When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet

When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption tax obligations become complex. Except for cases where platform taxation methods like Amazon apply, when you (foreign business operator) directly sell e-books and other digital services, the Japanese consumption tax liability depends on whether your customer is a business entity or a consumer. When the service recipient in Japan is a business (clearly defined in contracts), that Japanese domestic business becomes liable for consumption tax. Conversely, when Japanese consumers receive services from you, you become directly responsible for Japanese consumption tax filing and payment obligations.

This article provides a comprehensive explanation of Japanese consumption tax taxation methods for telecommunications services provided by foreign businesses, with specific examples. We particularly focus on the often confusing distinction between “business-to-business” and “business-to-consumer” classifications, referencing detailed National Tax Agency Q&A guidelines.

Basic Structure of Consumption Tax Systems for Telecommunications Services

When Japanese domestic businesses receive telecommunications services from foreign business entities, the first step is determining whether the transaction qualifies as “telecommunications services” under Japanese consumption tax law. Please see below for an explanation of what the provision of telecommunication services means.

Once classified as telecommunications services, the crucial distinction becomes whether the service targets “Japanese businesses” or “Japanese consumers.” This classification determines the taxation method (consumption tax liability) as follows:

When your (foreign business) services target:

Japanese domestic businesses: Reverse charge mechanism applies, and the Japanese domestic business receiving services bears consumption tax filing and payment obligations.

Japanese consumers: You (the foreign business entity) bear consumption tax filing and payment obligations in Japan.

Determining whether your services are business-oriented or consumer-oriented proves practically challenging, requiring careful assessment based on specific examples in National Tax Agency Q&A documents. While we outline legal definitions below, individual cases typically require thorough preliminary investigation and assessment.

Definition of Telecommunications Services

Telecommunications services refer to asset transfers conducted via telecommunications lines, including copyright material provision (including licensing transactions) and other services provided through telecommunications lines (excluding telephone and communication equipment services that mediate third-party communications). This excludes services incidental to other asset transfers, such as notifications of other transaction results (Consumption Tax Law Article 2, partially modified).

Specifically, this includes compensated transactions such as the following (Basic Circular 5-8-3, excerpted from National Tax Agency Q&A):

○ Internet-based distribution of e-books, digital newspapers, music, videos, and software (including various applications such as games)

○ Services providing customers access to cloud-based software and databases

○ Services providing cloud-based electronic data storage for customers

○ Internet advertising distribution and placement

○ Services providing access to online shopping sites and auction platforms (product listing fees, etc.)

○ Services providing platforms for selling game software and other products online

○ Internet-based accommodation and restaurant reservation sites (collecting listing fees from accommodation and dining establishments)

○ Internet-based English conversation classes

○ Ongoing consulting via phone and email, etc.

Transactions Not Classified as Telecommunications Services

Communications themselves, or telecommunications line activities incidental to other asset transfers, specifically the following transactions, do not qualify as “telecommunications services” (excerpted from National Tax Agency Q&A):

○ Phone, fax, telegraph, data transmission, internet line usage, and other services that merely mediate information transmission between parties (communications)

○ Software development, etc.

(When commissioning foreign businesses for copyright creation and receiving deliverables or providing instructions via internet, these transactions involve internet usage incidental to copyright creation and other asset transfers, thus not qualifying as telecommunications services.)

○ Management and operation of overseas assets (including online banking)

(Even when asset management, fund transfer instructions, status reports, and results use internet communications, these involve internet usage incidental to asset management and other transfers, thus not qualifying as telecommunications services. However, separate fees for cloud-based asset management software usage qualify as telecommunications services.)

○ Information collection and analysis commissioned from foreign businesses

(Even when information collection and analysis results use internet communications, these involve internet usage incidental to information gathering and other services, thus not qualifying as telecommunications services. However, providing access to self-collected and analyzed information for compensation, or internet-based access services, qualify as telecommunications services.)

○ Overseas legal proceedings conducted by foreign legal professionals

(Even when litigation status reports and related instructions use internet communications, these involve internet usage incidental to overseas litigation services, thus not qualifying as telecommunications services.)

○ Copyright transfers and leasing

(Even when copyright owners transfer or lease copyrights to businesses involved in reproduction, screening, and broadcasting via internet deliverables, these involve internet usage incidental to copyright transfers and leasing, thus not qualifying as telecommunications services.)

(Note) These transactions not qualifying as “telecommunications services” – asset transfers, leasing, and service provision – continue using previous internal/external determinations per Consumption Tax Law Article 4 and Consumption Tax Law Enforcement Order Article 6, based on transaction types. When classified as domestic transactions subject to consumption tax, tax obligations apply to businesses conducting these asset transfers.

