-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? “Tel… -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law “Telec… -

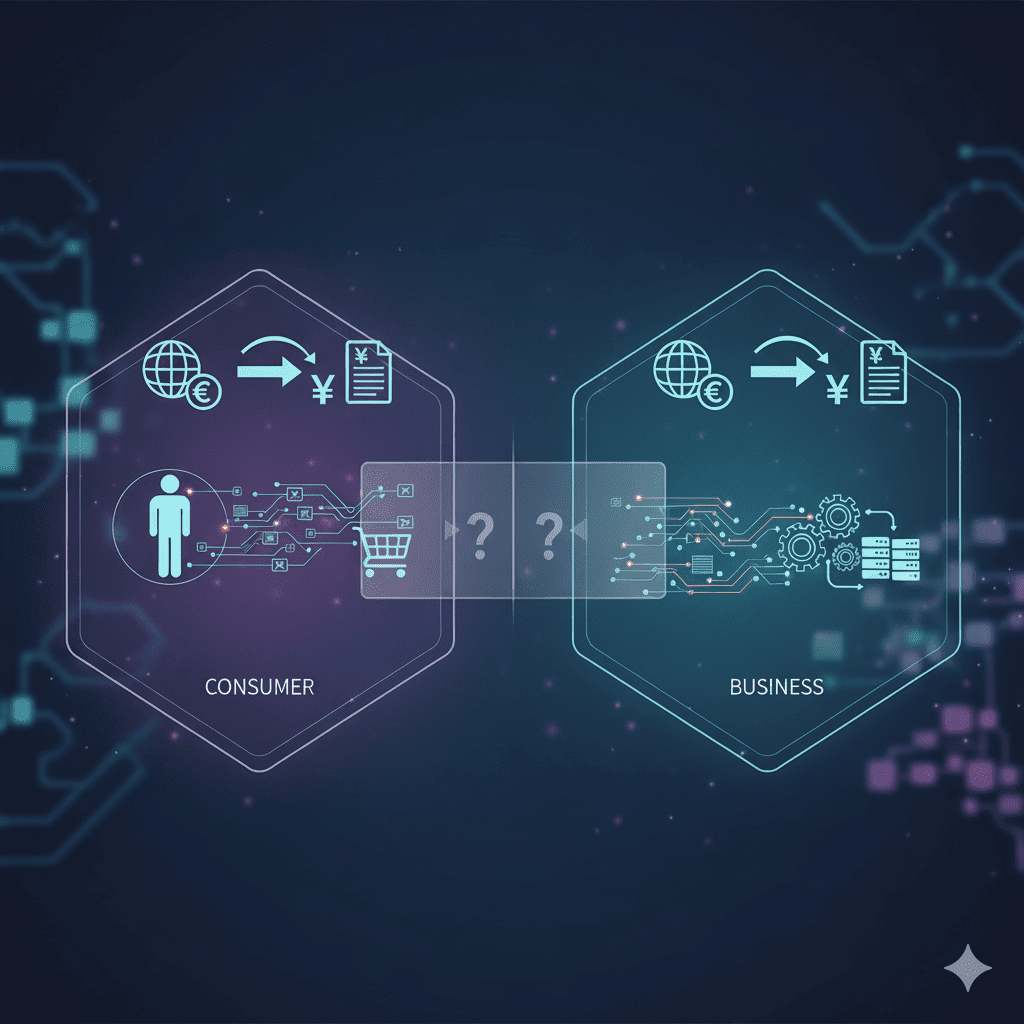

Japan Consumption Tax Guide for Foreign Digital Services & E-books

When You Sell E-books and Digital Services to Japanese Consumers and Business… -

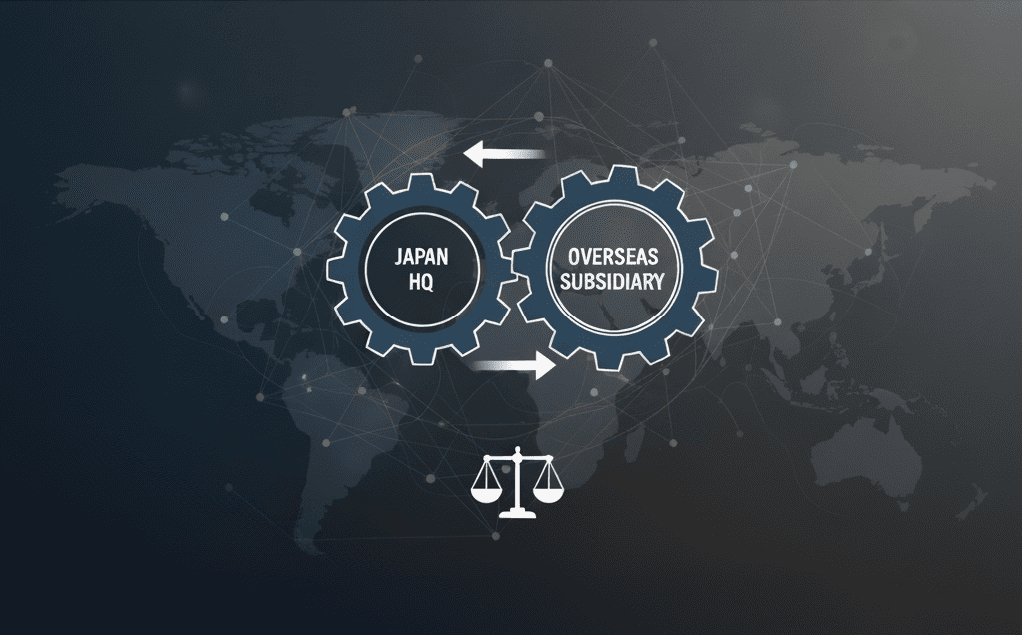

Transfer Pricing Compliance Guide for SMEs: Tax Risk Management

