What are Telecommunications Services Under Japanese Consumption Tax Law?

“Telecommunications services” refers to services provided through communication networks such as the internet. For example:

Services that allow users to download or access music, videos, and e-books online

Cloud services (such as online storage)

Provision of online games and applications

These are considered to fall under the category of telecommunications services.

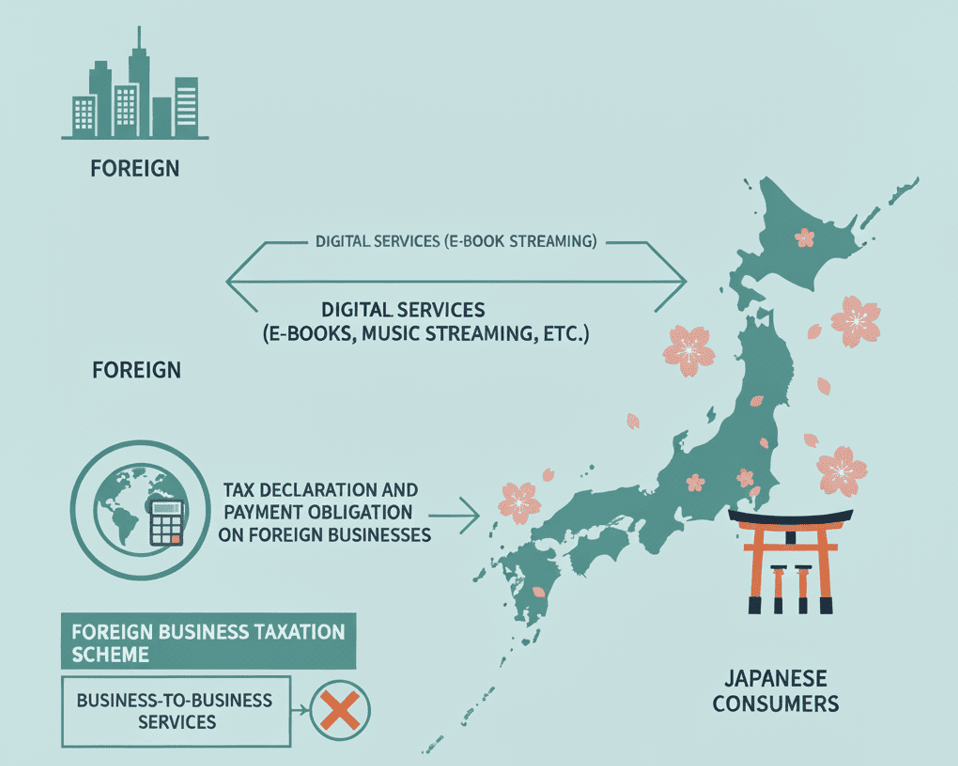

This guide provides a detailed explanation of the consumption tax obligations when foreign businesses (overseas companies without a base in Japan) engage in internet transactions such as downloadable e-book sales.

Overview of Japanese Consumption Tax Classification for Internet Transactions by Foreign Businesses

