Japan Tax– tag –

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

Japan Consumption Tax Guide for Foreign Digital Services & E-books

When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption ... -

Service Export Tax Exemption Guide: Complete International Tax Processing for Japanese Companies

Service Export Tax Exemption: Complete Guide to International Service Transactions and Tax Processing In today's era of expanding international business, Japanese companies increasingly have opportunities to provide services overseas. Su... -

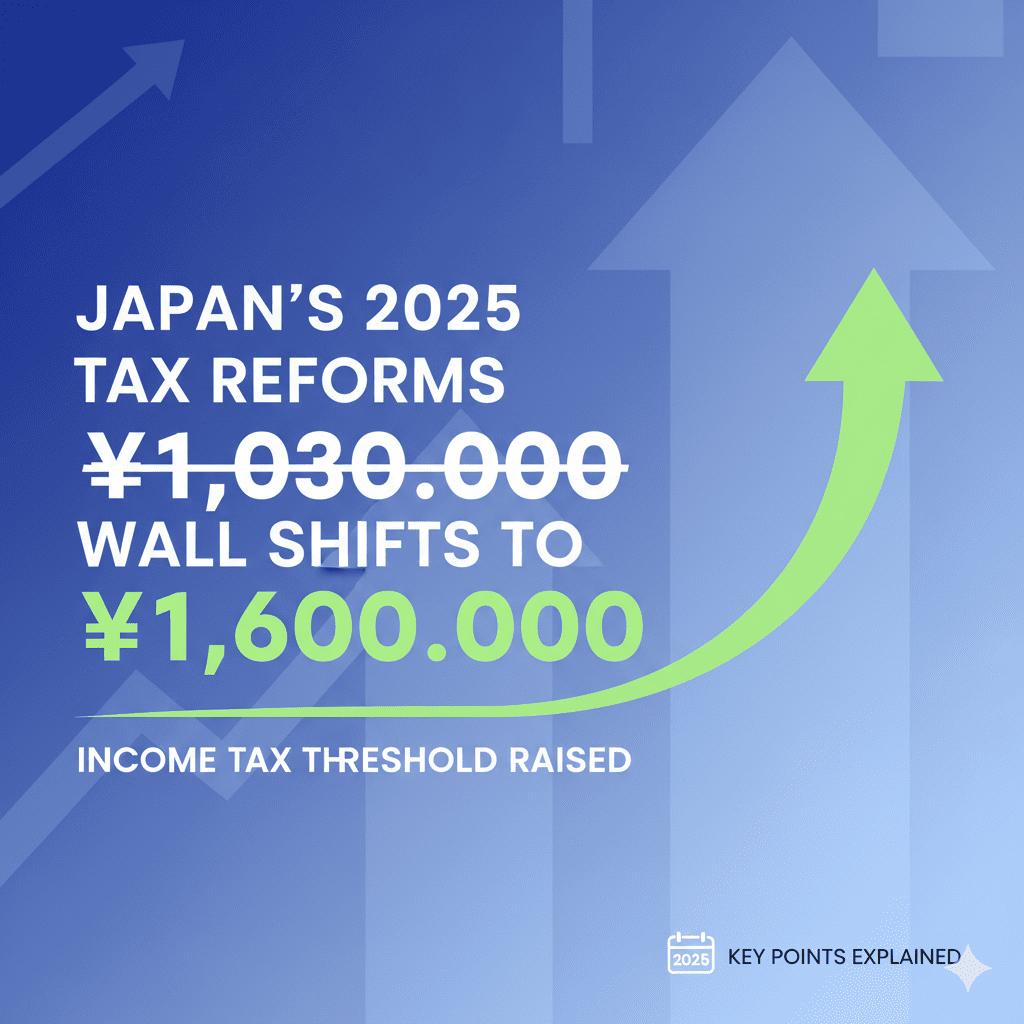

2025 Japan Tax Reform: 1.03M Yen Wall Raised to 1.6M – Complete Guide

2025 Tax Reform: The 1.03 Million Yen Wall Raised to 1.6 Million Yen! Key Points of Income Tax Reform Explained The 2025 (Reiwa 7) tax reform has significantly revised Japan's income tax system, affecting many working individuals. The ta... -

Japan Domestic Source Income of Foreign Corporations and the Tax Base for Corporate Tax

Four Categories of Taxpayers and Their Taxation Scope Japan's tax system divides taxpayers into four categories, each with different taxation scopes. Residents are individuals who have an address in Japan or have continuously mainta... -

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing Regulations One of the most crucial concepts in transfer pricing regulations is the determination of "foreign related parties." This determination is a vital e... -

DDP Import Issues in Japan: Tax Credit Problems & ACP Solutions 2025

Issues with DDP Transactions with Japanese businesses DDP (Delivered Duty Paid) is a commonly used trading condition in international trade. This is a convenient contract where "the seller bears all costs including customs duties an... -

Japan Export Tax Exemption Guide: Consumption Tax Rules 2025

Japan Export Tax Exemption for Consumption Tax The export tax exemption system is based on the fundamental principle that consumption tax, being a domestic consumption tax, should not be imposed on goods and services consumed abroad. Con... -

Amazon Japan Sales Tax for Foreign Companies (Import & Domestic)

What is fulfillment service? "Fulfillment service" is a service that performs a series of operations on behalf of e-commerce site operations, such as storage and management of products, order processing, packaging, shipping, and return h...

1