Transfer Pricing Compliance Guide for Small and Medium Enterprises: Essential… -

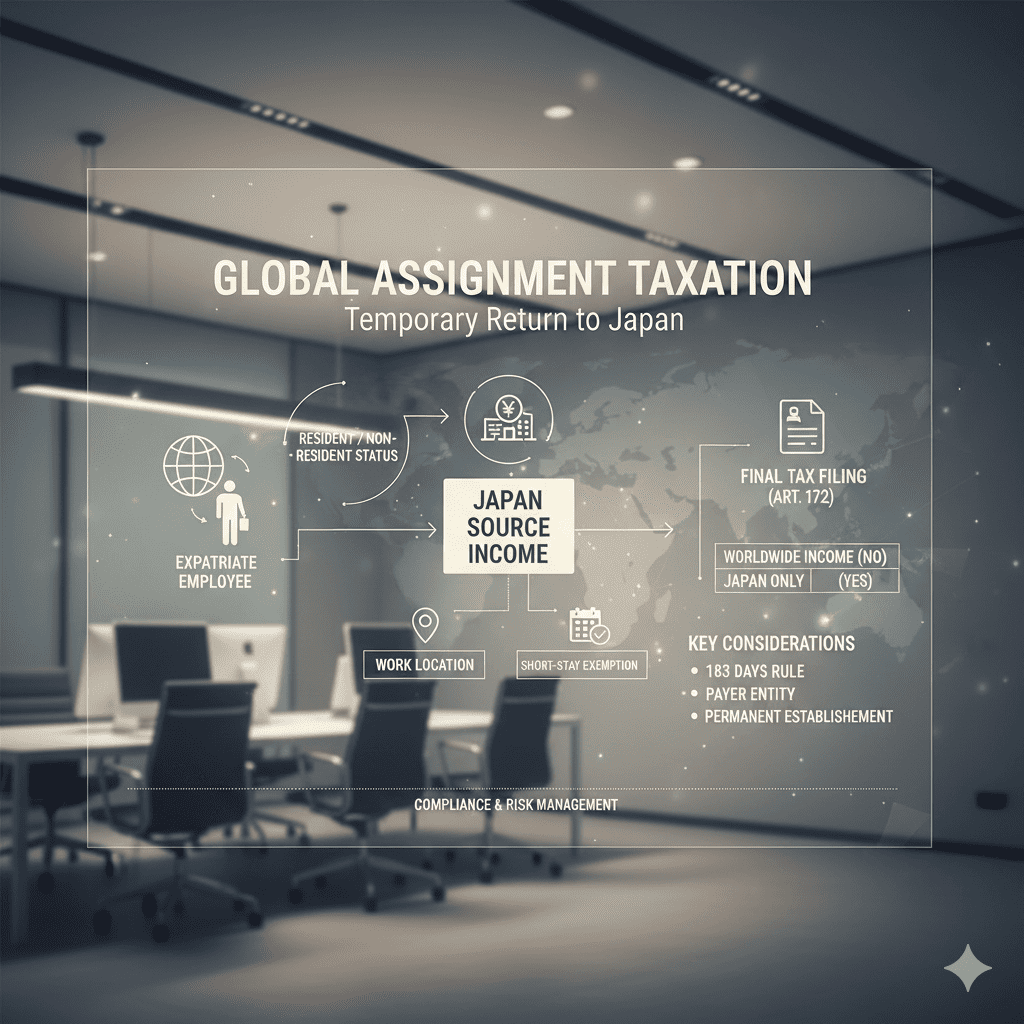

Tax Guide for Japanese Overseas Employees: Temporary Return Rules

Tax Treatment Considerations for Employees Temporarily Returning from Foreign… -

Service Export Tax Exemption Guide: Complete International Tax Processing for Japanese Companies

