Digital Services– tag –

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

Japan Consumption Tax Guide for Foreign Digital Services & E-books

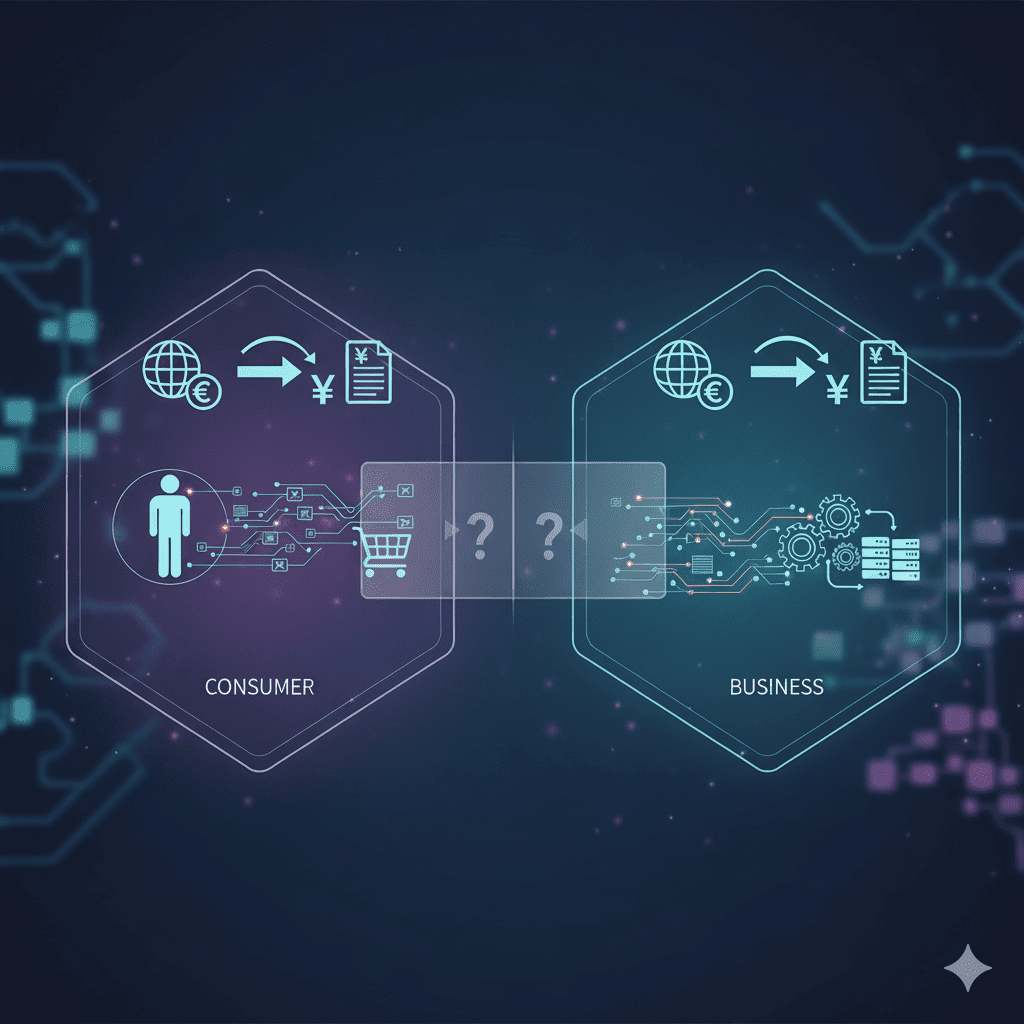

When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption ...

1