Japanese tax– tag –

-

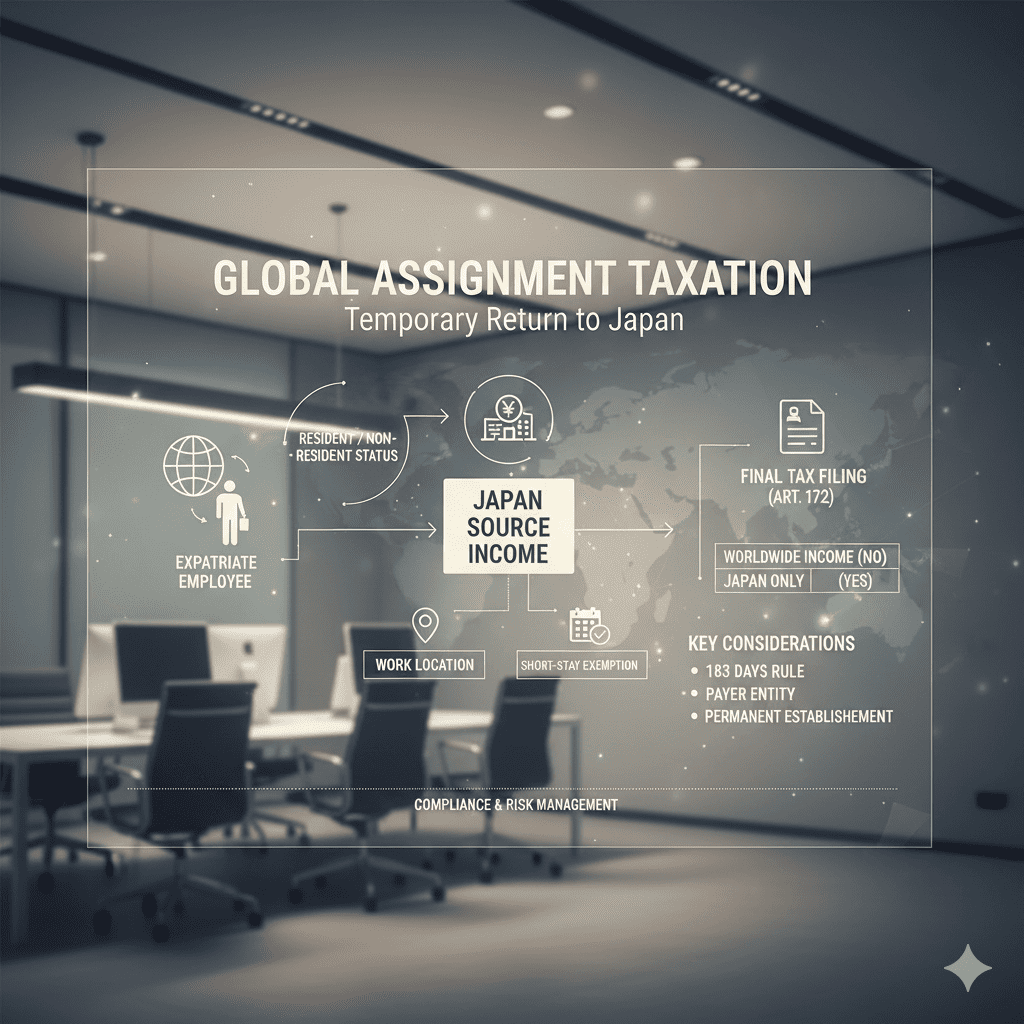

Tax Guide for Japanese Overseas Employees: Temporary Return Rules

Tax Treatment Considerations for Employees Temporarily Returning from Foreign Company Assignments In today's business environment where overseas assignments to foreign subsidiaries are increasing, the tax treatment of assigned employees ... -

