For example:

Services that enable downloading or using music, videos, e-books, etc., online

Cloud services (online storage, etc.)

Online games and app provision

are considered to fall under telecommunication services provision.

This article provides a detailed explanation of the consumption tax implications when foreign businesses (foreign companies without a presence in Japan) conduct internet transactions such as e-book download sales.

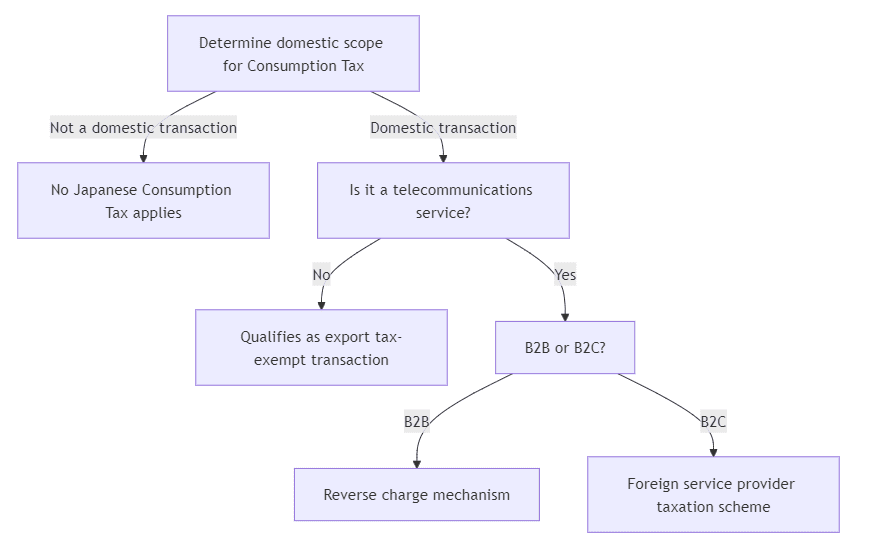

Consumption Tax for Foreign Businesses’ Telecommunication Services – Three-Step Tax Assessment Process

Information regarding consumption tax domestic/foreign determination and whether services qualify as telecommunication services provision is described in Part 1, so please refer to this page.

Additionally, apart from these two methods, platform taxation may apply in certain cases.