Service Export Tax Exemption: Complete Guide to International Service Transac… -

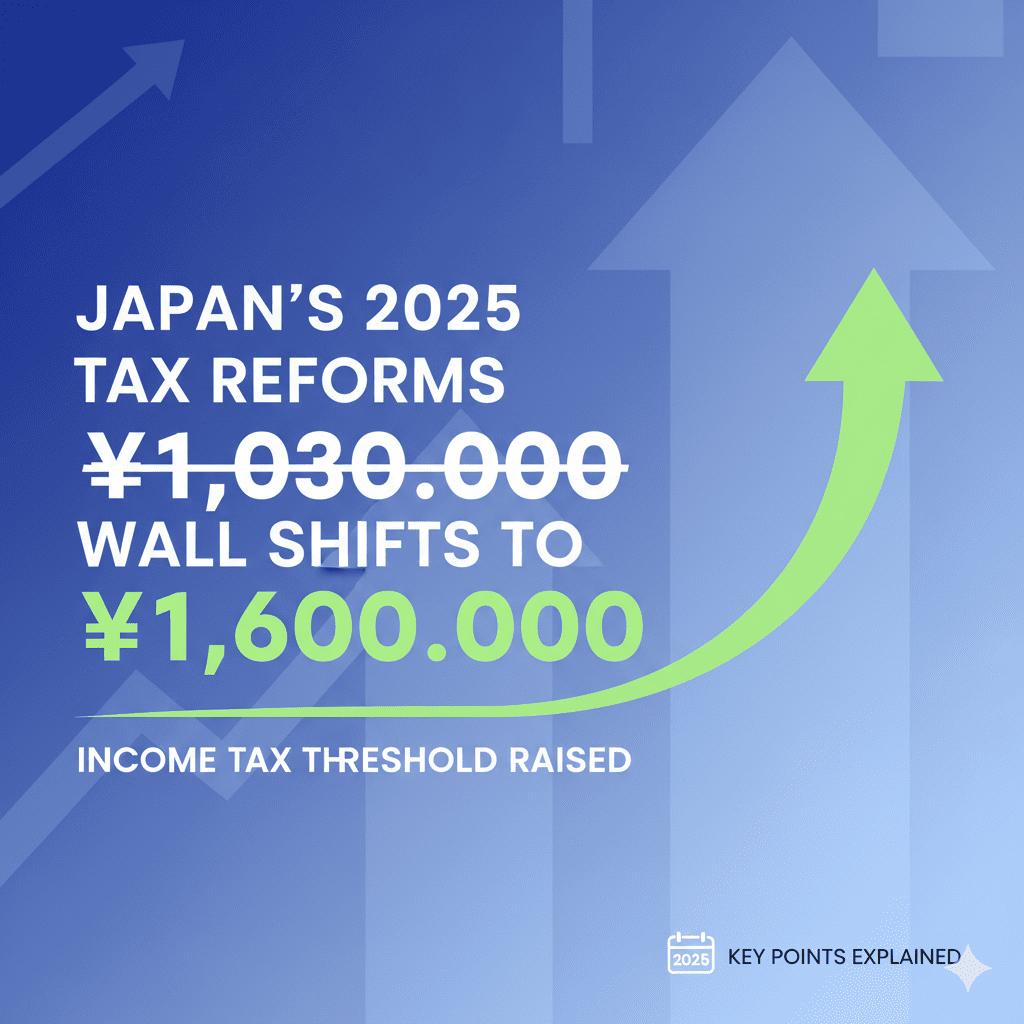

2025 Japan Tax Reform: 1.03M Yen Wall Raised to 1.6M – Complete Guide

2025 Tax Reform: The 1.03 Million Yen Wall Raised to 1.6 Million Yen! Key Poi… -

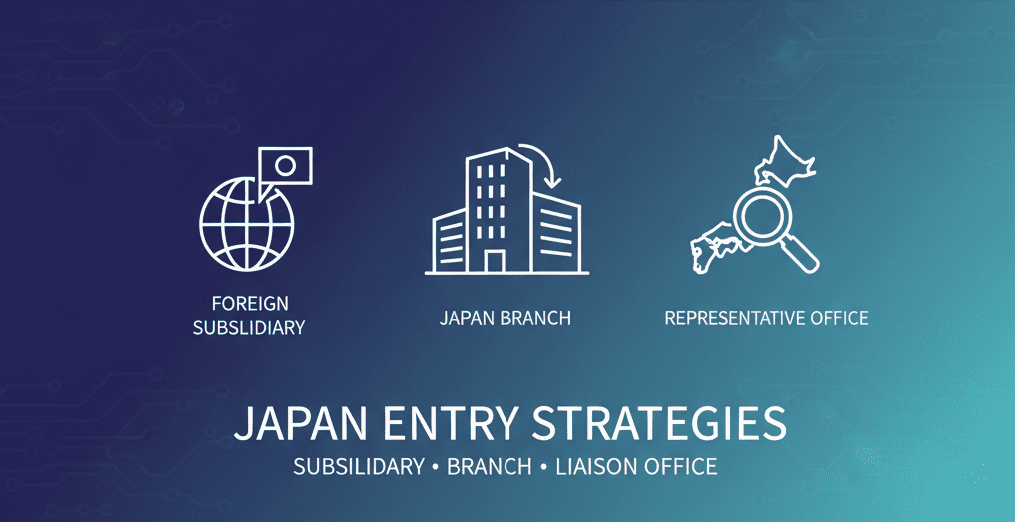

Foreign Company Entry Forms in Japan: Complete Guide

foreign company entry forms in Japan When foreign companies or foreign nation… -

