Tax Treatment Considerations for Employees Temporarily Returning from Foreign Company Assignments

In today’s business environment where overseas assignments to foreign subsidiaries are increasing, the tax treatment of assigned employees has become a critical issue for corporate HR and accounting departments. In particular, the tax implications during temporary returns due to illness or other circumstances can pose tax risks if not properly understood.

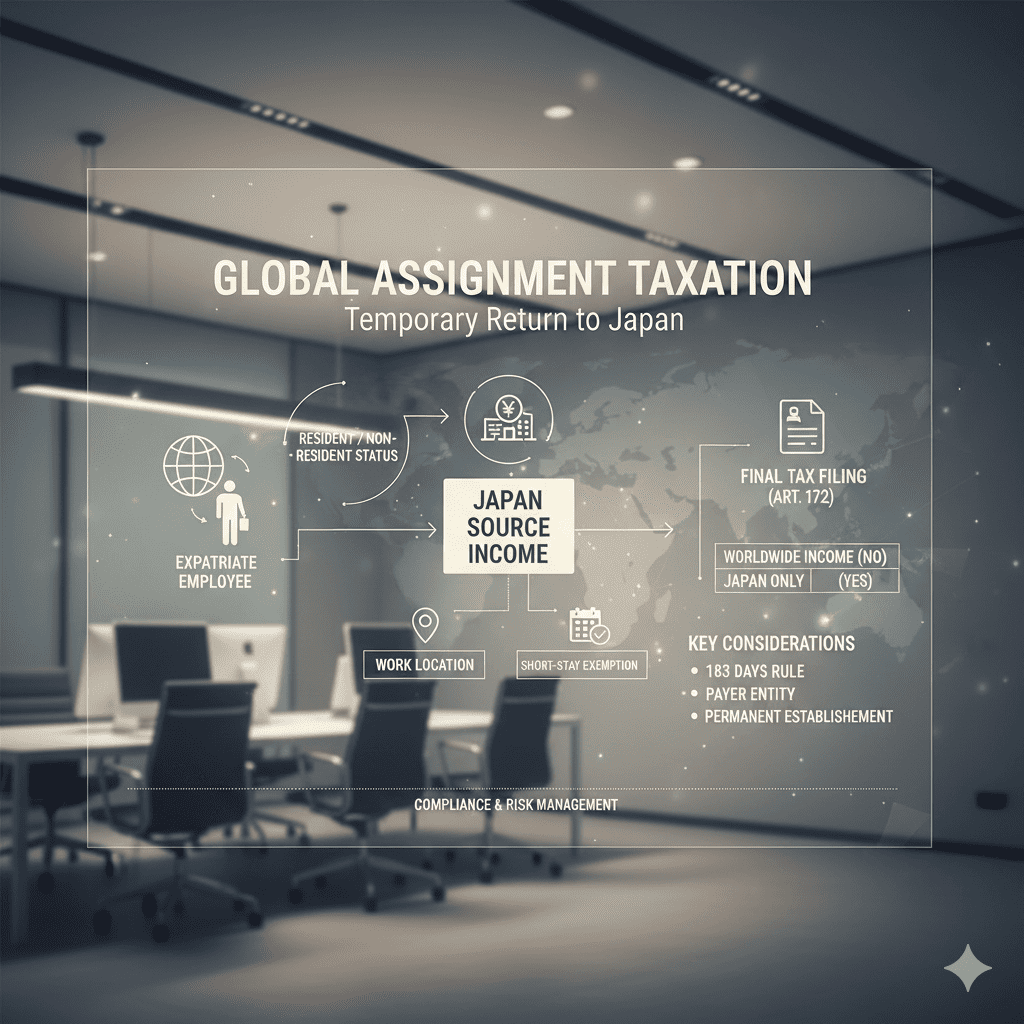

This article examines the case of employees assigned to foreign companies from Japanese domestic companies who temporarily return to Japan due to various circumstances. We will explain the criteria for determining resident vs. non-resident status for assigned employees, the scope of domestic source income, the necessity of quasi-final tax returns, and the short-term visitor tax exemption system under tax treaties.

Basic Principles for Determining Resident vs. Non-Resident Status of Overseas Employees

The determination of resident vs. non-resident status for tax purposes is the most important factor in determining the tax obligations of assigned employees. This determination significantly affects the scope of taxable income and applicable tax rates.

As a basic determination criterion, a resident is defined as “an individual who has an address in Japan or has continuously had a residence in Japan for one year or more up to the present.” Meanwhile, a non-resident is defined as “an individual other than a resident.”

For assignments to foreign companies, special presumption rules apply. When “engaged in an occupation that normally requires continuous residence outside Japan for one year or more,” the individual is presumed not to have an address in Japan. Under this presumption, those scheduled for overseas work of one year or more are treated as non-residents from the day following their departure from Japan.