National Tax Agency Website

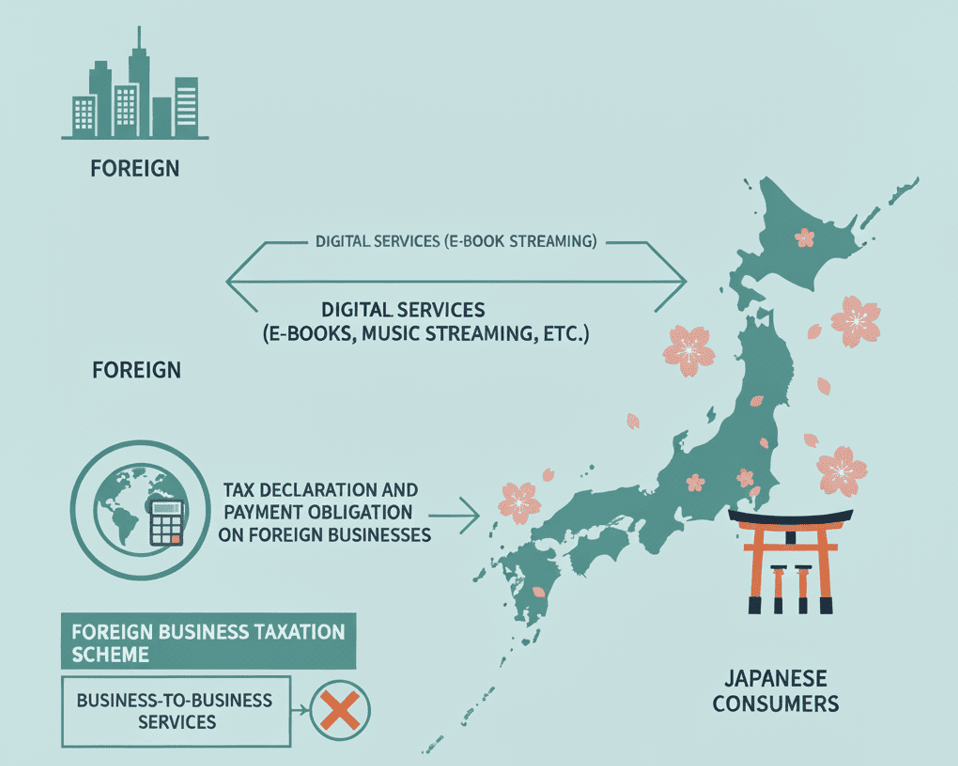

Differences in Taxation Methods: Business-to-Business vs Business-to-Consumer

When receiving telecommunication services from foreign businesses in Japan, it is important to note that the consumption tax obligor changes depending on whether the recipient is a business or a consumer – either the domestic business receiving the service or the foreign business providing the service.

Among “telecommunication services provision” provided by foreign businesses, for “business-to-business telecommunication services provision” (example: advertising distribution, etc.), the domestic business receiving the service is subject to declaration and tax payment obligations (reverse charge mechanism).

“Business-to-business telecommunication services provision” refers to telecommunication services provided by foreign businesses where, due to the nature of the service or transaction conditions, recipients are normally limited to businesses.

For telecommunication services provided by foreign businesses other than business-to-business telecommunication services provision (examples: e-books, music distribution, etc.), foreign businesses are subject to declaration and tax payment obligations (foreign business taxation method).

| Comparison Item | Reverse Charge Mechanism | Foreign Business Taxation Method |

|---|---|---|

| Applicable Services | Business-to-business telecommunication services provision | Telecommunication services provision other than business-to-business |

| Specific Examples | Advertising distribution, etc. | E-books, music distribution, etc. |

| Tax Declaration Obligor | Domestic business receiving the service | Foreign business |

Reverse Charge Mechanism (Domestic Business Tax Payment) – Transitional Measures Apply

First, when the transaction counterparty (contract party) is a Japanese domestic business, the “reverse charge mechanism” is adopted. This is a system to ensure tax compliance even when foreign businesses are not registered in Japan, where foreign businesses do not charge consumption tax when billing, and the domestic business receiving the service calculates and declares consumption tax itself. Domestic businesses record the consumption tax on received services as deemed output tax while simultaneously being able to deduct it as input tax. For example, this applies when domestic companies use overseas cloud services or online advertising.

Transitional Measure Application Requirements ⇒ Taxable Sales Ratio 95% or Higher OR Simplified Taxation System Applied

Note that under transitional measures, for the time being, ① general taxation periods with a taxable sales ratio of 95% or higher, OR ② taxation periods where simplified taxation or the 20% special provision applies, “specified taxable purchases” are treated as not having occurred under consumption tax law. Therefore, for the time being, businesses required to file under the reverse charge mechanism when receiving “business-to-business telecommunication services provision” are limited to businesses filing under general taxation with a taxable sales ratio below 95%.

Under current transitional measures (as of October 2025), only domestic businesses using general taxation with a taxable sales ratio below 95% bear declaration and tax payment obligations under this reverse charge mechanism.

| Item | Details |

|---|---|

| Applicable Transactions | When foreign businesses provide telecommunication services to Japanese businesses (domestic businesses) |

| Typical Examples | Overseas cloud services, online advertising, database usage, etc. (transaction partner is a Japanese company) |

| Tax Obligor | Domestic business receiving the service (= recipient side) |

| Mechanism | Foreign businesses do not charge consumption tax when issuing invoices; domestic businesses record both “deemed output tax” and “deemed input tax” themselves and file tax returns. |

| Purpose | To achieve domestic taxation even when foreign businesses are not registered in Japan. |

Foreign Business Taxation Method (Foreign Business Tax Payment)

On the other hand, when the transaction counterparty is a Japanese consumer (individuals and other non-business entities), the “foreign business taxation method” applies. This is a system that imposes Japanese consumption tax obligations directly on foreign businesses providing services, since consumers cannot apply reverse charge. Therefore, foreign businesses must register as qualified invoice issuers with Japanese tax offices, collect consumption tax on top of service fees, and remit it to Japan. (Tax exemption provisions may be applicable.) For example, this taxation method applies to overseas video streaming services, app stores, e-book sales, and other online services provided to Japanese individuals.

