Background of the introduction of the consumption tax invoice system

Japan’s invoice system is a consumption tax-related system that requires businesses to issue and save qualified invoices. This system will be introduced on October 1, 2023 and will play an important role in receiving appropriate consumption tax deductions.

Overview of the invoice system

Japan’s consumption tax invoice system tightens the requirements for businesses to deduct the amount of consumption tax they paid when they paid consumption tax. Specifically, when a business pays consumption tax to a supplier in order to purchase products from the supplier, a qualified invoice that meets the requirements is required to be saved.

A qualified invoice is an invoice issued to receive a consumption tax deduction, and includes details such as the consumption tax rate and consumption tax amount.

Eligible Invoice Requirements

Eligible invoices must include the following information: Invoices that do not include this information will not be eligible for input tax credit.

- Name and registration number of eligible invoice issuing business

- Transaction date

- Transaction details (items subject to reduced tax rate should be clearly stated)

- Consumption tax amount categorized by tax rate and transaction price list excluding or including tax

Registration of qualified invoice issuer

Only businesses registered as qualified invoice issuers can issue invoices. Registration is voluntary, but transactions with businesses that do not issue invoices may be disadvantageous for business partners, as they will not be able to receive consumption tax deductions.

Requirements for registration as a qualified invoice issuer

In order to become a qualified invoice issuing business, you must apply for registration with the local tax office. Both corporate businesses and individual businesses can apply for registration, but they must be a consumption tax payer.

Responses of tax exempt businesses

Businesses (tax-exempt businesses) whose annual taxable sales (strictly speaking, taxable sales during the base period) are 10 million yen or less are not obligated to pay consumption tax, in principle. However, with the introduction of the invoice system, unless a tax-exempt business becomes a qualified invoice issuing business, business partners will no longer be able to receive a purchase tax credit (though for the time being, a portion of the tax credit can be deducted). For this reason, many tax-exempt businesses will need to consider changing their selection of taxable businesses.

Impact of the invoice system on businesses

The invoice system has a significant impact on businesses’ consumption tax-related procedures. In particular, you should pay attention to the following points:

Stricter tax credit for consumption tax

When a business calculates its own consumption tax, in order to apply the input tax credit, the deduction will not be allowed unless the eligible invoices are saved (through transitional measures, the deduction amount will be gradually reduced). , decreases). Therefore, it is important to check whether your business partner is a qualified invoice issuer.

Impact of transactions with tax-exempt entities

If you do business with a tax-exempt business that cannot issue qualified invoices, you will not be able to receive input tax credits, so the cost of doing business with a tax-exempt business will be relatively high. Therefore, tax-exempt businesses may be forced by their business partners to review their transaction conditions, and will need to consider changing to taxable businesses.

Increased administrative procedures

Since it is essential to issue and store qualified invoices, a company’s accounting department must manage invoices. In particular, it requires checking the contents of eligible invoices and storing them appropriately, which increases administrative procedures.

Relationship with reduced tax rate

In Japan, a reduced consumption tax rate (8%) is applied to some transactions such as food and beverages. Under the invoice system, if a transaction is subject to a reduced tax rate, it must be clearly stated on the invoice. Specifically, the following actions are required:

- In the eligible invoice, the tax rate should be listed separately for the products eligible for the reduced tax rate.

- Businesses need to be prepared to distinguish between products eligible for the reduced tax rate and products subject to the standard tax rate.

transitional measures

With the introduction of the invoice system, transitional measures are in place for a certain period of time. During the transition period, some input tax credits are allowed even if you have not received a qualifying invoice.

- From October 1, 2023 to September 30, 2026: 80% of the sales tax paid will be eligible for input tax credit even if you have not received a qualified invoice.

- From October 1, 2026 to September 30, 2029: In similar circumstances, 50% of the sales tax paid will be deducted.

Points to consider

What you need to consider is as follows:

- Required to save eligible invoices: You must receive and save eligible invoices from your business partners to receive input tax credits.

- Registration as a qualified invoice issuer: In order to issue invoices, you must register with the tax office as a qualified invoice issuer.

