tax compliance– tag –

-

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No1

What are Telecommunications Services Under Japanese Consumption Tax Law? "Telecommunications services" refers to services provided through communication networks such as the internet. For example:Services that allow users to download or ... -

Japan Consumption Tax Guide for Foreign Businesses: Telecommunication Services & Digital Transactions No2

What is Telecommunication Services Provision Under Consumption Tax Law "Telecommunication services provision" refers to services provided through communication networks such as the internet. For example:Services that enable download... -

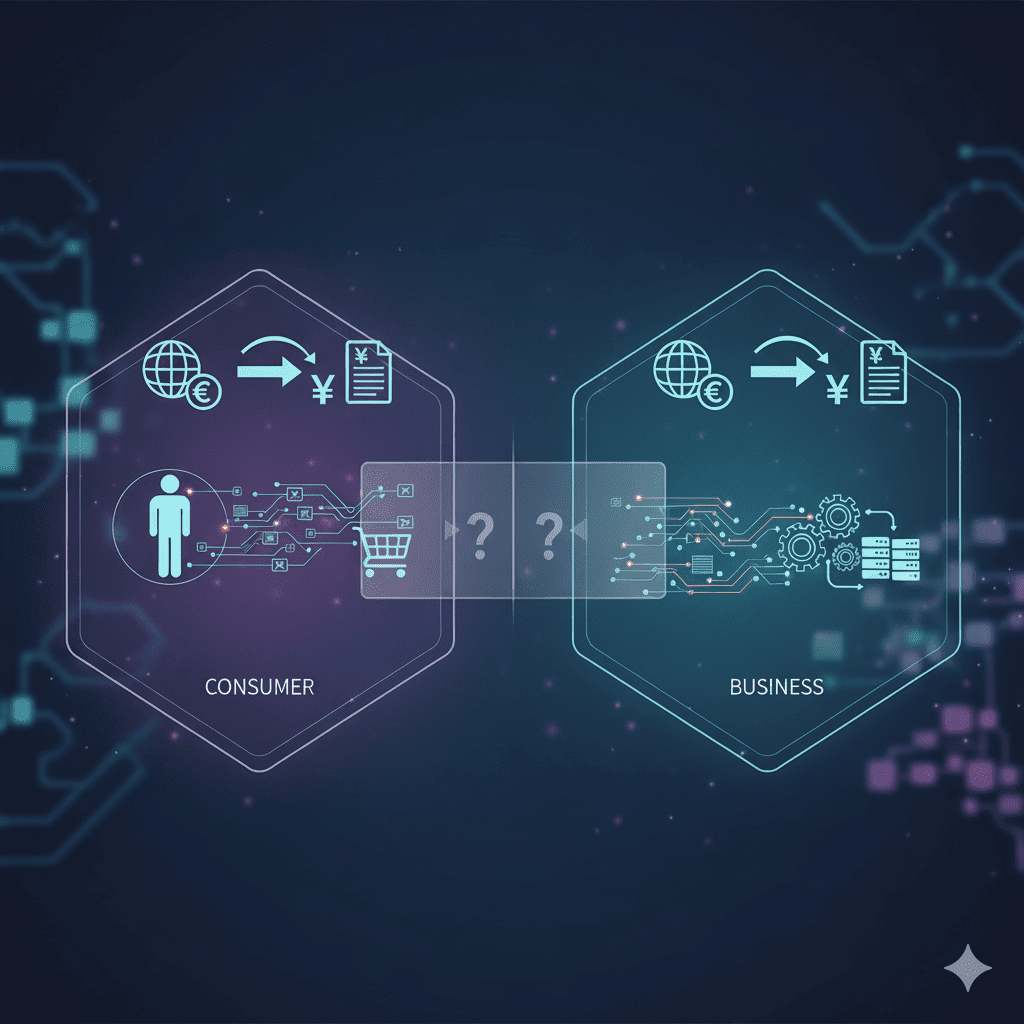

Japan Consumption Tax Guide for Foreign Digital Services & E-books

When You Sell E-books and Digital Services to Japanese Consumers and Businesses via the Internet When you (a foreign business entity) provide telecommunications services to Japanese businesses or consumers, the Japanese consumption ... -