Important Notes Regarding Applicable Transactions

Among services that distribute e-books, music, software, games, etc., via the internet, some are freely accessible to consumers (general public). For such services, even if website terms of use designate them as “business-oriented,” services that Japanese consumers can freely access are treated as “consumer-oriented services” under this method.

| Item | Details |

|---|---|

| Applicable Transactions | When foreign businesses provide telecommunication services to Japanese consumers (individuals and other non-business entities) |

| Typical Examples | Overseas video streaming, app purchases, e-books, online English conversation, etc. (consumers are Japanese individuals) |

| Tax Obligor | Foreign business (= service provider) |

| Mechanism | Foreign businesses register as “qualified invoice issuers” with Japanese tax offices, collect and remit consumption tax on top of fees. |

| Purpose | Since consumers cannot apply reverse charge, foreign businesses are directly obligated to pay taxes. |

🟩Key Points:

Foreign businesses → Designate a tax agent and bear direct consumption tax declaration and payment obligations

Note that consumer-oriented services are not limited to purely consumer-oriented services but may include cases where businesses can also receive provision

When Foreign Businesses Bear Japanese Consumption Tax Declaration Obligations

Transaction content: Online provision of e-books, music, videos, cloud services, apps, etc.

Provision method: Provided through telecommunication networks (internet, etc.)

Provider: Foreign business (without permanent establishment in Japan)

Transaction counterparty: Japanese consumers (individuals, etc.)

In this case, it qualifies as “telecommunication services provision by foreign businesses.”

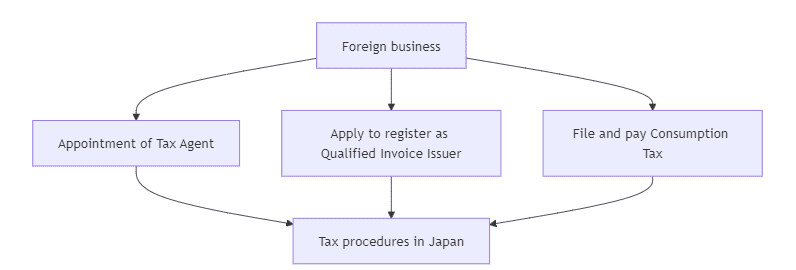

Appointment of Tax Agent

When foreign businesses do not have an address or office (permanent establishment) in Japan,

they must appoint a domestic person as a “tax agent” (Consumption Tax Act Article 148).

This tax agent handles filing and tax payment on their behalf.

Responding to the Invoice System

Foreign businesses meeting prescribed requirements can apply for registration as “qualified invoice issuers.” To enable domestic purchasers to receive deductions, it is practically important for foreign businesses to complete invoice registration and issue invoices with registration numbers.

Consumption Tax Filing and Payment Methods

Tax rate: 10%

Filing method: Generally annual filing

Tax return: Consumption tax return

Submission destination: Japanese tax office (submitted through tax agent)

Practical Considerations and Compliance Checklist

When receiving or providing telecommunication services from foreign businesses, careful attention to the following points is necessary for accurate consumption tax processing. To prevent practical errors, let’s review step by step.

🔍 STEP 1: Transaction Content Verification Checklist

□ Confirm transaction counterparty is a “foreign business”

Verify through contracts, invoice location information, registration details, etc., that the counterparty is a business without a head office or principal office in Japan.

□ Determine if service content qualifies as “telecommunication services provision”

The following services provided via telecommunication networks like the internet qualify:

・Cloud services (SaaS, PaaS, IaaS)

・Online advertising distribution

・E-book, music, and video distribution

・Software download sales

・Online games and app provision

・Database access rights provision

□ Confirm service provision location is “within Japan”

Verify that service recipients are located in Japan based on contractor address, head office location, service user IP addresses, etc.