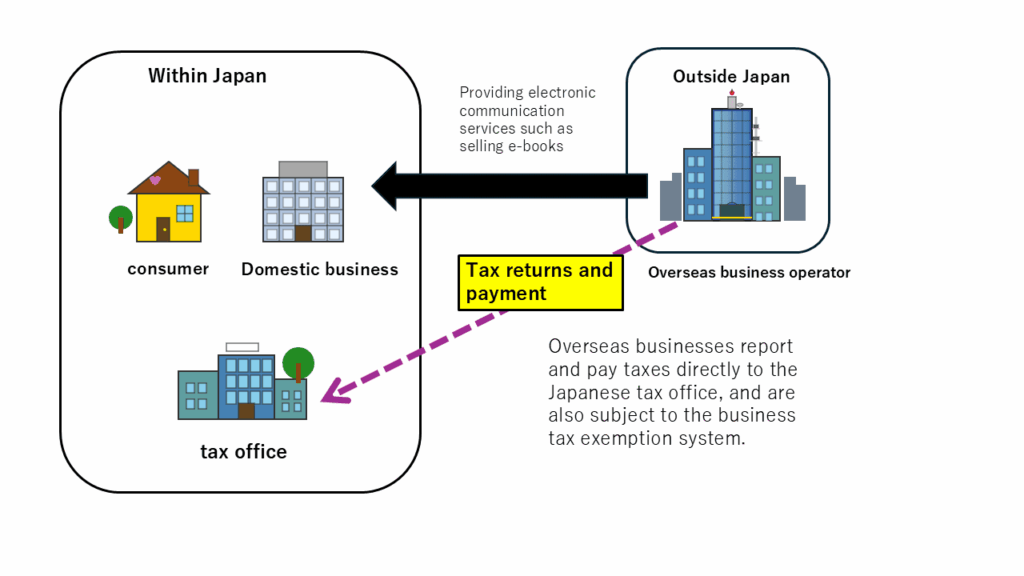

Consumer-Oriented Telecommunications Services in Japan (Foreign Business Filing and Payment System)

For consumer-oriented telecommunications services within Japan, the “Foreign Business Filing and Payment System” applies. Under this system, you (the foreign business) directly file and pay taxes to Japanese tax authorities.

Examples include e-book and music distribution, video streaming services, etc. Importantly, this defines “domestic individual consumer-oriented” services. Specifically, services that cannot effectively restrict applications from consumers and non-business entities also qualify as consumer-oriented services.

For example, cloud services accepting applications through internet websites may advertise as “business-oriented” but actually cannot restrict consumer applications. Such services qualify as consumer-oriented telecommunications services in Japan (National Tax Agency website).

Requirements When You (Foreign Business) Have Consumption Tax Filing and Payment Obligations

Foreign businesses providing consumer-oriented telecommunications services must meet the following requirements:

Small Business Tax Exemption System Application: Generally, businesses with taxable sales of 10 million yen or less during the base period are exempt from tax obligations. For foreign businesses providing only telecommunications services, this determination uses domestic “consumer-oriented telecommunications services” sales during the base period (typically two fiscal years prior).

Tax Administrator Selection: Individual businesses without Japanese addresses or residences, and corporations without domestic headquarters or offices, must select consumption tax administrators within Japan for filing documents and tax payments.

Consumption Tax Filing and Payment by Deadline: Consumption tax filing and payment must occur within two months of fiscal year-end.

Invoice System: Foreign businesses can become qualified invoice issuers by choosing taxable business status.

Business-Oriented Telecommunications Services (Reverse Charge Method → Domestic Business Taxation)

When your services qualify as business-oriented telecommunications services for Japanese domestic businesses, the reverse charge method applies, making the Japanese domestic business receiving your services liable for tax obligations.

According to National Tax Agency Q&A, determining whether telecommunications services are business-oriented depends on services clearly identifiable as business-oriented by nature (such as advertising distribution or internet-based game and software sales platform services) or assessment based on transaction conditions.

Specifically, services involving individual negotiation of service content between transaction parties, unique contracts between parties, and clear business orientation evident in contract processes and final agreements qualify. In such cases, Japanese domestic businesses receiving services bear Japanese consumption tax obligations.

Foreign businesses (you) providing business-oriented telecommunications services have obligations to display that Japanese domestic businesses receiving services bear Japanese consumption tax liability (reverse charge method applicability).

Consumption Tax Law Article 62: Businesses conducting specific asset transfers (limited to those qualifying as specific taxable purchases by others domestically) must display in advance that businesses making specific taxable purchases have consumption tax payment obligations. (Partially modified, emphasis added by author)

Summary

Consumption tax systems for telecommunications services vary significantly based on business-oriented versus consumer-oriented determinations. Consumer-oriented services require foreign businesses to bear filing and payment obligations, while business-oriented services require domestic businesses to bear tax obligations through reverse charge methods.

Since these determinations often prove practically difficult, detailed contract and transaction condition reviews require careful consideration. Additionally, verifying appropriate displays from foreign businesses becomes a key confirmation point. As digital economy development increases these transactions, accurate understanding and appropriate responses become essential.

When foreign businesses (you) bear filing tax obligations, you must select consumption tax administrators within Japan and complete consumption tax filing and payment within two months of fiscal year-end. Additionally, under the invoice system, qualified invoice issuer registration numbers should be obtained as qualified invoice issuers.

Foreign Business Operator’s

Consumption Tax Filing Obligations

Foreign Business Operator (You)

When you have tax filing obligations

Appoint a consumption tax payment administrator in Japan

You must select a qualified person or entity in Japan to serve as your tax payment administrator for consumption tax matters.

File and pay consumption tax within 2 months of fiscal year end

Submit your consumption tax return and complete payment within the specified deadline to avoid penalties.

Fiscal Year End

2 Months Later

Filing & Payment Deadline

⚠️ Both requirements must be fulfilled

While we strive for accuracy in the content of this website, it is based on laws and regulations as of October 14, 2025 (Reiwa 7) and represents the author’s analysis. We make no warranty regarding its accuracy, completeness, suitability for any purpose, or any other aspect. Furthermore, we do not track legal amendments after this date. We accept no liability whatsoever for any damages arising from actions taken or not taken based on this website or the materials contained herein.