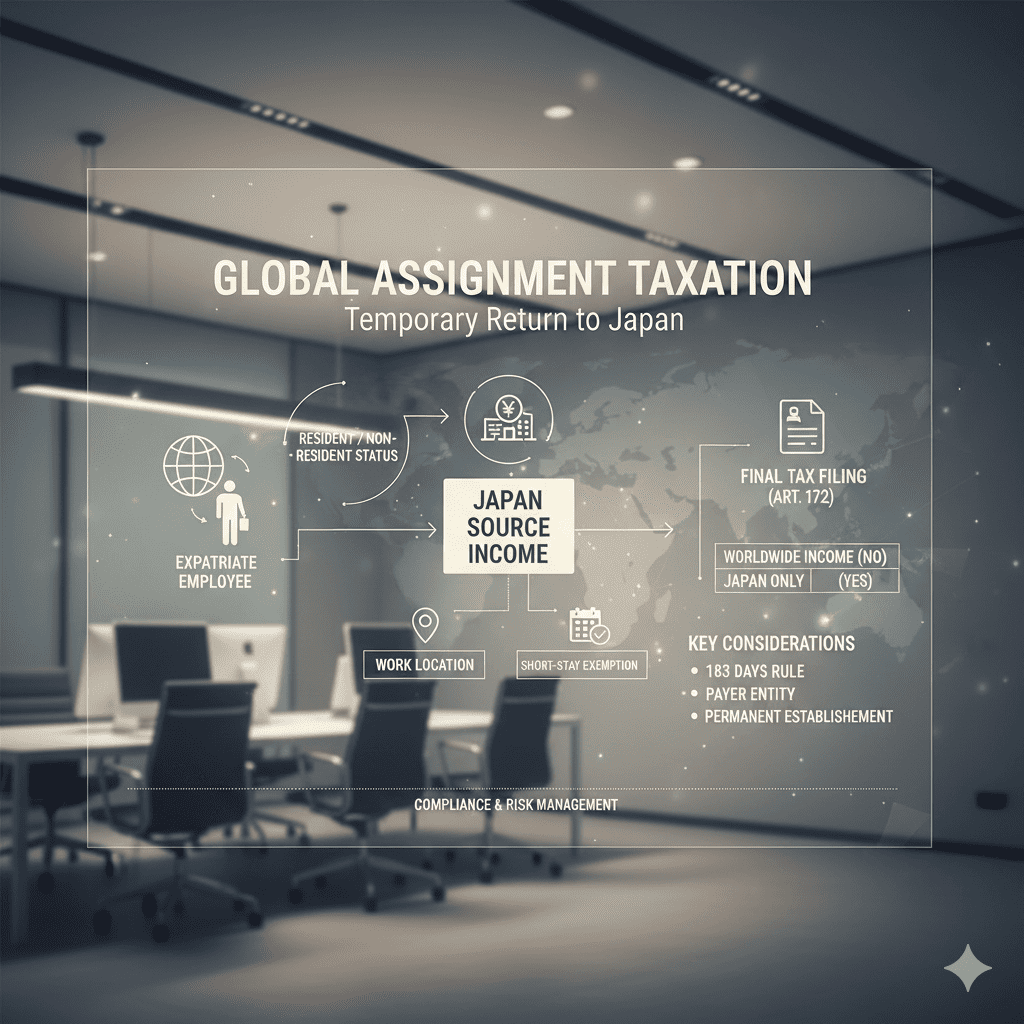

Tax Guide for Japanese Overseas Employees: Temporary Return Rules

Tax Treatment Considerations for Employees Temporarily Returning from Foreign Company Assignments In today's business environment where overseas assignments to foreign subsidiaries are increasing, the tax treatment of assigned employees ... -