⚖️ STEP 2: Taxation Method Determination Checklist

□ Determine if service is “business-oriented” or “consumer-oriented”

| Determination Point | Business-Oriented | Consumer-Oriented |

|---|---|---|

| Service Nature | Used only in business activities (e.g., advertising distribution, business cloud) | Available to individuals (e.g., video streaming, e-books) |

| Contract Conditions | Individual contracts, corporate terms | Anyone can apply, standardized terms |

| Usage Restrictions | Business verification required | Cannot restrict consumer use |

| Applied Method | Reverse Charge Mechanism | Foreign Business Taxation Method |

⚠️ Common Determination Errors

Even if a website states “corporate services,” if individuals can actually apply and businesses do not restrict this, it is treated as “consumer-oriented.” It’s important to verify actual conditions, not just terms and conditions.

📊 STEP 3: Reverse Charge Mechanism Application Determination (For Domestic Businesses)

Domestic businesses receiving business-oriented telecommunication services should check the following.

□ Confirm your company’s taxation method

If any of the following apply, filing under the reverse charge mechanism is not required (transitional measure):

- ✅ Simplified taxation system applied

- ✅ 20% special provision applied

- ✅ General taxation with taxable sales ratio 95% or higher for the taxation period

Filing under reverse charge mechanism is required for:

Only businesses adopting general taxation with a taxable sales ratio below 95%.

✍️ Accounting Treatment When Reverse Charge Applies

Example journal entry when reverse charge mechanism applies:

【When using service (receiving invoice)】

(Debit) Advertising expenses 110,000 yen / (Credit) Accounts payable 100,000 yen

(Debit) Input tax 10,000 yen / (Credit) Output tax 10,000 yen

※Invoice amount from foreign business is 100,000 yen (tax excluded)

※Company calculates 10,000 yen consumption tax and records both input/output🌏 STEP 4: Foreign Business Taxation Method Response Checklist (For Foreign Businesses)

Foreign businesses providing services to Japanese consumers must take the following actions.

□ Appointment of tax agent

If no address or office exists in Japan, appoint a domestic resident or tax accountant corporation as tax agent and submit notification to tax office.

□ Qualified invoice issuer (invoice system) registration application

Obtain registration number so transaction partners can receive input tax deductions.

Registration number is issued in “T + 13 digits” format.

□ Consumption tax collection and display

When billing Japanese consumers, add and display consumption tax of 10%.

Example: Service fee 1,000 yen → Billed amount 1,100 yen (tax included)

□ Consumption tax return preparation and submission

Generally, submit returns annually after taxation period ends.

Submission destination: Tax office with jurisdiction over tax address (via tax agent)

⚠️ Practical Considerations and Common Errors

❌ Case 1: Determination error leading to filing omission

Example error:

Using overseas cloud services (business SaaS) but assuming “foreign companies don’t relate to Japanese consumption tax” and not filing under reverse charge mechanism.

Correct response:

For general taxation businesses with taxable sales ratio below 95%, must file and pay consumption tax as specified taxable purchases.

❌ Case 2: Overlooking transitional measure application requirements

Example error:

Misunderstanding that “reverse charge mechanism applies to all businesses” and filing despite taxable sales ratio being 95% or higher.

Correct response:

Under transitional measures, filing is not required when taxable sales ratio is 95% or higher or when simplified taxation/20% special provision applies. Accurately understand your company’s situation.

❌ Case 3: “Business-oriented” determination error

Example error:

Overseas video streaming service offers “business plan,” so determined as “business-oriented service” and processed under reverse charge mechanism.

Correct response:

If individuals can also apply from the same platform and usage is not restricted, it qualifies as “consumer-oriented.” Must verify actual conditions and treat under foreign business taxation method.