Consumption Tax for Non-Residents with Japanese Branches: Guide 2025

Consumption Tax Implications for Services Provided to Non-Residents with Japa… -

183-Day Rule Guide: Avoid Double Taxation with Short-Term Resident Exemption

Essential International Tax Knowledge In today’s globalized world, many compa… -

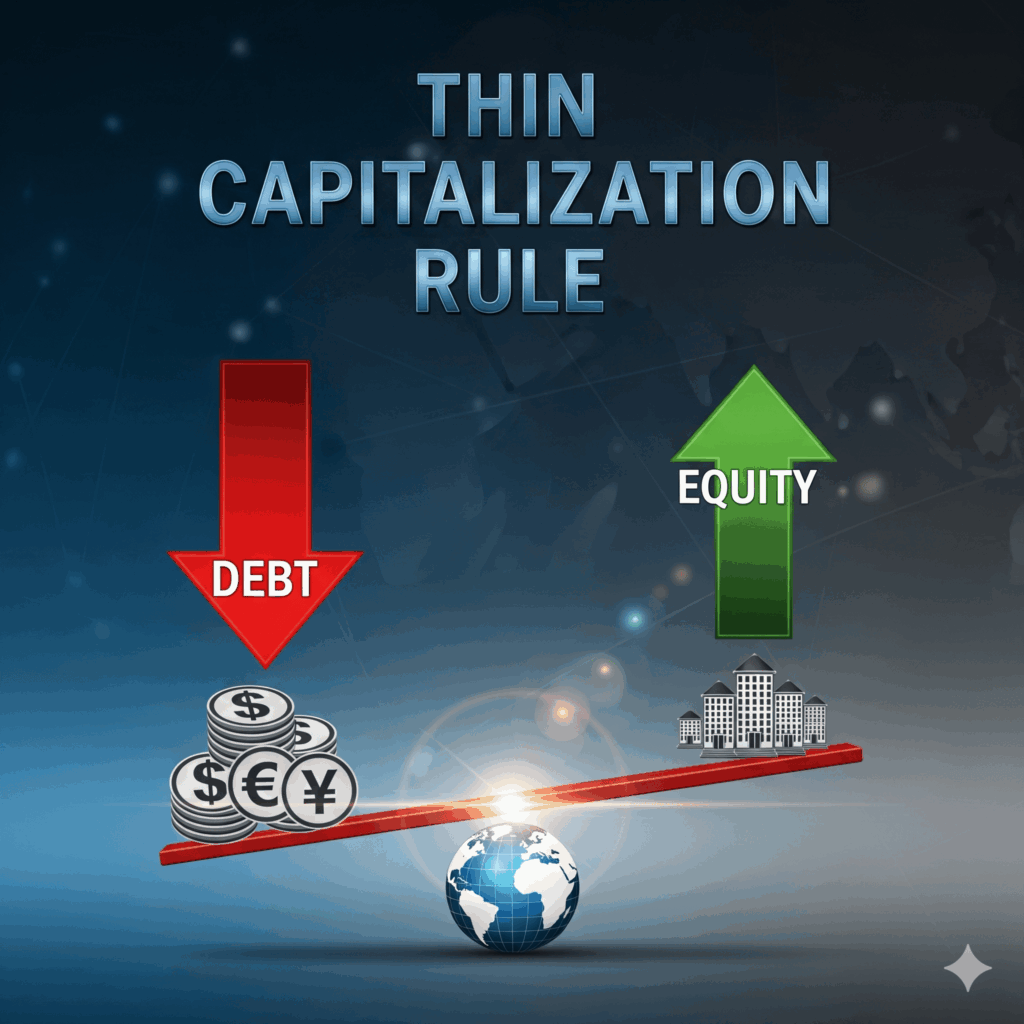

Japan Thin Capitalization Rules Guide: Anti-Tax Avoidance for Overseas Related Companies