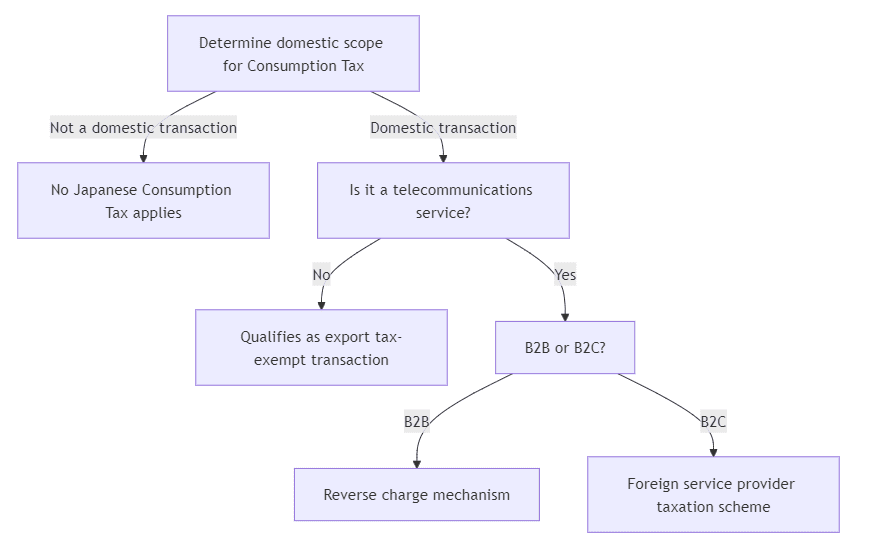

When considering the consumption tax obligations for businesses conducted by foreign companies via the internet, it is necessary to think through three stages. As this is a lengthy topic, this page will focus on explaining Stage 1 (determining domestic vs. international transactions for consumption tax purposes) and Stage 2 (determining whether services provided by foreign companies to Japan constitute telecommunications services). The diagram below is only a schematic overview. For Stage 3, please refer to this page.

Stage 1: Determining Whether Services Provided by Foreign Businesses Constitute Domestic Transactions or Specified Purchases Under Consumption Tax Law

First, it is necessary to determine whether the telecommunications services in question are subject to Japanese consumption tax. The determination is made based on the provisions below, but it is highly technical, with different criteria depending on whether you are providing or receiving services. Primarily, the determination is based on whether the recipient of the internet-based service is located in Japan. However, for example, information provision services related to overseas assets are treated as transactions conducted outside Japan and are not subject to consumption tax. Therefore, the determination can be quite complex.

Consumption Tax Act Article 4 (Partial excerpt with author’s modifications and emphasis)

Consumption tax shall be imposed under this Act on transfers of assets, etc. (excluding transfers of specified assets, etc.) conducted by business operators in Japan and on specified purchases (transfers of specified assets, etc. received from others as a business).

3. The determination of whether a transfer of assets, etc. was conducted in Japan shall be made according to whether the location specified in each of the following items for the cases listed in those items is in Japan. However, in the case listed in item 3, if there is no location as specified in that item, the transfer of assets, etc. shall be deemed to have been conducted outside Japan.

Item 3: In the case of provision of telecommunications services: The address or residence (a place where one has continuously resided for one year or more) of the recipient of the telecommunications services, or the location of their head office or principal office

4. The determination of whether specified purchases were conducted in Japan shall be made based on whether the location specified in item 2 or 3 of the preceding paragraph for the provision of services received from others as specified purchases by the business operator making such specified purchases is in Japan. However, specified purchases made by foreign businesses at permanent establishments (limited to those corresponding to business-oriented telecommunications services received from others) that are necessary for transfers of assets, etc. conducted in Japan shall be deemed to have been conducted in Japan, and specified purchases made by business operators (excluding foreign businesses) at foreign offices that are necessary only for transfers of assets, etc. conducted outside Japan shall be deemed to have been conducted outside Japan.

Stage 2: What Constitutes Telecommunications Services Under Consumption Tax Law? – Critical Determination

As the second stage, I will explain whether the transaction in question constitutes telecommunications services under Japanese consumption tax law. First, let me introduce the legal provisions regarding telecommunications services.

Consumption Tax Act Article 2, Paragraph 1 (with partial author modifications)

Item 8-3: Telecommunications Services – Among transfers of assets, etc., the provision of copyrighted works (copyrighted works as defined in the Copyright Act) conducted via telecommunications lines (including transactions related to permission to use such copyrighted works) and other services provided via telecommunications lines (excluding services that mediate communications of others using telephone, telegraph, or other communication facilities), excluding services incidental to other transfers of assets, etc., such as notification of results of other transfers of assets, etc.

Interpreting this provision, “telecommunications services” refers to services provided through communication networks such as the internet.

For example:

Services that allow users to download or access music, videos, and e-books online

Cloud services (such as online storage)

Provision of online games and applications

These are considered to constitute telecommunications services.

However, the following are not included:

Services that mediate communications themselves, such as telephone and email, do not constitute telecommunications services.

Services provided incidentally to other transactions also do not constitute telecommunications services.