Consumption Tax for Non-Residents with Japanese Branches: Guide 2025

Consumption Tax Implications for Services Provided to Non-Residents with Japanese Branches One key transaction type in international consumption tax handling is the "provision of services to non-residents with Japanese branches" and its ... -

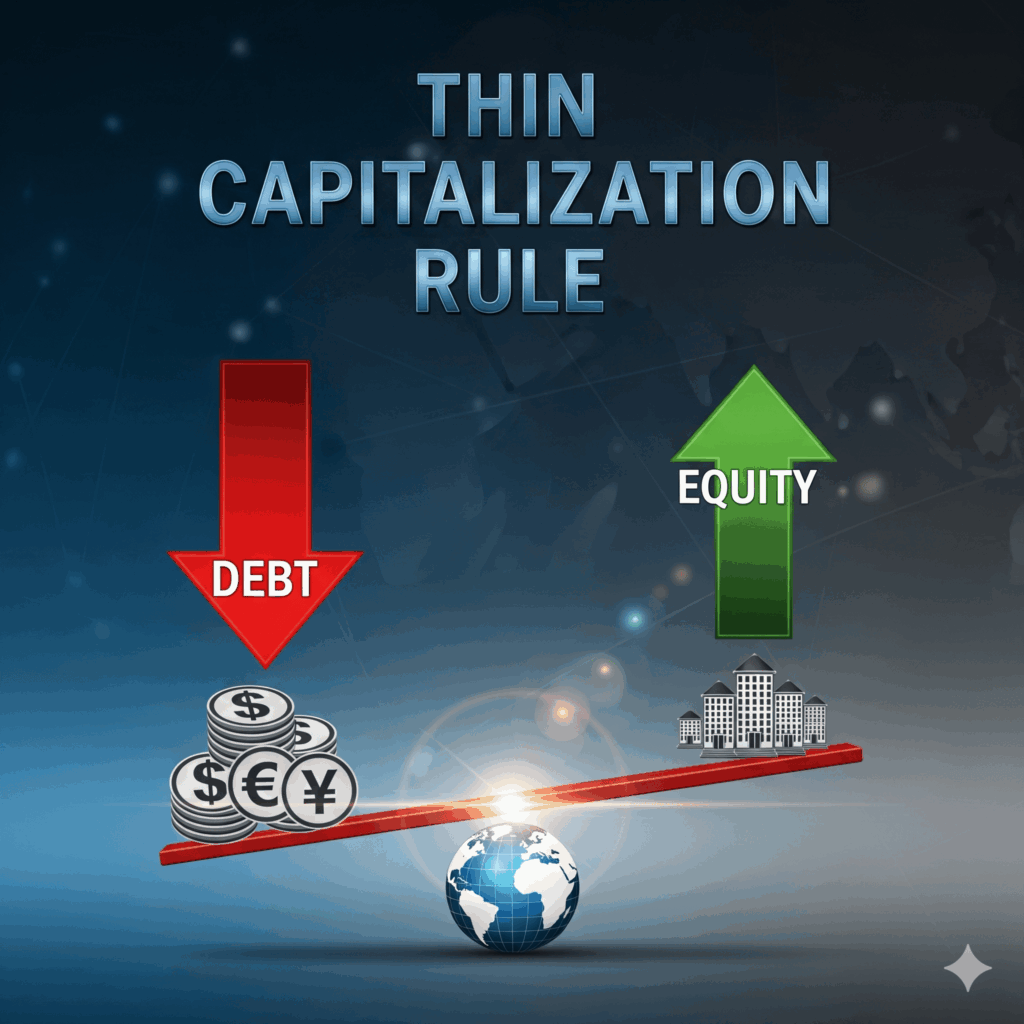

Japan Thin Capitalization Rules Guide: Anti-Tax Avoidance for Overseas Related Companies