Anti-Tax Avoidance System for Transactions with Overseas Related Companies Fo… -

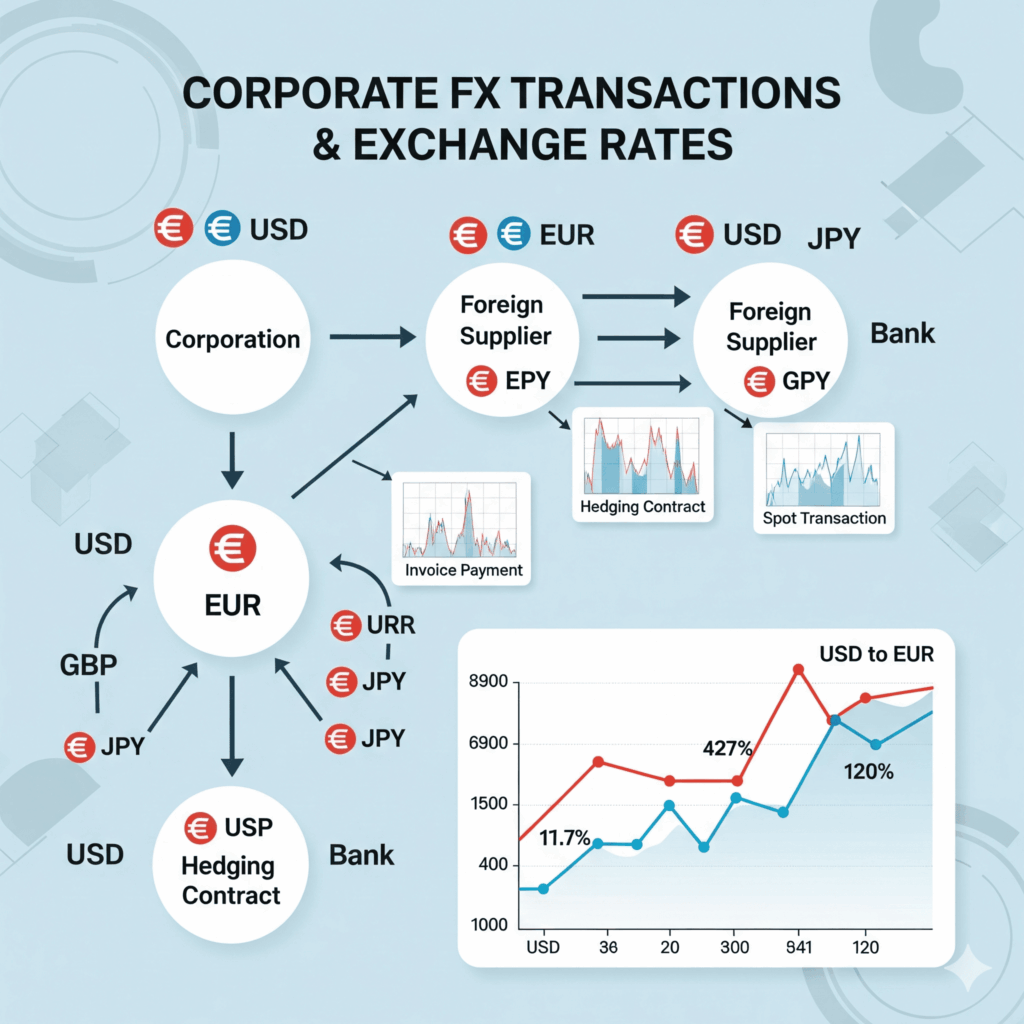

Foreign Currency Exchange Rate Treatment: Japanese Corporate Tax Law Guide 2025

Foreign Currency Exchange Rate Treatment for Corporate Transactions In today’… -

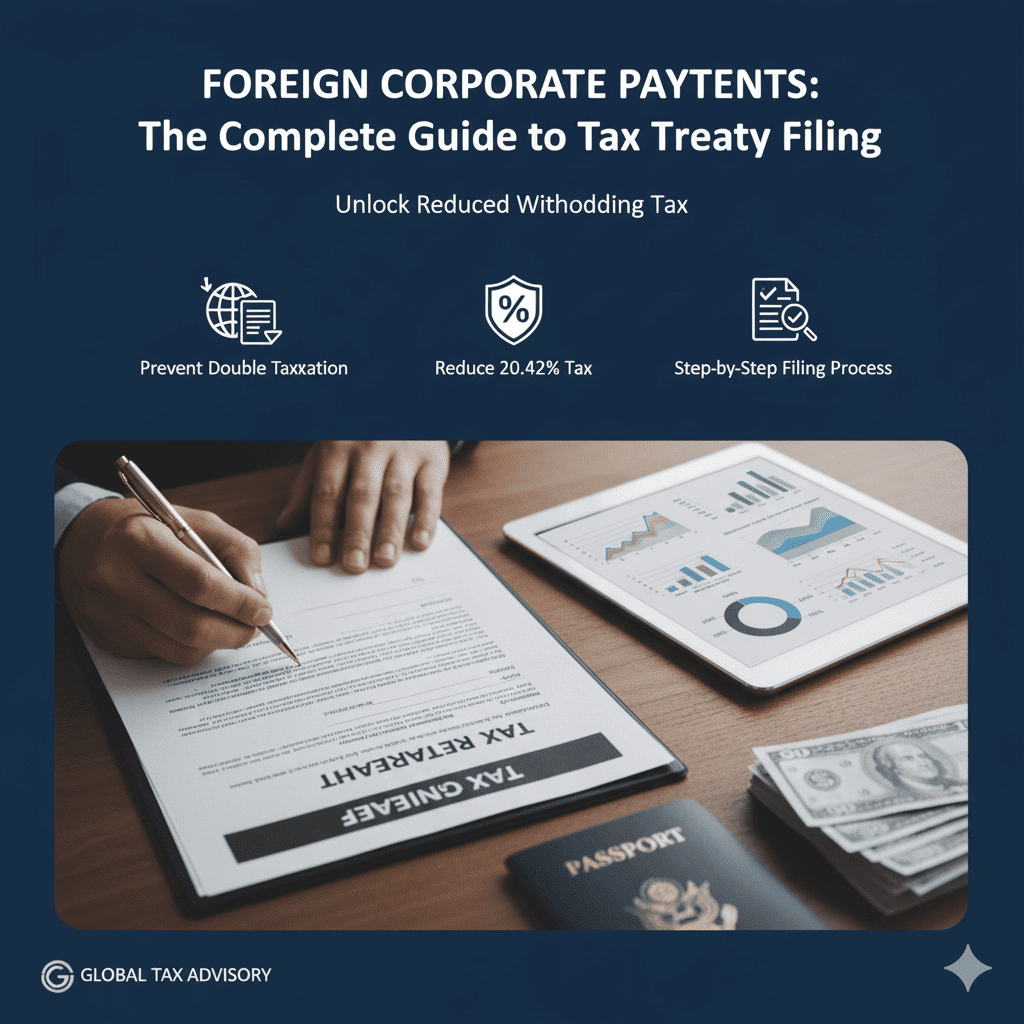

Tax Treaty Applications for Foreign Corporations in Japan: Guide

Tax Treaty Applications for Payments to Foreign Corporations When making paym… -

Japan Domestic Source Income of Foreign Corporations and the Tax Base for Corporate Tax