- Impact on tax-exempt businesses: Transactions with tax-exempt businesses that cannot issue invoices may result in higher costs for business partners, as input tax credits cannot be deducted. For this reason, tax-exempt businesses should consider changing to taxable businesses.

Explanation using specific examples

Specific calculation method of consumption tax

There are two main ways to calculate consumption tax for general companies and individuals: the basic method and the simplified tax method. We will explain the calculation method based on the assumption that a basic method will be adopted.

The basic calculation method for consumption tax is as follows: During the tax period, the consumption tax paid is subtracted from the consumption tax deposited, and if the difference is positive, the consumption tax is paid; if the difference is negative, the consumption tax is paid. This is a way to request a refund.

When calculating this difference, subtracting the consumption tax paid (not necessarily the full amount) is called input tax credit.

A requirement for deducting this paid consumption tax (input tax credit) is to save eligible invoices.

Examples of specific calculation methods

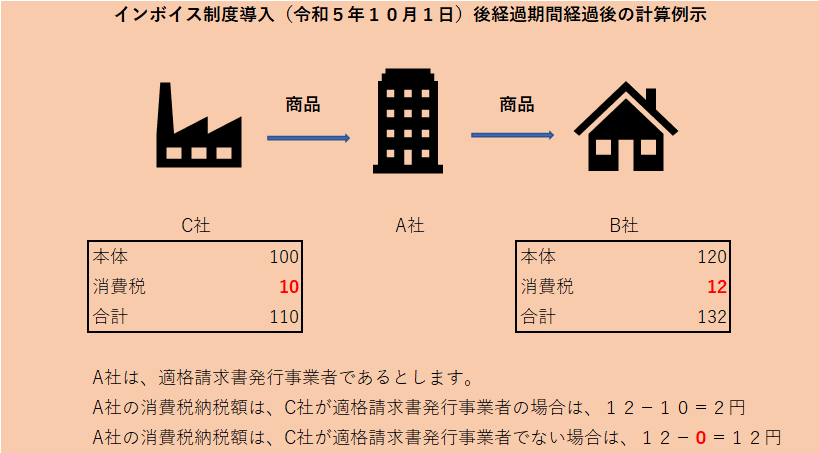

Company A (qualified invoice issuing business) purchases a product from Company C for 110 yen (100 yen for the product + 10 yen consumption tax) and sells it to Company B for 132 yen (120 yen for the product + 12 yen consumption tax). Let’s consider Company A’s consumption tax in this case.

Company A sells products by paying 10 yen in consumption tax to Company C and keeping 12 yen in consumption tax from Company B.

In this case, Company A keeps 12 yen of consumption tax and pays 10 yen of consumption tax. Currently, if you receive a regular invoice from Company C, all you have to do is subtract 10 yen from 12 yen and pay the difference of 2 yen to the government as consumption tax.

However, under the invoice system, unless the invoice that Company C submits to Company A is a qualified invoice, it will not be possible to deduct this 10 yen. We are currently in the middle of transitional measures such as being able to subtract 8 yen.

In other words, if Company C is not a business that can issue qualified invoices, the amount of consumption tax paid by Company A will change.

Company C has two options. Company C is a company that does not register as a qualified business entity. One way is to sell it to Company A for 100 yen without adding consumption tax. (Actually, consumption tax cannot be passed on.)

Another option for Company C is to register as a qualified business entity and issue qualified invoices. By delivering this to Company A, Company A will be able to deduct the purchase tax of 10 yen.

Unless Company C registers as a qualified business entity and issues qualified invoices, Company A, the sales partner, will not be able to claim purchase tax deductions. I believe that Company C will have no choice but to become a qualified invoice issuer if it wishes to continue doing business with the company.

What is a qualified invoice?

A qualified invoice is one that includes the following information: Even if it is handwritten, it still qualifies as a qualified invoice.

- Name and registration number of eligible invoice issuing business

- Transaction date

- Transaction details (item eligible for reduced tax rate)

- Amount of consideration categorized and totaled by tax rate (excluding tax or including tax) and applicable tax rate

- Consumption tax amount categorized by tax rate

- Name of the business operator receiving the document