Japanese tax law– tag –

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

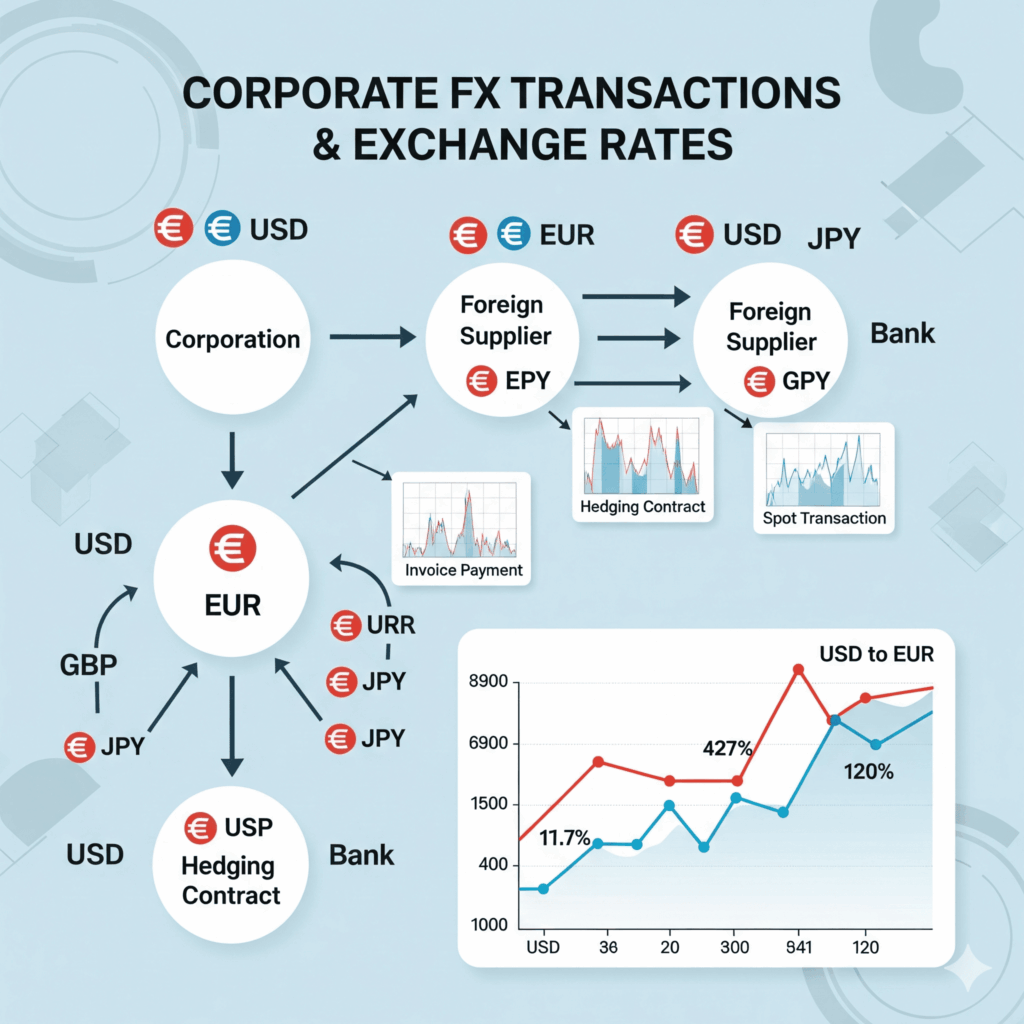

Foreign Currency Exchange Rate Treatment: Japanese Corporate Tax Law Guide 2025

Foreign Currency Exchange Rate Treatment for Corporate Transactions In today's globalized world, many companies engage in foreign currency transactions. However, there are complex rules regarding yen conversion methods for tax purposes, ... -

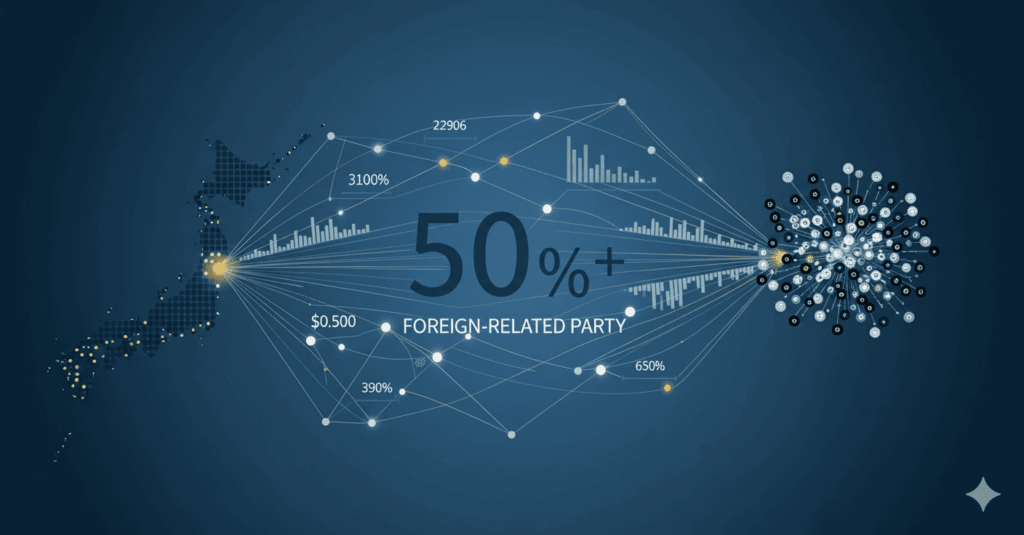

Basics of Japan’s Transfer Pricing System (2) | What Is a Foreign Related Party?

The Critical Importance of Foreign Related Party Concepts in Transfer Pricing Regulations One of the most crucial concepts in transfer pricing regulations is the determination of "foreign related parties." This determination is a vital e...

1