→ For example, “download notification emails” sent when purchasing goods, or

”communication services incidental to product sales” are not included.

| Category | Description |

|---|---|

| Scope | Services provided using internet lines and similar networks |

| Examples of telecommunications services | Music and video streaming, e-book downloads, cloud services, etc. |

| Examples NOT constituting telecommunications services | Communication mediation by telephone/communication companies, notifications incidental to product sales, etc. |

Consumption Tax Obligations When Services Constitute Telecommunications Services (Explained on separate page)

In this case, the consumption tax method differs depending on whether the recipient of telecommunications services from a foreign business is a business operator or a consumer. Additionally, if the telecommunications services are provided through a specific platform, they may be subject to platform taxation.

Detailed Explanation Based on Basic Circular (Cases Constituting Telecommunications Services)

Consumption Tax Basic Circular (Partial excerpt with author modifications)

(Telecommunications Services)

5-8-3 Telecommunications services refer to the provision of copyrighted works conducted via telecommunications lines and other services provided via telecommunications lines, excluding services incidental to other transfers of assets, etc., such as notification of results of other transfers of assets, etc. Examples include the following:

(1) Distribution of e-books via the internet

(2) Provision of services allowing viewing of music and videos via the internet

(3) Provision of services allowing use of software via the internet

(4) Provision of services offering product sales locations for other business operators on internet websites

(5) Provision of services placing advertisements on internet websites

(6) Ongoing consulting via telephone or email

This means that businesses distributing e-book sales to Japanese consumers or business operators via the internet, showing videos, or providing music streaming services are considered to constitute telecommunications services under consumption tax law.

Detailed Explanation Based on Basic Circular (Cases NOT Constituting Telecommunications Services)

Services incidental to other transfers of assets, etc., such as notification of results of other transfers of assets, etc., which do not constitute telecommunications services, include the following examples:

1. Cases where a business operator commissioned to manage or operate assets located overseas reports the status of such management to the client via the internet or email

2. Cases where a business operator commissioned to develop software develops the software overseas and transmits the completed software to the client via the internet or similar means

1. Cases where a business operator commissioned to manage or operate assets located overseas reports the status of such management to the client via the internet or email are considered management and operation of assets located overseas, constituting international transactions, and are not subject to consumption tax in the first place.

2. Cases where a business operator commissioned to develop software develops the software overseas and transmits the completed software to the client via the internet or similar means constitute a purchase of software from an overseas business operator, but do not constitute telecommunications services (and therefore do not become specified purchases), so they are not considered subject to the reverse charge method or foreign taxation method.

Summary of Japanese Consumption Tax Obligations for Internet Transactions by Foreign Businesses

Stage 1: Determining Domestic vs. International Transactions

- Basic Rule: Determined by whether the recipient’s address, residence, head office, or principal office is located in Japan

- Exception: Information provision services related to overseas assets may be treated as international transactions and excluded from consumption tax

Stage 2: Determining Whether Services Constitute Telecommunications Services

Services that qualify:

- Music, video, and e-book distribution

- Cloud services

- Online games and applications

- Provision of product sales locations on the internet

- Web advertising placement

- Ongoing consulting via telephone or email

Services that do NOT qualify:

- Communication mediation services such as telephone and email

- Notification emails incidental to product sales

- Management reports for overseas assets (international transactions)

Stage 3: Determining Tax Method (Explained on separate page)

The tax method differs depending on whether the service recipient is a business operator or a consumer, and special tax methods may apply when services are provided through platforms.

Key Point: Determination is complex and technical, requiring careful consideration for individual cases.

FAQ

Q: Are services received from overseas Netflix or Spotify subject to consumption tax?

A: Yes, when used by Japan residents, they constitute telecommunications services and are subject to consumption tax.

Q: Do internet communications associated with overseas software development commissions constitute telecommunications services?

A: No, they do not. These are deliveries of work products, and internet-based payment communications and similar services are considered incidental services and do not constitute telecommunications services.

While we strive for accuracy in the content of this website, it is based on laws and regulations as of October 14, 2025 (Reiwa 7) and represents the author’s analysis. We make no warranty regarding its accuracy, completeness, suitability for any purpose, or any other aspect. Furthermore, we do not track legal amendments after this date. We accept no liability whatsoever for any damages arising from actions taken or not taken based on this website or the materials contained herein.