Consumption Tax for Non-Residents with Japanese Branches: Guide 2025

Consumption Tax Implications for Services Provided to Non-Residents with Japanese Branches One key transaction type in international consumption tax handling is the "provision of services to non-residents with Japanese branches" and its ... -

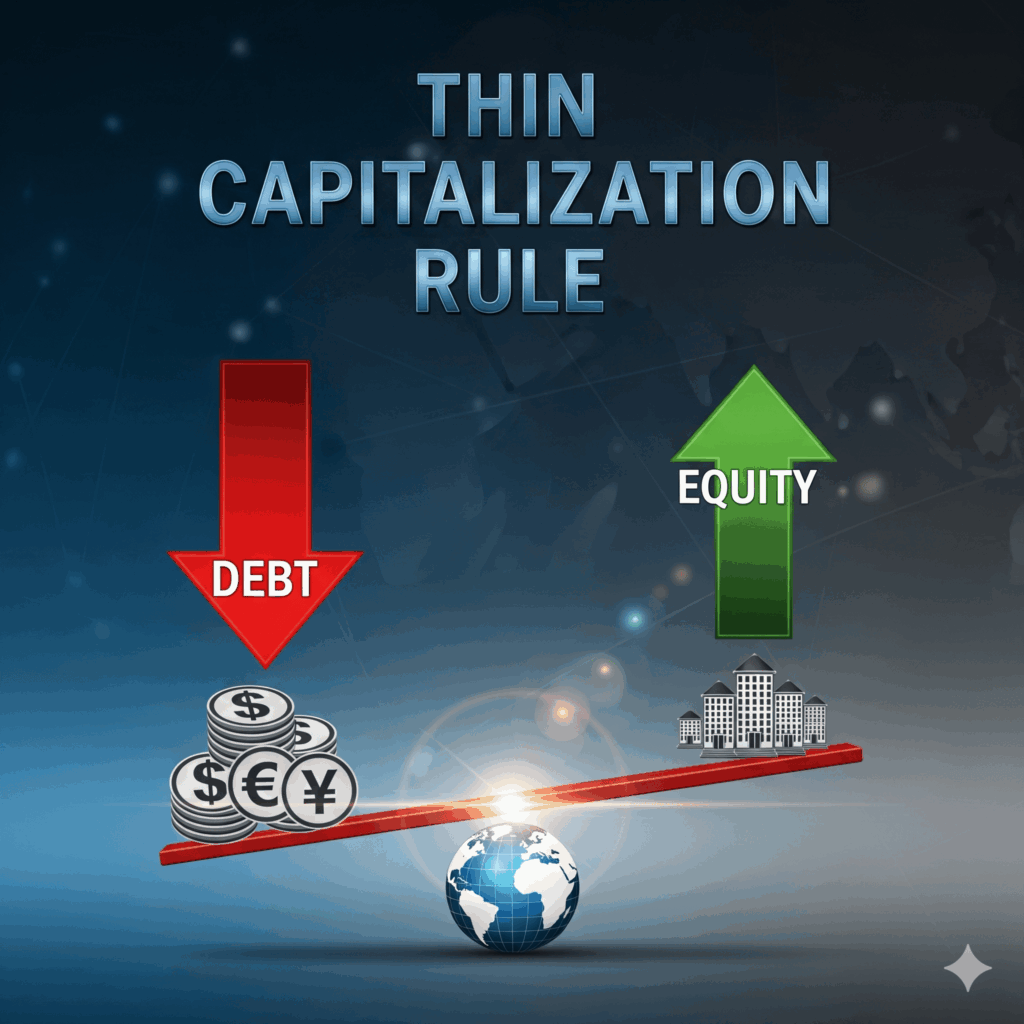

Japan Thin Capitalization Rules Guide: Anti-Tax Avoidance for Overseas Related Companies

Anti-Tax Avoidance System for Transactions with Overseas Related Companies For companies with overseas related companies, the choice of financing methods becomes a crucial tax consideration. The decision between equity investment or borr...

1