📋 Comprehensive Checklist (Summary)

| Checklist Item | Verification Details | Responsible Party |

|---|---|---|

| □ Foreign business confirmation | Does contract partner have head office, etc., outside Japan | Common |

| □ Telecommunication services qualification | Service provision via internet, etc. | Common |

| □ Domestic transaction determination | Is service recipient located in Japan | Common |

| □ Business-oriented/consumer-oriented determination | Actual nature of service, contract conditions, usage restrictions | Common |

| □ Taxation method confirmation | General taxation, simplified taxation, or 20% special provision | Domestic business |

| □ Taxable sales ratio confirmation | 95% or higher vs below 95% | Domestic business |

| □ Reverse charge filing necessity | File only if general taxation and below 95% | Domestic business |

| □ Tax agent appointment | Appointed representative in Japan | Foreign business |

| □ Invoice registration | Registered as qualified invoice issuer | Foreign business |

| □ Consumption tax collection/payment | Collecting 10% surcharge and filing | Foreign business |

🎯 Practical Key Points

Consumption tax assessment is complex, but by mastering ①accurately understanding transaction reality, ②understanding your company’s taxation method, ③confirming transitional measure application requirements, errors can be prevented. When in doubt, we recommend consulting a tax accountant or tax office.

Legal Basis (Consumption Tax Act Article 4)

Consumption Tax Act Article 4 (Modified, bolded, and abbreviated by author)

Article 4: Consumption tax shall be imposed on the transfer of assets, etc. (excluding transfers of specified assets) conducted by business operators in Japan and specified purchases (transfers of specified assets received from others as a business, hereinafter the same in this chapter).

(3) In the case of telecommunication services provision, the residence or domicile (meaning a place of continuous residence for one year or more to date) of the person receiving such telecommunication services provision, or the location of the head office or principal office

(4) Determination of whether specified purchases are conducted domestically shall be based on whether the location specified in paragraph 3, item 2 or 3 regarding services received from others as specified purchases by the business operator conducting such specified purchases is in Japan. However, among specified purchases conducted by foreign businesses at permanent establishments (permanent establishments as defined in Income Tax Act Article 2, Paragraph 1, Item 8-4 (Definitions) or Corporation Tax Act Article 2, Item 12-19 (Definitions)) (limited to those qualifying as business-oriented telecommunication services provision received from others, hereinafter the same in this paragraph), those required for transfers of assets, etc., conducted domestically are deemed to be conducted domestically, and among specified purchases conducted by business operators (excluding foreign businesses) at foreign business offices, etc. (foreign business offices, etc., as defined in Income Tax Act Article 95, Paragraph 4, Item 1 (Foreign Tax Credit) or Corporation Tax Act Article 69, Paragraph 4, Item 1 (Foreign Tax Credit)), those required only for transfers of assets, etc., conducted outside Japan are deemed to be conducted outside Japan.

Consumption Tax Basic Guidelines

Consumption Tax Basic Guidelines (Modified and abbreviated by author)

(Business-Oriented Telecommunication Services Provision)

5-8-4 Business-oriented telecommunication services provision refers to telecommunication services provision by foreign businesses where, due to the nature of the service or transaction conditions for providing such services, recipients are normally limited to business operators. For example, the following qualify: (Added by Heisei 27 Taxation Consumer 1-17)

(1) Services objectively clearly business-oriented by nature, such as advertising placement on internet websites

(2) Telecommunication services provision conducted based on contracts concluded by individually determining transaction content with each business operator according to the business receiving the service, where it is clear from contracts that business operators receiving services use them for business purposes

(Note) Services such as e-book/music distribution or provision of various software and games via the internet that are also widely provided to consumers are not considered business-oriented telecommunication services provision based on transaction conditions, even if internet website terms and conditions specify they target only business operators, when consumer applications occur and cannot be practically restricted. Please note this carefully.

While we strive for accuracy in the content of this website, it is based on laws and regulations as of October 14, 2025 (Reiwa 7) and represents the author’s analysis. We make no warranty regarding its accuracy, completeness, suitability for any purpose, or any other aspect. Furthermore, we do not track legal amendments after this date. We accept no liability whatsoever for any damages arising from actions taken or not taken based on this website or the materials contained herein.