OECD– tag –

-

183-Day Rule Guide: Avoid Double Taxation with Short-Term Resident Exemption

Essential International Tax Knowledge In today's globalized world, many companies regularly conduct overseas business trips and short-term assignments. A crucial concept that must be understood in such situations is the "short-term resid... -

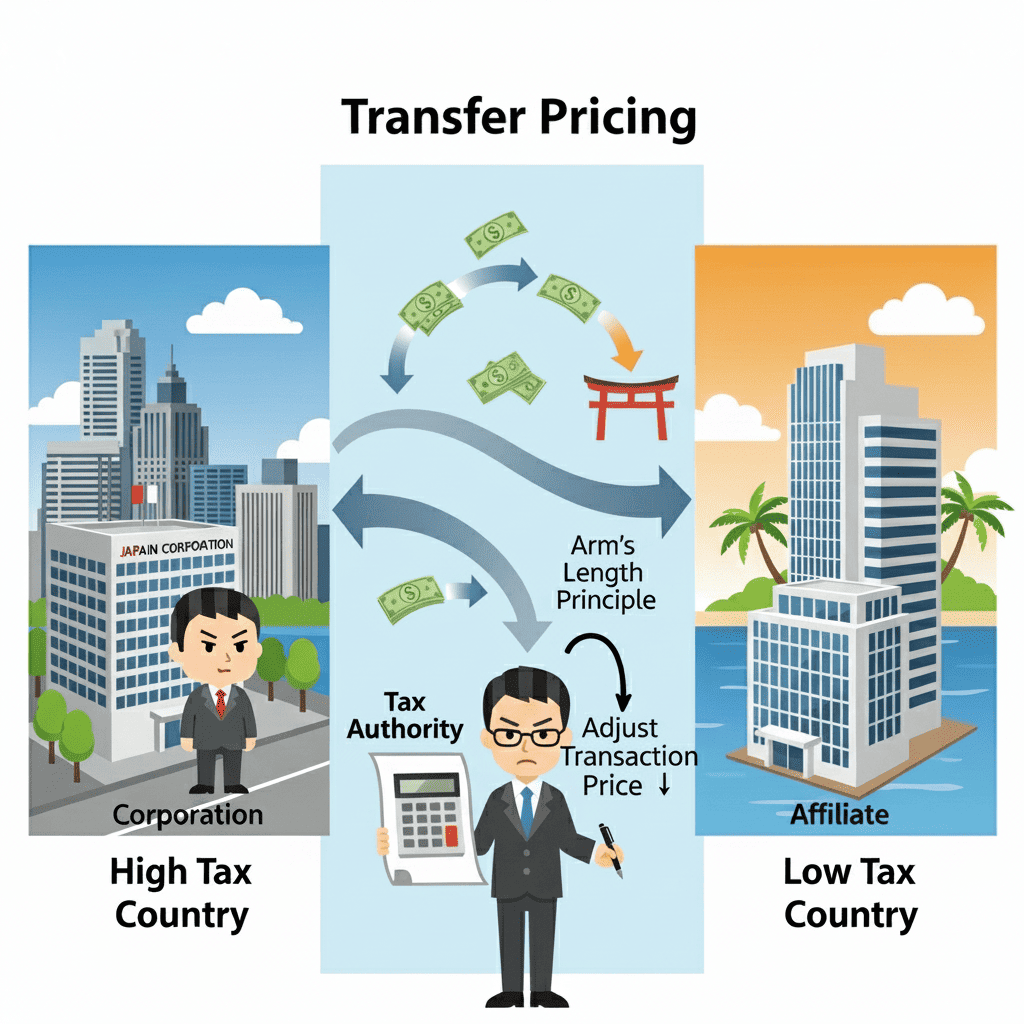

Basics of Japan’s Transfer Pricing System (1)

Basic Mechanism and Purpose of Transfer Pricing Taxation System Transfer pricing taxation system is a system that recalculates taxable income based on appropriate prices when income is transferred overseas due to transaction prices ...

1