Ecommerce– tag –

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

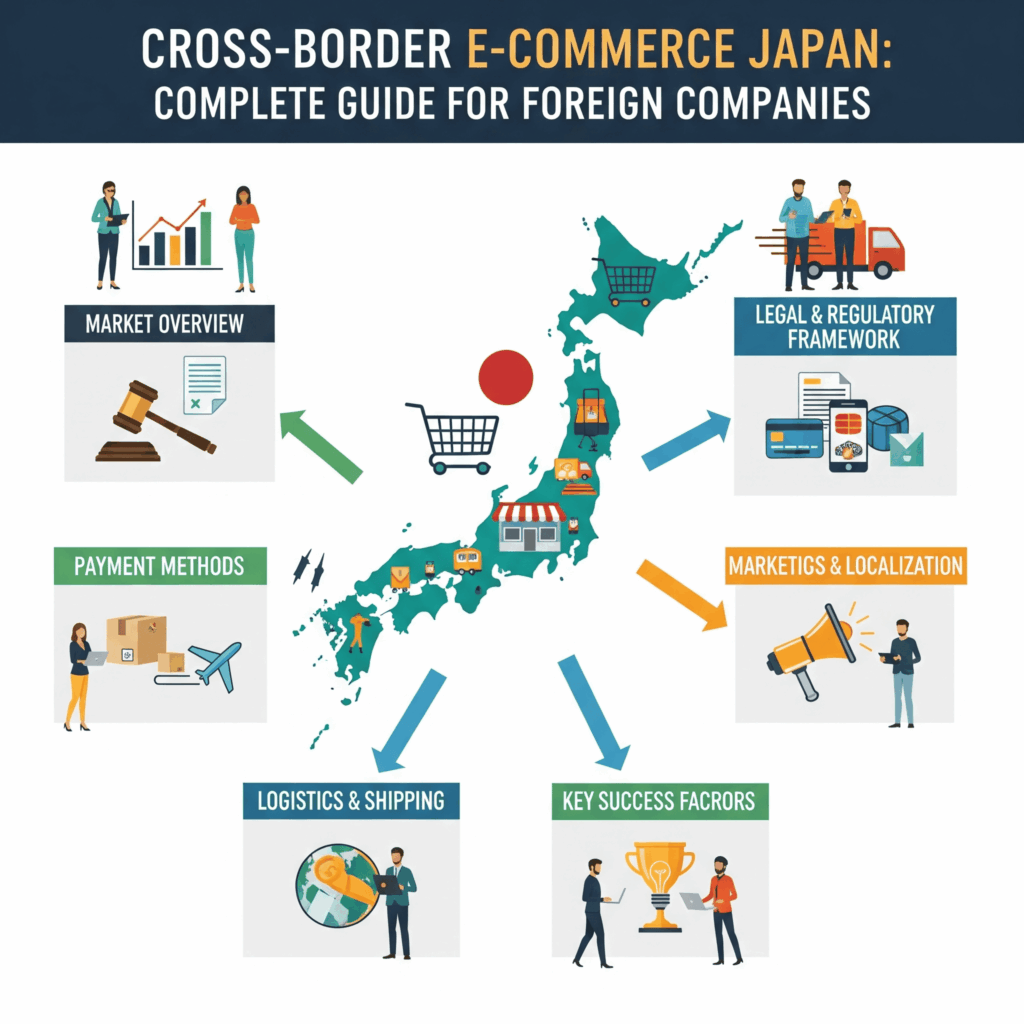

Cross-Border E-Commerce Japan: Complete Guide for Foreign Companies

Cross-Border E-Commerce for Foreign Companies Without Japanese Operations Cross-border e-commerce business, where foreign companies sell products and services directly to Japanese consumers through their own websites without establishing...

1