Four Categories of Taxpayers and Their Taxation Scope Japan’s tax system divi… -

Japan Tax-Exempt Refund System 2026: Complete Guide for Stores

Tax-Exempt Store Refund System Transition in Japan Starting November 1, 2026,… -

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing… -

DDP Import Issues in Japan: Tax Credit Problems & ACP Solutions 2025

Issues with DDP Transactions with Japanese businesses DDP (Delivered Duty Pai… -

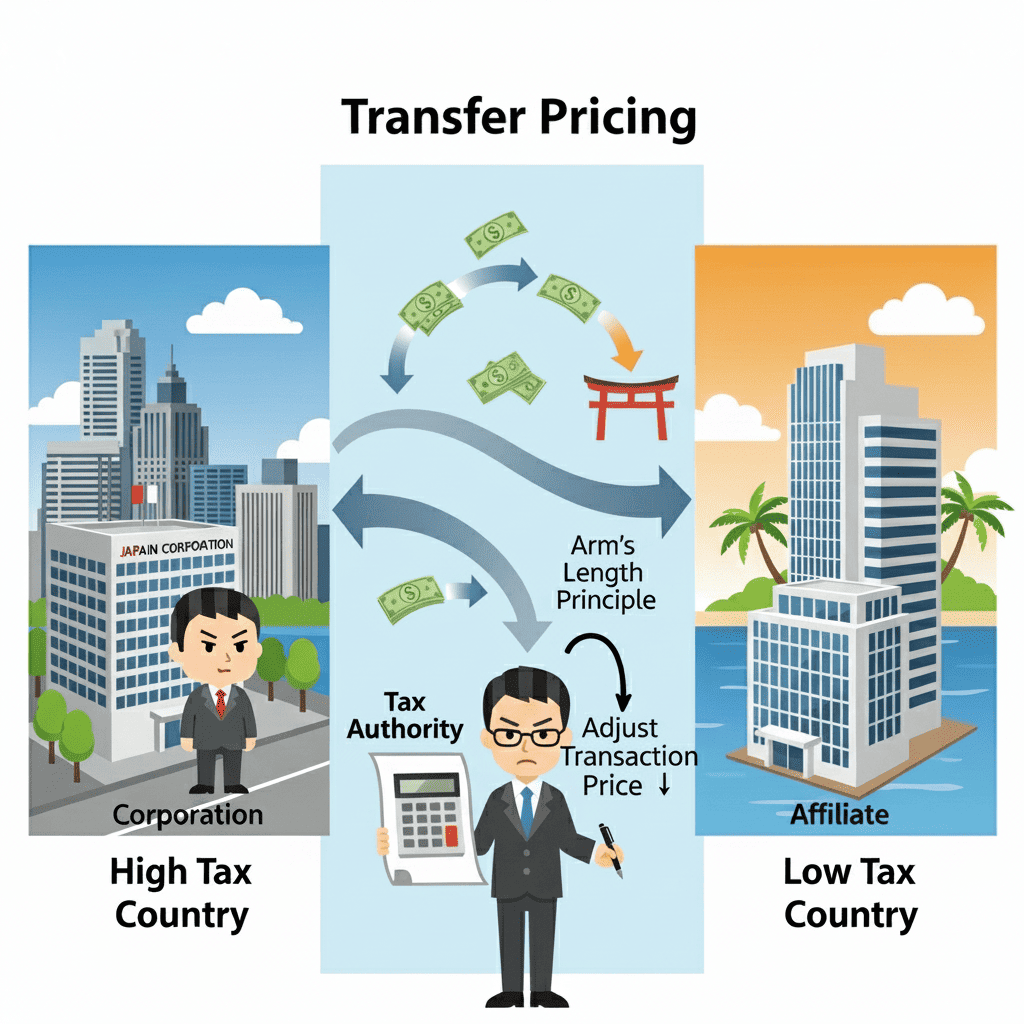

Basics of Japan’s Transfer Pricing System (1)