An important point is that non-resident status continues even in cases of temporary return to Japan. Even if returning due to illness, as long as there are plans to resume overseas work after recovery, the individual is treated as a non-resident during their stay in Japan.

Thus, individuals who come to reside outside Japan are generally presumed to be non-residents under income tax law, except when it is clear in advance that their stay outside Japan will be less than one year.

Assuming salary earners who receive only company salary with no other income, Japanese income tax is generally not imposed on salary earned by non-residents from overseas work.

Criteria for Determining Domestic Source Income and the Importance of Work Location

Taxable income for non-residents is limited to “domestic source income” only. This is an important concept that clarifies the scope of Japan’s taxation rights.

Domestic source income for salary income is defined as income “attributable to services or other personal services performed in Japan.” The most important factor in this determination is the location of work (place of service provision).

The specific determination principles are as follows:

If work is physically performed within Japan, it constitutes domestic source income regardless of the content or purpose of the work. For example, even if work for a U.S. subsidiary is conducted from Japan via email or web conferences, it is treated as domestic source income as long as the work location is in Japan. Conversely, if work for a Japanese parent company is performed overseas, for non-residents, it becomes foreign source income and is not taxed in Japan.

This principle holds important significance in today’s telework environment, as tax obligations are determined by whether the location of remote work is domestic or overseas.

Quasi-Final Tax Return System (Article 172 Filing) Mechanism and Procedures

When non-residents (individuals who do not have an address in Japan and do not have a residence for one year or more) earn domestic source income, a special filing system called “quasi-final tax return” (Article 172 filing) applies. This is a unique system different from regular final tax returns. When non-residents receive foreign-paid salaries that are not subject to Japanese withholding tax but attributable to domestic work, they must generally prepare a Japanese quasi-final tax return and file and pay taxes by the filing deadline. However, there are cases where this is not necessary due to tax treaties.

Characteristics of quasi-final tax returns include filing only for domestic source income, with no application of salary income deductions or personal deductions such as basic deductions. A tax rate of 20.42% (combining income tax and special reconstruction income tax) is applied, and the tax amount is calculated by directly multiplying this rate by the income amount.

The filing deadline is generally by March 15 of the following year, but if the individual ceases to have a residence in Japan before March 15, the tax return must be filed by that date. Managing this deadline is very important, as penalties such as additional taxes may be imposed if the deadline is missed.

| Item | Resident Final Tax Return | Non-Resident Quasi-Final Tax Return |

|---|---|---|

| Taxable Income | Worldwide Income | Domestic Source Income Only |

| Salary Income Deduction | Applicable | Not Applicable |

| Basic Deduction | Applicable | Not Applicable |

| Tax Rate | Progressive Tax Rate | 20.42% (Flat Rate) |

Example: Short-Term Visitor Tax Exemption System Requirements and Effects (When Assignment Destination is the United States)

The short-term visitor tax exemption system under the Japan-U.S. Tax Treaty is an important system for promoting international personal exchange. When certain requirements are met, this system can exempt individuals from Japanese income tax.

The requirements for short-term visitor tax exemption under Article 14, Paragraph 2 of the Japan-U.S. Tax Treaty are the following three:

First, regarding the period of stay, it must be within 183 days in aggregate during the tax year. Second, the payer of remuneration must not be a resident of the country from which the individual became a non-resident (Japan in this case). Finally, the remuneration must not be borne by a permanent establishment of a resident of the country from which the individual became a non-resident.

When these requirements are met, Japanese income tax is exempted, and quasi-final tax returns are also unnecessary. However, the determination of requirements must be conducted carefully, with particular attention to calculating days of stay and confirming the bearer of remuneration being important points.

Practical Considerations and Tax Risk Management

There are multiple considerations in tax management for assigned employees. First, the determination of resident vs. non-resident status is based not on the formal presence or absence of resident registration, but on the actual circumstances of daily life, requiring comprehensive judgment.

In determining domestic source income, accurate understanding of work location is important. Particularly with the spread of telework, proper management of records showing where work was actually performed is required.

In determining the application of short-term visitor tax exemption, accurate calculation of days of stay and confirmation of the payer and bearer of remuneration are necessary. If these requirements are not met, quasi-final tax returns must be filed.

From a tax compliance perspective, it is important to establish a consistent tax management system from the issuance of assignment orders through repatriation and maintain appropriate record keeping.

Conclusion

The tax treatment of employees assigned to foreign companies during temporary returns to Japan requires comprehensive consideration of multiple factors, including resident vs. non-resident determination, the scope of domestic source income, the necessity of quasi-final tax returns, and the application of short-term visitor tax exemption systems.