Anti-Tax Avoidance System for Transactions with Overseas Related Companies For companies with overseas related companies, the choice of financing methods becomes a crucial tax consideration. The decision between equity investment or borr... -

Tax Treaty Applications for Foreign Corporations in Japan: Guide

Tax Treaty Applications for Payments to Foreign Corporations When making payments of dividends, interest, or royalties to foreign corporations, failure to follow proper procedures can result in a high withholding tax rate of 20.42%. By c... -

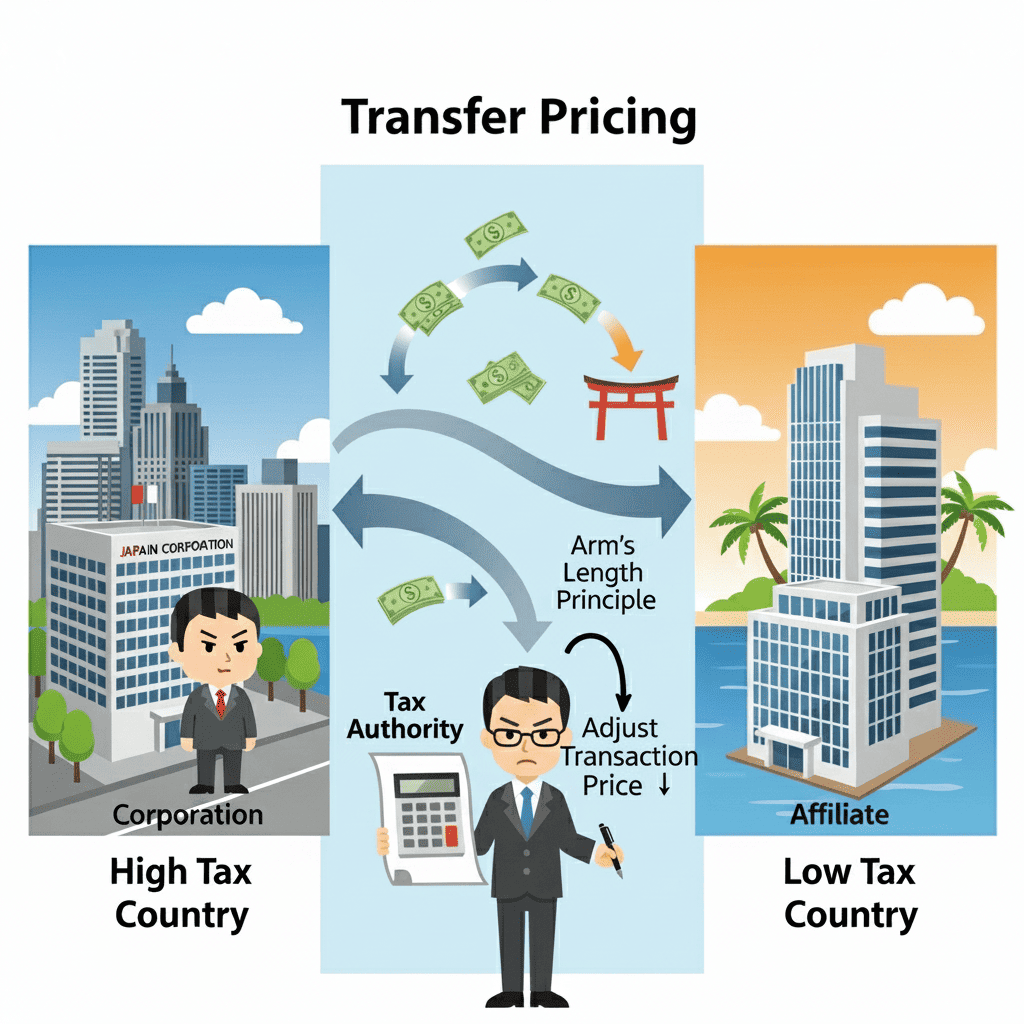

Basics of Japan’s Transfer Pricing System (1)

