Anti-Tax Avoidance System for Transactions with Overseas Related Companies

For companies with overseas related companies, the choice of financing methods becomes a crucial tax consideration. The decision between equity investment or borrowing significantly impacts corporate tax burden in Japan. Thin capitalization rules are established to prevent tax avoidance through the use of these financing methods, and companies engaging in transactions with overseas related companies must understand these regulations.

This article provides clear explanations of essential practical knowledge, from the basic mechanisms of thin capitalization rules to their application requirements. To implement appropriate tax strategies, please read through to the end.

Basic Concepts and Background of Thin Capitalization Rules

Thin capitalization rules are a system designed to prevent tax avoidance where domestic corporations receiving funding from overseas related companies accept excessive loans instead of equity investments to reduce their tax burden. These rules are stipulated in Article 66-5 of the Special Taxation Measures Law and constitute one of the important regulations in international taxation.

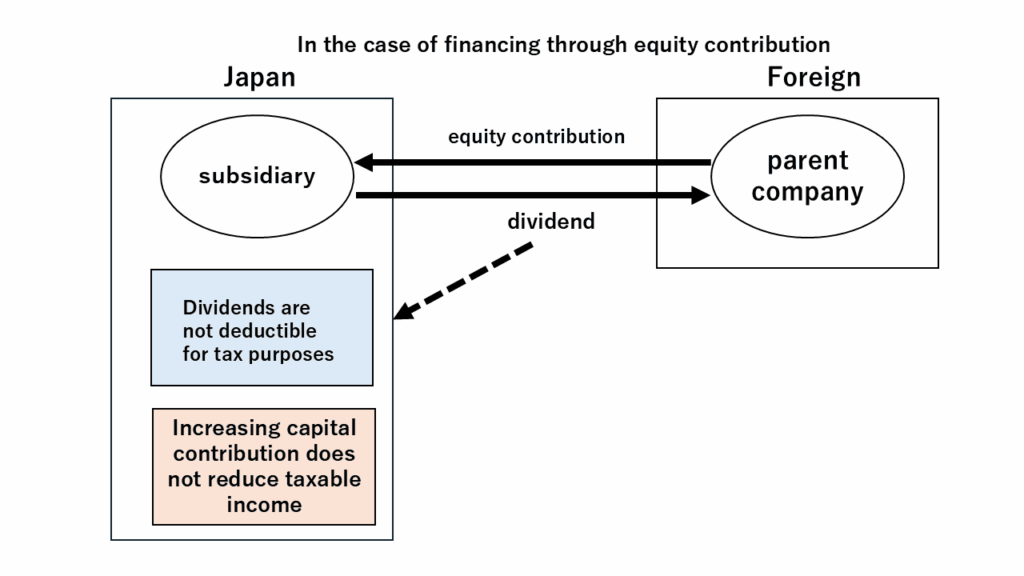

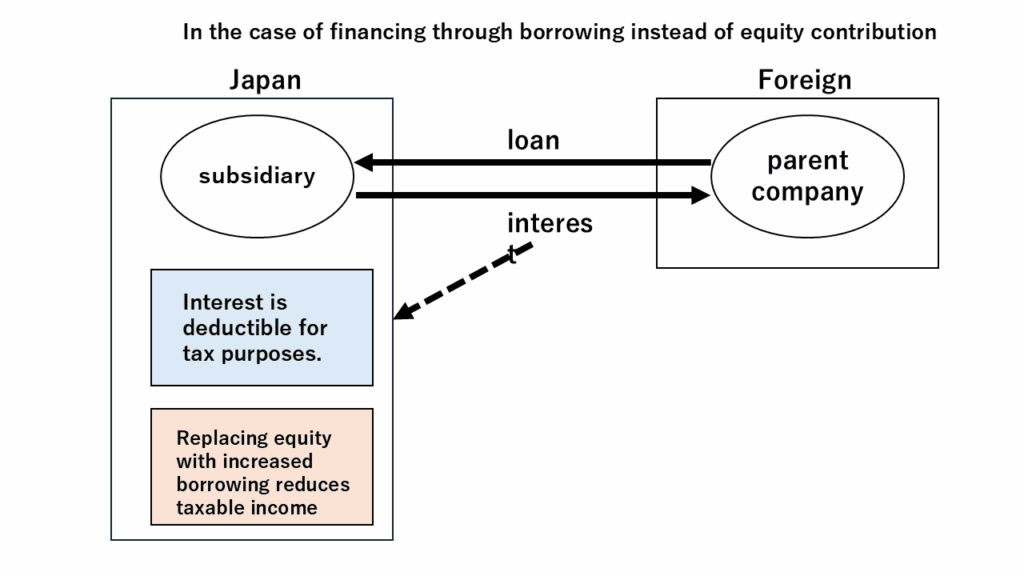

Why are such rules necessary? The background lies in the different tax treatment of equity investments versus borrowings. Dividends are not deductible expenses, so increasing equity investments does not reduce taxable income. Conversely, interest payments are deductible expenses, so increasing borrowings can reduce taxable income. By utilizing this mechanism, companies can substitute what should properly be equity capital with excessive borrowings, thereby reducing their tax burden in Japan.