Basic Mechanism and Purpose of Transfer Pricing Taxation System Transfer pric… -

Japan Export Tax Exemption Guide: Consumption Tax Rules 2025

Japan Export Tax Exemption for Consumption Tax The export tax exemption syste… -

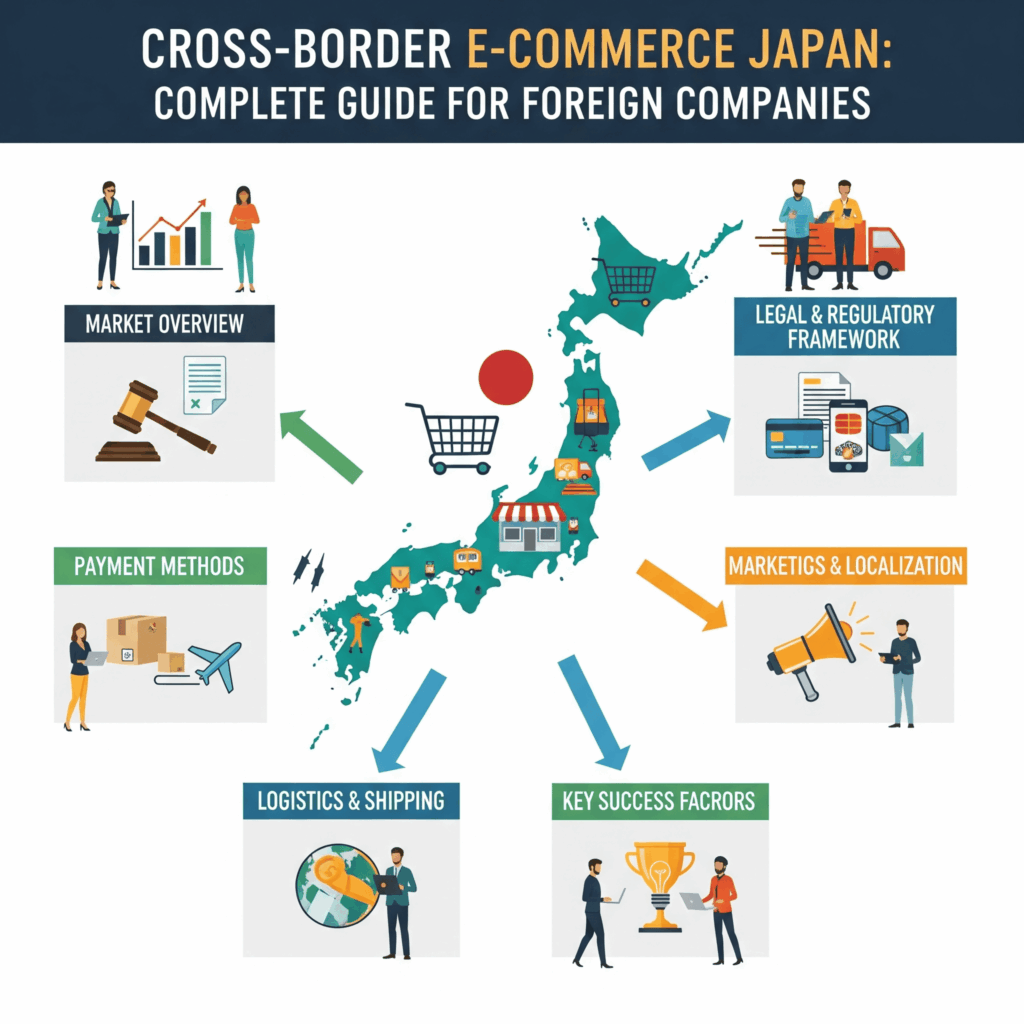

Cross-Border E-Commerce Japan: Complete Guide for Foreign Companies

Cross-Border E-Commerce for Foreign Companies Without Japanese Operations Cro… -

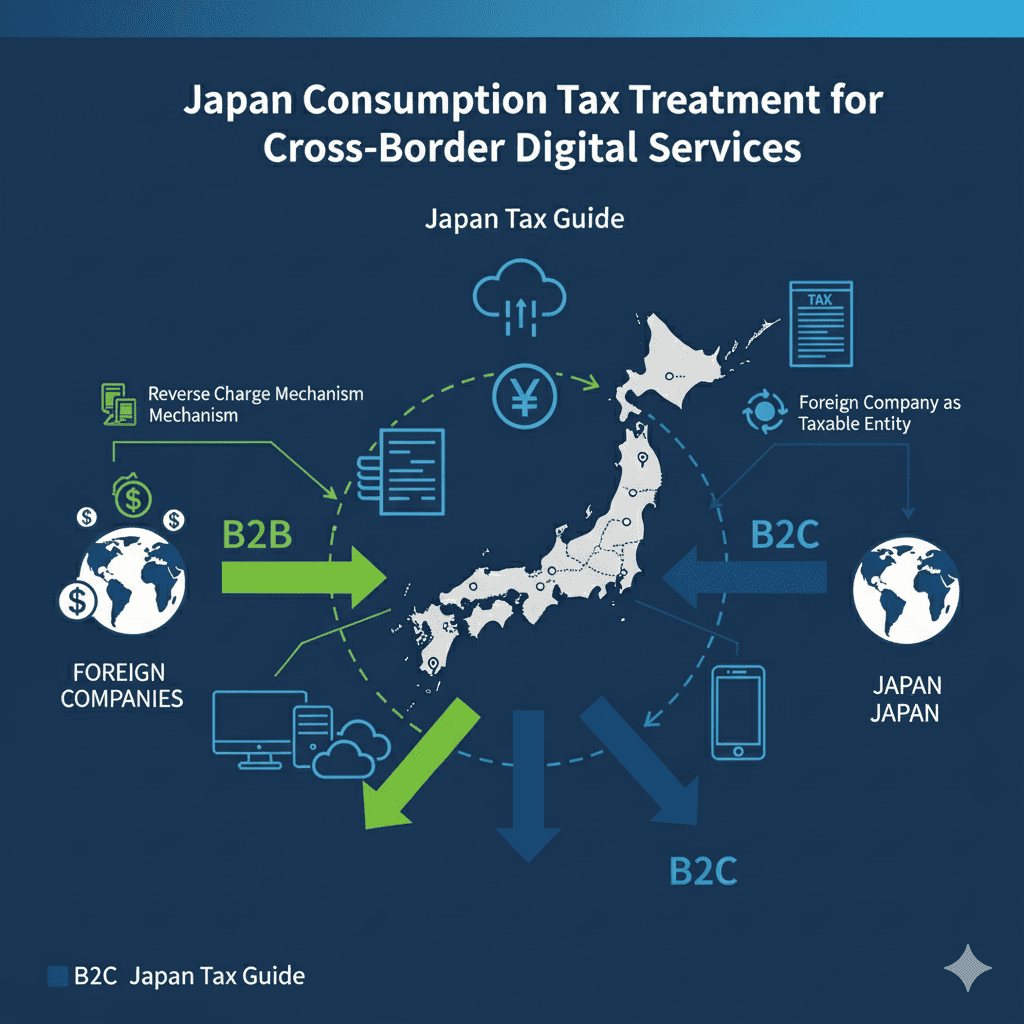

Japan Consumption Tax Treatment for Cross-Border Digital Services | Japan Tax Guide

Why is domestic and foreign judgment important regarding Japan’s consumption … -

Income Tax in Japan: Classification of Residents, Non-Permanent Residents, and Non-Residents

What is a resident? According to the Income Tax Act, a “resident” is defined … -

Amazon Japan Sales Tax for Foreign Companies (Import & Domestic)

What is fulfillment service? “Fulfillment service” is a service that performs… -

Japan’s Customs Law Changes: New Import Consumption Tax Impact on Export Businesses

Background of the Correction Due to the revision of the Customs Act, the requ…