Basic Mechanism and Purpose of Transfer Pricing Taxation System Transfer pricing taxation system is a system that recalculates taxable income based on appropriate prices when income is transferred overseas due to transaction prices ... -

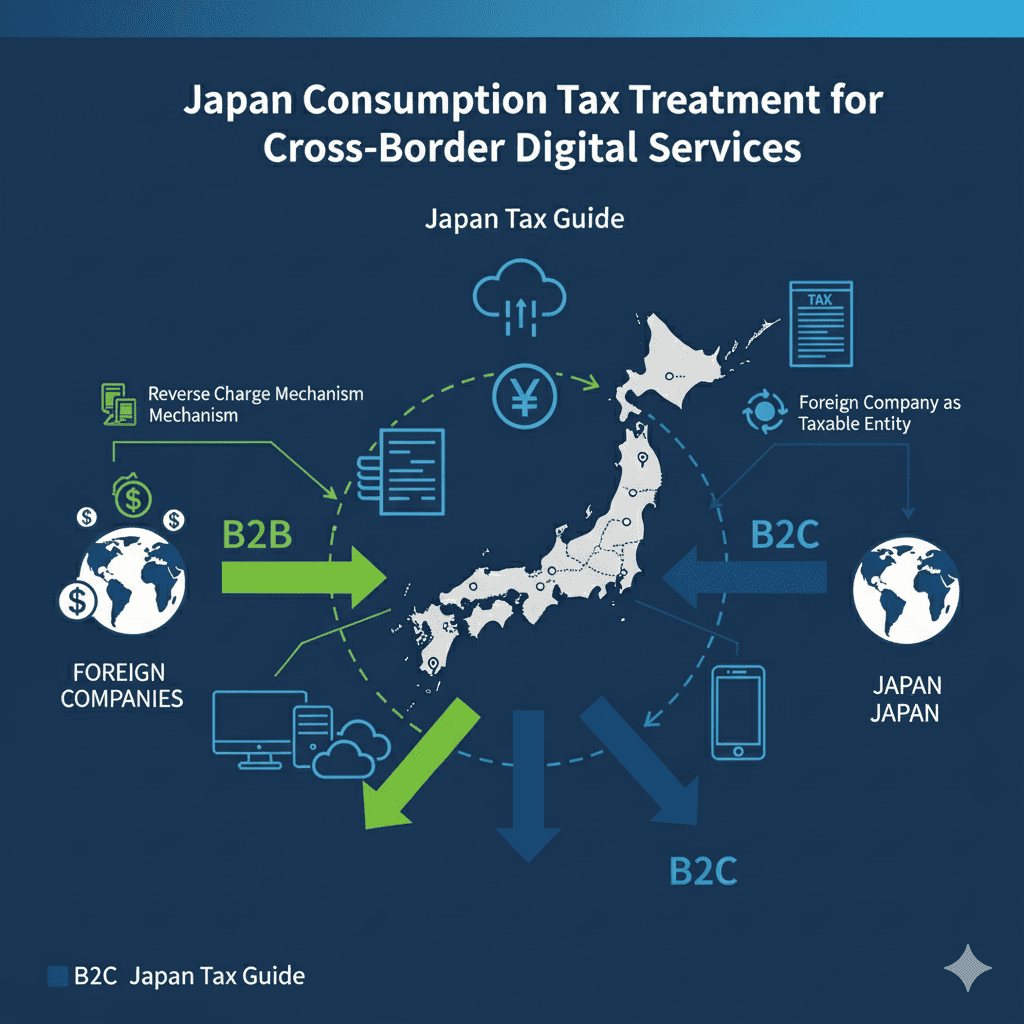

Japan Consumption Tax Treatment for Cross-Border Digital Services | Japan Tax Guide

Why is domestic and foreign judgment important regarding Japan's consumption tax? When considering the taxation relationship for Japanese consumption tax, we consider the taxation relationship in stages. First, we need to consider whethe...

1