Thin capitalization rules were introduced to prevent such tax avoidance practices and ensure fair tax burden distribution.

Specific Mechanisms and Calculation Methods of Thin Capitalization Rules

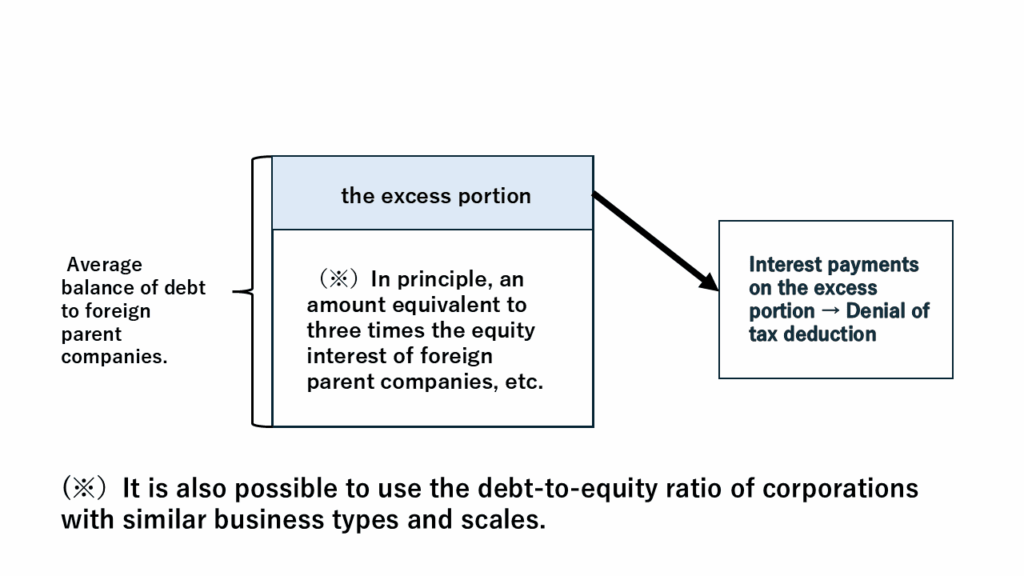

The core of thin capitalization rules is the “3x standard.” When the average outstanding balance of debt to foreign controlling shareholders and fund providers exceeds three times the capital contribution of foreign controlling shareholders, the deductibility of interest payments corresponding to the excess portion is denied.

The specific calculation formula is as follows: Thin capitalization rules apply when the debt-to-equity ratio for foreign controlling shareholders and fund providers exceeds 3x. This ratio is calculated as “Average debt balance to foreign controlling shareholders and fund providers ÷ Capital contribution of foreign controlling shareholders.”

Let’s clarify important terminology here. “Foreign controlling shareholders” refers to non-residents or foreign corporations that directly or indirectly hold 50% or more of the issued shares of a domestic corporation. “Fund providers” refers to those who provide funds to domestic corporations and others defined by government ordinance as related to such fund provision.

“Debt interest” includes not only regular interest payments on borrowings but also redemption gains/losses on monetary debts and debt guarantee fees. However, payments included in the taxable income of the recipient are excluded.

Importance of Safe Harbor Rules

Thin capitalization rules include an important exception provision called “Safe Harbor Rules.” When the average debt balance of a domestic corporation’s total debt is equal to or less than three times the amount of the corporation’s equity capital, thin capitalization rule restrictions do not apply.

In other words, if the company’s overall debt-to-equity ratio is 3x or less, thin capitalization rules will not apply regardless of the amount of borrowings from overseas related companies. This rule allows companies maintaining sound financial conditions to conduct flexible financing without excessive regulation.

The amount of equity capital is calculated as the remainder after deducting total liabilities from total assets. However, if this amount is less than the amount of stated capital, the stated capital amount is used. Furthermore, if the stated capital amount is less than the capital stock amount, the capital stock amount is used.

The above materials are excerpted and created from Ministry of Finance documents.

Application Requirements and Practical Considerations

When considering the application of thin capitalization rules, the first step is to confirm whether safe harbor rules apply. Only when it is determined that such application does not exist does detailed examination of debt interest subject to regulation begin.

In practice, thin capitalization rules apply only when both of the following two ratios exceed 3x: the debt-to-equity ratio for foreign controlling shareholders and fund providers, and the total debt-to-equity ratio. This two-stage check clarifies the scope of the system’s application.